What happened last week?

Central banks

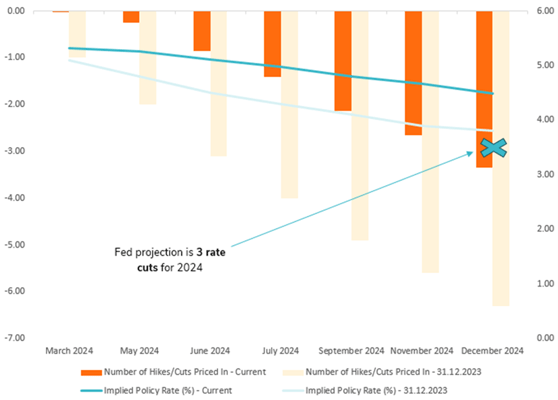

This week's discourse from Federal Reserve officials, notably Cook, Jefferson, and Harker, has been one of caution towards interest rate cuts, emphasizing the importance of significant evidence of inflation nearing the 2% target. Recent FOMC minutes echo this sentiment, advocating for a cautious approach amidst economic uncertainties and inflation risks. The market's expectations for rate cuts have adjusted accordingly, now more in line with the Fed's projection of around three cuts in 2024. Across the pond, ECB President Lagarde views recent euro-area labor compensation data as a positive sign but stresses the necessity for more conclusive evidence before decisively moving on rate cuts, despite the Q4 wage growth slowdown. Governing Council members, including Simkus and Holzmann, voice a collective need for caution, with Simkus suggesting a potential policy shift by summer 2024, contingent on inflation nearing its target. However, Holzmann underscores the ECB's intention to act independently of the Federal Reserve, emphasizing the importance of deliberative rate reductions in response to wage growth and geopolitical developments. The ECB's January meeting minutes hinted at a growing likelihood of a June interest rate cut, propelled by signs of wage growth deceleration and a quicker than anticipated disinflation path. In the UK, BoE officials, including Greene and Dhingra, convey a cautious outlook on interest rate cuts amidst persistent inflation worries. Governor Bailey deems market expectations for 2024 rate cuts as rational, suggesting the possibility of easing before inflation hits the target. The market has fully priced in a cut by August, with increasing probabilities for a June reduction. In Japan, Governor Ueda's comments suggest a cautious yet optimistic outlook for ending negative interest rates, backed by a strengthening economic cycle. Despite recent downturns, the BOJ remains focused on achieving stable inflation, with market speculation anticipating policy normalization possibly by April.

Credit

The credit market is currently experiencing a period of celebration, with another impressive week under its belt and issuers clearly wielding power in the market, evidenced by significant tightening from initial price talks (IPT). A notable instance is HCA's market entry with a four-part senior bond offering, which saw spreads tighten by 30bps from IPT. For the first time since 2021, the credit spread (OAS) of the Bloomberg U.S. Corporate Bond Index has dipped below 90bps, reflecting a robust tightening across the board. In this favorable market environment, the Vanguard U.S. Corporate ETF achieved a 0.4% gain over the week, underlining the strength of the investment-grade (IG) sector. The U.S. high yield (HY) segment also demonstrated resilience, with the iShares USD HY ETF recording a 0.5% gain. Rating agencies continue to lean towards more upgrades than downgrades, with Uber's long-term corporate family rating being upgraded by Moody's to Ba1 from Ba3, showcasing the positive momentum within the credit market. Across the Atlantic, European IG also saw commendable performance, supported by light primary activity. A total of €12bn was priced across markets, marking the second lowest weekly volume this year. The iShares Core EUR IG Corporate Bond ETF posted a +0.3% gain over the week, with all sectors advancing, particularly financials which outpaced non-financials. AT1 CoCos experienced the most significant tightening, leading to a +0.7% gain over the week. Corporate hybrids have also had a strong start to the year, with gains exceeding 1%. The primary market displayed keen interest in Enel Hybrids' new issue last week, which saw IPTs tighten by more than 50bps. The European HY segment added to the upbeat mood with a +0.4% gain over the week, as credit spreads tightened by 8bps to 345bps, marking the lowest level since early 2022.

Rates

U.S. government bonds concluded the week on a high note, buoyed by a decrease in the 10-year Treasury yield to 4.25% from 4.35%, propelling the Bloomberg U.S. Treasury Index to a 0.3% gain. Despite this uplift, the week was characterized by sustained volatility, as evidenced by the MOVE index, which tracks interest rate fluctuations, finishing above 100, signaling ongoing market sensitivity to interest rate movements. The week's auctions highlighted the challenges in the supply side of the market. A notably weak 20-year bond auction contrasted with a 30-year TIPS auction that showed soft demand, evident from a tail of 2.2 basis points and a high non-dealer bidding rate of 91.0%, against an average of 87.4%, reflecting nuanced market sentiments towards supply dynamics. Mirroring the trends in U.S. rates, European government bonds also experienced a dip, with the 10-year German yield falling by 5bps to 2.36%. Despite stronger-than-expected Eurozone PMI services data, inflationary pressures appeared contained within the region. Notably, France reported a modest rise in prices for goods and services, marking the weakest increase in three years. Similarly, Germany's output price inflation rate remained stable for the second consecutive month, offering reassurance on the inflation front. German government bonds echoed this positive sentiment, closing the week with a 0.3% gain. In the UK, government bonds outperformed, registering a 0.6% increase over the week. This was supported by a significant drop of almost 10bps in the 10-year UK yield, which ended just above 4%, reflecting a broader trend of easing yields across major bond markets. This week's developments underscore a dynamic fixed income landscape, where rates are closely intertwined with supply factors and inflationary indicators, setting the stage for a cautiously optimistic outlook amidst persistent volatility.

Emerging market

Emerging Market (EM) corporate bonds have showcased remarkable performance since the beginning of 2024, buoyed by significant spread tightening. The Bloomberg EM Corporate Bond Index witnessed spreads narrowing by over 50bps, reaching 230bps - a level last observed in early 2018. This robust spread performance has propelled EM corporate bonds to a nearly 1% gain year-to-date, starkly outperforming EM Sovereign and local bonds, which have declined by more than 1%. In China, the People’s Bank of China’s (PBoC) decision to reduce the five-year loan prime rate (LPR) by 25 bps marks the most substantial cut since 2019, promising mortgage savings for households and injecting at least 60 billion yuan into real estate projects eligible for loans. This move has particularly benefited Chinese credit markets, with spreads tightening further - 5bps for Asia IG and 40bps for HY dollar bonds over the week. China's junk dollar bonds and real estate bonds have experienced significant gains, with the latter climbing 3% over the week and recording double-digit growth year-to-date. Latin America sees Venezuela and PDVSA bonds set to join the EMBI Global/Diversified benchmarks in a phased inclusion from April 30, anticipated to drive about $1bn in market flows and expand the benchmarks' spread by 59bps. This step, partly priced in by the market, underscores Venezuela's restructuring potential amid a challenging political context. Meanwhile, Paraguay’s central bank enacted its seventh rate cut since August, maintaining inflation below 4%, reflecting continued monetary policy adjustments. Turkey's Central Bank held the one-week repo rate at 45%, halting a series of aggressive rate hikes initiated post-May 2023 elections, which amounted to a 36.5% increase. Despite this pause, the bank's press statement provided a hawkish outlook, suggesting further rate hikes could be on the horizon if inflationary pressures intensify.

.png)