What happened last week?

Central banks

This week's spotlight was on the FOMC meeting, with the Federal Reserve holding interest rates steady for the fourth time in a row. Chair Jerome Powell nuanced expectations for a policy shift, noting that while immediate changes are unlikely by the March meeting, the current policy rate might be at its peak. Powell indicated that, should the economy follow expected trends, policy easing could commence this year, with the market now adjusting its outlook to foresee a rate cut in May or June, anticipating 5 to 6 cuts in 2024. Echoing the Fed's cautious optimism, ECB official Mario Centeno highlighted a gradual approach towards future rate adjustments, aiming for a 2% inflation target. Despite holding rates steady, the ECB's narrative suggests openness to rate cuts if inflation trends downward, with a 60% market chance for a cut in April and expectations for more than 5 cuts in 2024. This stance underscores a strategic patience post-terminal rate achievement, focusing on nurturing Europe's internal growth for inflation control. The Bank of England (BoE) kept its key rate at 5.25%, subtly shifting its stance by dropping tightening bias and projecting CPI to fall to 1.4% in two years, hinting at potential rate cuts in Q2 2024. Despite this forward-looking outlook, BoE Chief Economist Huw Pill emphasized the continuation of a restrictive monetary policy to ensure inflation targets are met, with labor market conditions and wage growth as critical metrics for deciding on monetary easing. The market's expectations align with a rate cut between May and June 2024, reflecting a strategic wait-and-see approach by the central banks. Central banks globally are threading through economic indicators and inflation trends, with the Federal Reserve, ECB, and BoE articulating a mix of caution and preparedness for future easing, grounded in economic data and inflation trajectories.

Credit

As January 2024 unfolded, the US credit landscape navigated through a phase of adjustment, influenced by an uptrend in interest rates. The Bloomberg US IG Corporate Bond Index witnessed a slight decline of 0.2%, despite experiencing a tightening of 5bps in credit spreads, underscoring the nuanced impact of broader economic factors on bond performance. Similarly, the Bloomberg US High Yield Index demonstrated resilience, maintaining a nearly flat performance despite the volatile market conditions. This period was marked by an unprecedented surge in corporate bond issuance, with nearly $200 billion in sales recorded for the month, setting a new benchmark for January. This surge is largely interpreted as a strategic move by corporations to preemptively address the looming 'maturity wall,' a significant refinancing hurdle anticipated in Q2 2024. According to insights from Saxo Bank, the market is braced for the refinancing of roughly $276 billion worth of IG and HY corporate bonds, confronting a notable shift in interest rates. High Yield issuances, in particular, are poised to navigate a transition in average coupon rates from 5.8% to an elevated 9%, while Investment Grade bonds are expected to adjust from an average coupon of 3.77% to 5.75%, indicating the second most substantial rate increase since the third quarter of 2007. Meanwhile, Europe's credit market embarked on 2024 with a positive trajectory. The Bloomberg EUR IG Corporate Bond Index registered a gain of 0.2%, and the European HY Index concluded the month with an impressive 1% uptick. This growth was facilitated by a tightening of credit spreads—7bps for IG and nearly 20bps for HY—highlighting the improving market sentiment towards European credit. Notably, Additional Tier 1 (AT1) bonds stood out as the best performers of the month, with gains exceeding 1.6%. This remarkable performance underscores the burgeoning appeal of AT1 bonds among investors, drawn by their potential for higher yields amidst the shifting contours of the European financial landscape.

Rates

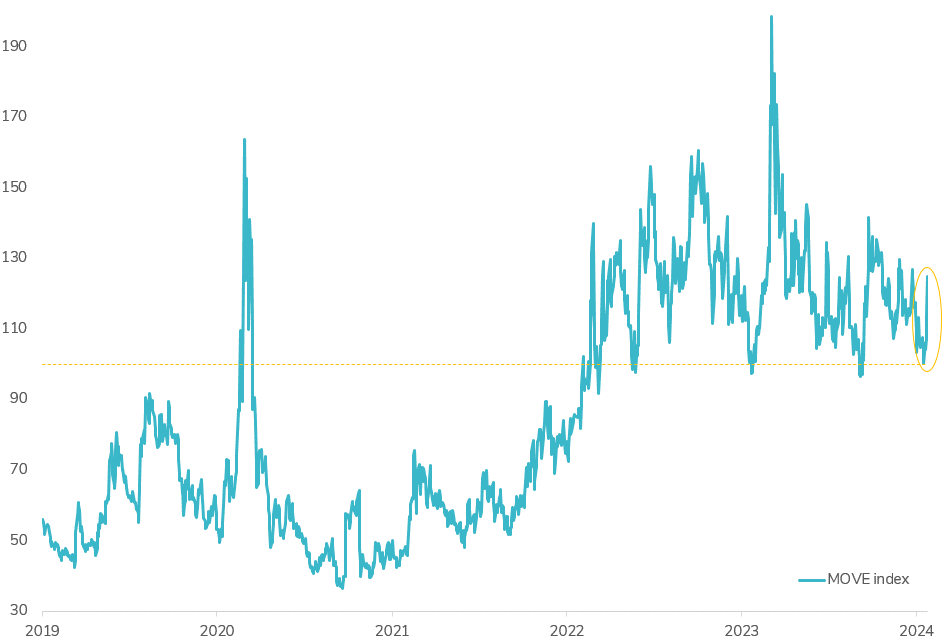

It was a week marked by volatility in the US Treasury market. The 10-year US Treasury yield experienced a dramatic swing, dropping to its lowest level of the year at 3.81% before surging to 4.05% by Friday. This rebound was propelled by January's unexpectedly robust Non-Farm Payrolls (NFP) report, which reported 353k jobs added versus the 185k forecasted. Conversely, investor sentiment had briefly shifted towards buying treasury bonds amid concerns over regional banking, highlighted by New York Community Bank's unexpected Q4 2023 loss and a notable increase in provisions. Amid these fluctuations, the US Treasury Department's announcement of a projected $760bn borrowing in Q1 2024, a $55bn decrease from its previous estimate, offered a positive note. However, the decline in China’s holdings of US Treasuries, which have fallen by $300bn since 2021 to levels not seen since 2009, cast a shadow over the market. These developments have kept the MOVE index, which benchmarks volatility in US interest rates, above the elusive 100 mark for the fourth time, signaling persistent uncertainty. This volatile backdrop did not spare the Bloomberg U.S. Treasury Index, contributing to its nearly 1% decline year-to-date, a testament to the ongoing challenges within the bond market. In Europe, German bonds mirrored this downward trajectory, now down over 1% year-to-date, with the 10-year yield closing the week at 2.25%. The spread between Italian and German 10-year yields briefly hit a two-year low of 150 bps, before widening slightly to 158bps, indicating some market adjustments. In the UK, the 10-year yield concluded the week at 3.92%, marginally lower than the previous week, reflecting the broader trends affecting bond markets globally.

Emerging market

Emerging Markets (EM) witnessed mixed fortunes in the first month of 2024. In a standout performance, hard currency-denominated EM corporate bonds recorded a +0.7% gain for January, contrasting with the challenges faced by other segments. EM sovereign debts were adversely affected by rising US rates, while local currency debts saw a 1.1% decline, primarily due to a strengthening US dollar. In Asia, high-yield bonds showcased resilience with a +3% gain in January, despite a generally pessimistic regional sentiment. Dollar bond sales in Asia had their weakest start since 2016, totaling $19 billion, a 28% year-on-year (YoY) decrease. The real estate sector in China continued to struggle, with a significant drop in sales (-30/40% YoY in January) among top developers and the high-profile liquidation order for China Evergrande Group, signaling deepening challenges within the sector. Conversely, India's bond market experienced its best January in five years, buoyed by increased foreign inflows in anticipation of global index inclusion. This shift indicates a pivot of foreign investor interest from China to India, highlighting changing investment dynamics in EM. In Latin America, bonds faced a -0.5% decline in January, influenced by a slight widening of credit spreads. Last week, Venezuelan government and PDVSA bonds also saw decreases, following the US's reconsideration of its sanctions policy. Nonetheless, several Latin American central banks proceeded with rate cuts, aligning with market expectations, except for Colombia, which opted for a more conservative reduction. Finally, Paraguay received a notable upgrade from S&P, elevating its long-term foreign currency debt rating to BB+, just shy of investment grade, from BB, marking a positive note in the region's economic outlook.

.png)