What happened last week?

Central banks

Recent comments from Federal Reserve officials, including John Williams and Michael Barr, suggest a cautious approach to monetary policy, underscoring the effectiveness of the current restrictive stance in controlling inflation. The possibility of rate cuts is tied to further reductions in inflation, although the market is more bullish, predicting up to seven rate cuts within a year, aligning with JPMorgan's forecast of a 150 basis point reduction. This difference highlights the uncertainty about the Fed's future moves. Dallas Fed President Lorie Logan mentioned the potential for the Federal Reserve to consider slowing its balance sheet reduction (quantitative tightening - QT) this year. However, Cleveland Fed President Loretta Mester believes that the current level of reserves makes an immediate adjustment to QT unnecessary. Discussions throughout the year will focus on the timing and method of adjusting the balance sheet runoff, with a data-driven approach. Bank of America expects the Fed to announce plans to taper its Treasury holdings in March, potentially coinciding with its first rate cut. In Europe, ECB President Christine Lagarde stated that rate cuts would be considered when inflation convincingly tracks towards the 2% target by 2025. Despite the recent slowdown in inflation, the ECB is maintaining caution, awaiting wage data before deciding on rate cuts. Market expectations lean towards six rate cuts this year, with the first fully priced for April, although ECB officials suggest a mid-year timeline is more realistic. The Bank of Japan (BOJ) is prepared to end its negative interest rate policy, likely in April, contingent on economic data and March wage talks results. Japan's normalization process will differ from the Fed and ECB, as its economy still requires monetary easing. The BOJ's terminal rate might reach around 0.5% over three to four years, starting with one or two rate hikes in the first year.

Credit

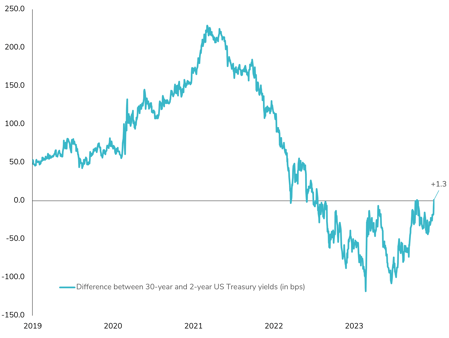

In the US credit market, Investment Grade (IG) corporate bonds witnessed a notable gain of +1.2% over the past week, buoyed by a tightening in credit spreads, which decreased by 6bps to 97bps. This marks the lowest level for credit spreads since January 2022. In the High Yield (HY) segment, the performance was equally robust with a gain of +1%, supported by a spread tightening of 15bps. However, despite these weekly gains, both IG and HY bonds are experiencing a downtrend in 2024 so far, registering -0.3% and -0.2% respectively, primarily due to adverse movements in rates. The current dynamics in the credit market are particularly intriguing given the increased issuance of IG bonds amid an inverted yield curve that is often interpreted as signaling an impending recession. Historically, the inversion of the 10-year minus 3-month Treasury yield curve has frequently been a precursor to economic downturns. Nonetheless, credit spreads have managed to tighten year-to-date. When juxtaposed with equity market volatility, credit spreads appear in line with the levels of realized equity volatility. In Europe, the story is somewhat different but still positive. Both IG and HY bonds saw upward movements, driven exclusively by spread tightening. The Bloomberg EUR IG corporate bonds index increased by +0.3%, and European HY bonds achieved a +1% gain. This improvement was marked by a 5bps tightening in European IG spreads to 140bps and an even more substantial tightening in HY spreads by almost 30bps to 382bps. This level for HY spreads is the lowest observed in the past two years, signaling a strong recovery and investor confidence in the riskier segments of the European credit market. The Additional Tier 1 market continues to perform well, underscored by a new issuance from Banco Comercial Portugues. This issuance reflects the ongoing appetite for riskier bank capital instruments. The iBoxx EUR CoCo index, tracking these contingent convertible bonds, also reflected this positive sentiment, showing a 1% increase over the week.

Rates

US Treasury bonds experienced an upswing of around +0.7% over the past week, driven primarily by a strong performance at the short end of the yield curve. The 2-year US Treasury yield notably closed the week at 4.14%, marking its lowest level since May 2023. Despite mixed inflation numbers, factors such as heavy supply on the long end and resilient economic data exerted influence on the yield curve dynamics. The spread between 5-year and 30-year Treasury yields notably surged to 34 basis points, a peak not seen since May 2023. Concerns about the long end of the US Treasury yield curve, stemming from negative term premiums, a substantial supply forecast for Q1, and a robust US economy, are now coming to fruition. Breakeven rates in the US saw an increase over the week, with the 10-year US breakeven rate climbing to 2.28%, its highest in two months. In contrast, European rates underperformed, with EUR government bonds showing almost flat performance. The 10-year German Treasury yield ended the week 2bps higher at 2.18%. However, peripheral spreads in Europe fared relatively well, exemplified by the narrowing difference between the 10-year Italy and German yields to 155 basis points, the lowest since April 2022. The week also served as a significant test for European government supply, witnessing strong global demand. Spain, Italy, and Belgium reported record order books, supported by central banks and funds from the Middle East and Asia. The UK market had a robust start to 2024 with a successful auction of 20-year bonds, raising GBP 2.25 billion at a yield of 4.391%, significantly higher than the previous auction's yield of 1.36% in October 2021. This auction displayed a robust bid-to-cover ratio of 3.6, indicating strong investor confidence. However, despite this successful auction, UK government bonds declined by 0.5% over the week. Market participants are now keeping a keen eye on upcoming wage and inflation data, especially in anticipation of the new 30-year gilt syndication. With core inflation trends showing signs of stabilization, these data releases will be crucial in shaping future rate movements.

Emerging market

This week in the Emerging Markets (EM), bonds exhibited strong performance, significantly influenced by the positive total return of US interest rates. The Bloomberg EM Corporate Bond Index rose by 0.7%, and the EM Sovereign Bond Index increased by an impressive 1.0%. The Bloomberg EM Local Debt Index, while facing slight headwinds due to the strengthening US dollar, managed a modest increase of 0.2%. This uptick in EM corporate bond spreads to 280bps, up from last week’s low, is indicative of the nuanced and interconnected nature of EM with global market dynamics. Despite facing a challenging year in 2023 with a mild negative credit rating trend and a decrease in net rating volume by $49 billion, largely due to downgrades in Latin America and the Chinese property sector, EM markets are showing resilience and signs of recovery. The scenario in specific markets like Egypt, Argentina, and China further underscores this. Egypt’s bonds have gained momentum following international endorsements of its economic reforms, demonstrating the impact of geopolitical and economic alliances on market confidence. Argentina's new financial arrangement with the IMF, involving a crucial $4.7 billion disbursement, marks a critical milestone towards fiscal stability and economic recovery. In China, the real estate sector, a significant component of the economy, is showing promising signs of revival. Positive debt restructuring moves and an uplift in investor sentiment have led to a notable increase in the iBoxx China Real Estate Bonds Index. Overall, these developments across the EM landscape – from the support for Egypt’s economic policies to Argentina’s critical IMF deal, and China's real estate sector showing signs of a turnaround – paint a picture of an EM space that is dynamic and gradually stabilizing.

.png)