Chart #1 —

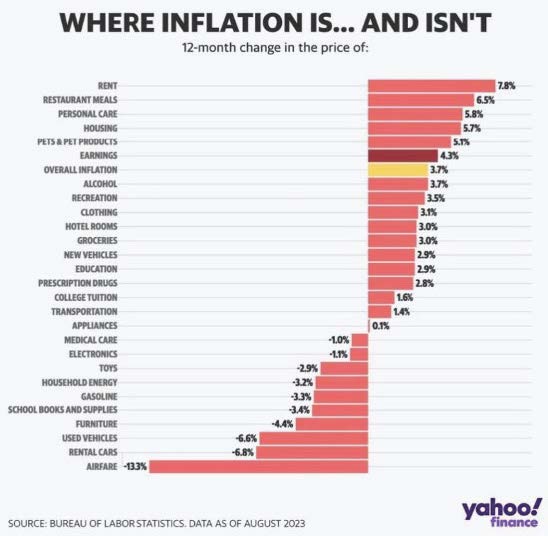

US 12-month inflation continues to remain high in many segments of the

economy

It was the week's most eagerly awaited macroeconomic figure, the US inflation rate for August. The headline inflation figures were in line with expectations (+0.6% on a sequential basis). This was the biggest monthly rise since June 2022 and the second consecutive monthly increase. The energy index rose by 5.6% in August after increasing by 0.1% in July. Airline fares underwent a major turnaround. They rose by 4.9% after falling by 8.1% over the previous two months. On a rolling 12-month basis (see chart below), the overall CPI index rose by 3.7%, slightly more than expected (3.6%).

The surprise came from the core index, which was slightly higher than expected (+0.3% on a sequential basis), an acceleration compared to July. This was mainly due to the housing index, which has risen by 7.3% over the past year, accounting for over 70% of the total increase in all items except food and energy. On a rolling 12-month basis, the Core index is up 4.3%, in line with expectations.

source: Yahoo Finance

.png)