Chart #1 —

S&P 500 closes above the 200-day moving average

The S&P 500 index has gained 17.4% since its low point on October 13, marking the fifth bear market rally since the market peaked in early January. Last week, the index closed above its 200-day moving average for the first time in more than 7 months.

Looking at the 13 times (since 1950) that the S&P 500 has traded below this average for 6 months or more and closed above it, it has only once returned to new lows. One year later, the index was up 18.8% on average.

S&P 500 Index versus 200-day moving average

Source: Charlie Bilello

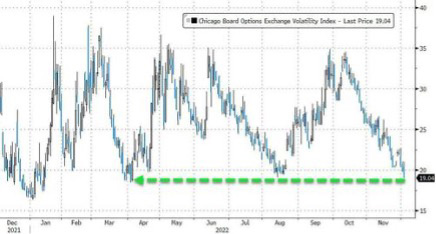

Chart #2 —

VIX falls back below 20

The S&P 500 VIX implied volatility index (or fear index) closed below 20 yesterday for the first time since August. The year has been marked by significant swings in the VIX, with brief periods of calm followed by a return to greater volatility. The VIX average for the year is around 26 (while the historical average is 19.7).

VIX Index

Source: Bloomberg, www.zerohedge.com

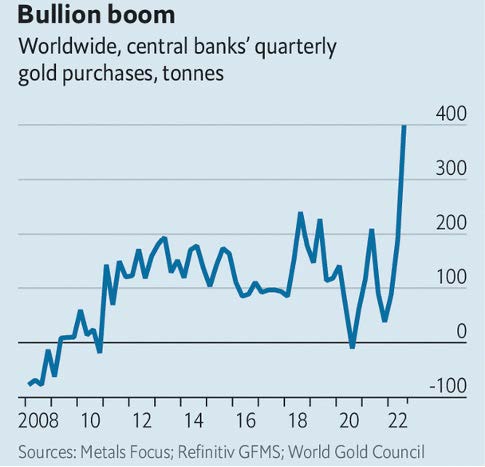

Chart #3 —

Central banks continue to accumulate gold

Gold rose back above $1,800 last week, its highest level since August. The weakening dollar and falling real yields have supported the yellow metal. As the Economist article points out, central banks around the world have been accumulating gold reserves this year at a rate not seen since 1967, when the US dollar was still backed by the precious metal. According to the World Gold Council, almost 400 tonnes were purchased by central banks, increasing their net long positions to 673 tonnes. Turkey was the largest buyer of gold during the quarter, followed by Uzbekistan

(26.13 tonnes) and India (17.46 tonnes). Though not all countries report their gold purchases on a regular basis, so it is difficult to know how much China and Russia bought during the same period.

Central bank gold purchases by quarter in tonnes

Source: The Economist

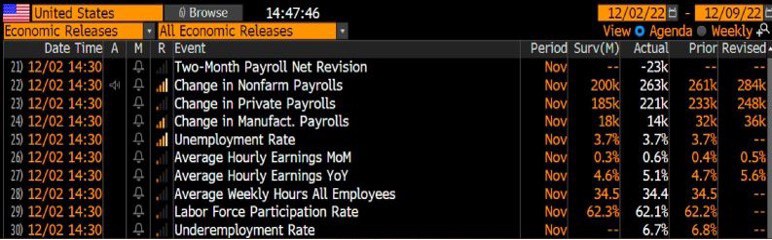

Chart #4 —

A better than expected US employment report

This was the most anticipated statistic of the week. The US employment figures turned out to be better than expected, which is not good news for the markets. Indeed, a deterioration in the job market is a necessary condition for the Fed to pause or reverse its interest rate hike.

In November, job creation rose by 263,000 against the 200,000 expected by the consensus. This is the 23rd consecutive monthly increase (the longest streak in history was 113 months of job growth from October 2010 to February 2020). Unemployment rate stands at 3.7% (as expected). Hourly earnings rose by 0.6% from the previous month (vs. +0.3% expected) and by 5.1% year-on-year (vs. +4.6%expected).

US unemployment statistics for November

Source: Bloomberg

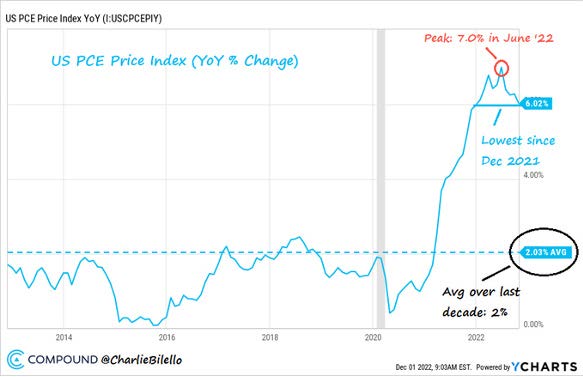

Chart #5 —

Peak inflation in the US seems to be behind us

The past week has provided further evidence that the rate of inflation in the US is slowing. Indeed, the PCE price index (the measure most closely followed by the Fed) fell to 6%, its lowest level since last December. The peak was 7% in June.

US PCE Price Index (YoY % Change)

Source: Charlie Bilello

Chart #6 —

The come-back of the energy crisis in Europe?

As we can all feel it, temperatures have fallen across Europe and the one-year price of natural gas is up 40% from its mid-November low. This means that the Eurozone's trade balance is deteriorating again, even though the euro has recently appreciated. Will the euro soon resume its downward trend with the known consequences on imported inflation?

1-year natural gas futures contract

Source: Bloomberg

Chart #7 —

S&P downgrades France's outlook

France's credit outlook has been downgraded to “negative” by Standard & Poor's (S&P) as the slowdown in the domestic economy and the government's measures to protect households and businesses from rising energy costs weigh on public finances. The AA rating is confirmed but S&P has reduced the GDP forecast for 2023 from 1.7% to 0.2% and the public deficit forecast from 4% to 5.4% of GDP.

Debt/GDP ratio for France (white) and Germany (yellow)

Source: Bloomberg

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Plus, Berkshire Hathaway’s cash peaks as South Korea’s KOSPI rockets. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the USD continues to lead transactions and China stockpiles gold. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)