THE FACTS

The surprise announcement Saturday to avoid a shutdown has put some real pressure on McCarthy’s Speakership. McCarthy’s ouster was effectively set in quick motion on Saturday when he pulled off a surprising legislative victory, getting Democrats to join Republicans in approving a short-term funding bill that avoided a government shutdown. While McCarthy pleased the White House with that move, it fueled resentments over his leadership among far-right members of the GOP caucus.

On Tuesday, The House of Representatives ousted Republican Kevin McCarthy as speaker, the first time in history that the chamber has dethroned its leader in a no-confidence vote.

The vote was triggered when Rep. Matt Gaetz and a group of far-right lawmakers formally launched the process of trying to remove McCarthy on Monday evening. Matt Gaetz said McCarthy no longer represents the interests of the Republican caucus after he worked with Democrats to pass a stopgap funding bill to avoid a government shutdown.

McCarthy told colleagues Tuesday evening that he will not be running for speaker again.

OUR TAKE

This is a big event, at least politically. The House has no Speaker and important laws cannot be passed until a new Speaker is in place.

For now, Republican Patrick McHenry will act as interim Speaker, although his powers are limited to those deemed “necessary and appropriate” to elect a speaker. Such constraints render him a civil servant unable to pass legislation. Given McCarthy's struggle to get elected (15 rounds of voting were needed) and the fact there is no time limit on McHenry’s time in the chair, the process could take quite a while.

As such, legislative gridlock will likely remain the order of the day until next year’s general election. At one level, not much has changed: Democrats’ control of the Senate means that major bills cannot be passed, while a continuing resolution will keep the government funded for another six weeks. Thereafter, however, the absence of a Speaker means that no government funding bill can be passed, which points to a looming shutdown in late November.

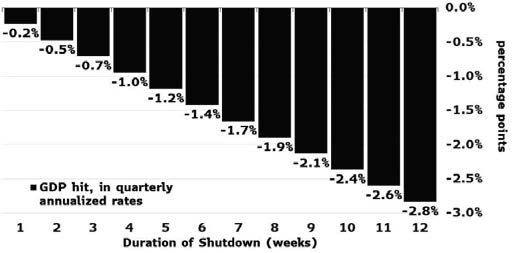

A shutdown should exert a minor drag on the US economy. According to Goldman, a government-wide shutdown would reduce quarterly annualized growth by around 0.2% for each week it lasted after accounting for modest private sector effects. Meanwhile, Bloomberg also speculates that in an extreme tail event, the maximum hit to 4Q GDP would be a drag of 2.8% if the shutdown lasts for the entire quarter. US government debt repayment will be unaffected, for unlike hitting the debt ceiling, a shutdown does not limit the Treasury’s ability to service its obligations.

Impact on GDP of a US federal Government shutdown

WHAT ABOUT THE CONSEQUENCES ON

FINANCIAL MARKETS?

Even if a shutdown late November would have a minor effect on the economy, the ousting of McCarthy and the looming shutdown could become a negative event for financial markets. The recent rise in bond yields is being driven by

a lot of factors and political dysfunction is probably one of them. The US debt servicing cost has hit the inflection point for austerity at the same time basic governing is proving to be impossible. And in the event of a shutdown taking place in 45 days, there are several reasons why US equity volatility should rise:

- The suspension of government spending removes one pillar of economic stability. A government shutdown could raise investors’ doubts on Uncle Sam’s ability to maintain stability in the economy through fiscal spending and government hirings. It would come at a time where other external events are weighing on economic prospects. Indeed,

the auto shutdown, declining consumer aid, and rising gasoline prices make the combination of these events more impactful; - Data releases from agencies like the Bureau of Labor Statistics, the Census Bureau and the Bureau of Economic Analysis may be suspended during a shutdown. As a reminder, the Fed has repeatedly said it will be data dependent. The fact that the shutdown might result in an information void could leave both the Fed and investors in the dark for a while.

- This political crisis is coming at the time where there are fears of an impending US debt crisis. Billionaire investor Ray Dalio is watching closely the “risky” U.S. fiscal situation.

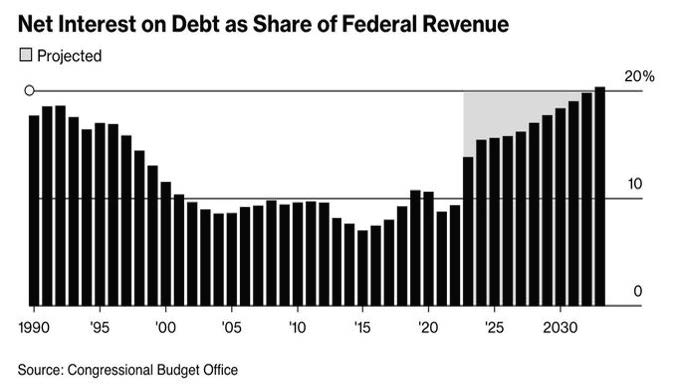

“We're going to have a debt crisis in this country” he said earlier this week, adding to US Treasury volatility. Indeed, the US debt servicing cost is increasing for the first time in 35 years. For nearly 20 years, it was effectively free for the US to issue debt as debt service costs were ~1.5%. Now, debt service costs have doubled to 3% and will rise toward 5% as rates skyrocket. To put this in perspective, 5% on $33 trillion is ~$1.7 trillion PER YEAR of interest expense. As deficit spending rises, rates are also rising as the US issues trillions in bonds to cover the deficit. It's a never ending cycle of borrowing to spend which is driving rates higher and leading to interest expense being 20% of US revenue. And there is no long-term plan…

Bottom-line: more bond and equity markets volatility are likely at least in the short-term. We should use volatility at our own advantage and add on equities on weakness.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Flash note

.png)