Chart #1 —

Following a rather "hawkish" Jackson Hole, markets raise the Fed's terminal rate by 15 basis points

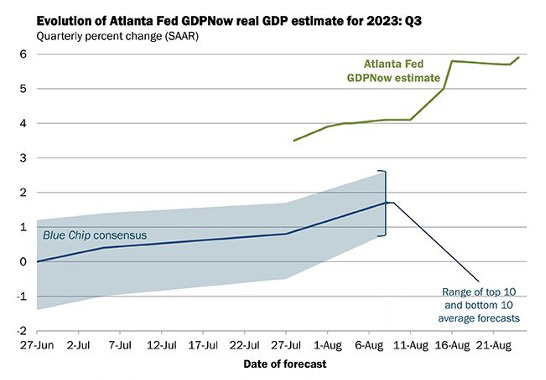

The eagerly awaited symposium of central bankers in Jackson Hole, Wyoming, did not provide any new information on the Fed's monetary policy. The general tone of Chairman Powell's speech in Jackson Hole was relatively hawkish, i.e. in favour of pursuing a restrictive monetary policy. However, Mr Powell was not as hawkish as some had feared, given the recent macroeconomic data (see chart #4). The main message is that the Fed is ready to take a break from monetary policy, but will adopt a more hawkish stance if the economic data continues to be so strong.

The Fed's terminal rate was revised upwards by the markets following Powell's speech. The markets are now assigning a probability of a rate hike in September of 21.5% (compared with 10% before Mr Powell's speech). The probability of another rate hike this year has just reached its highest level in two months, at 52.1%. According to the yield curve, the markets do not expect a rate cut before June 2024.

Source: Bloomberg

.png)