Chart #1 - Nasdaq on track for worst run of negative quarters since the 2008 crisis

Global equities recorded a second consecutive week of declines after the Fed announced a 75 basis points rate hike while suggesting that monetary policy will remain tight in the coming months.

During the session, the Dow Jones Industrial Average reached its lowest level since the end of 2020, while the S&P 500 and Nasdaq Composite are holding mid-June 2022 levels for now. The S&P 500 is now down 22.5% year-to-date, the fifth worst run in history.

As for the Nasdaq, traders only have a few sessions left to prevent the index from recording its three worst consecutive quarters since 2008.

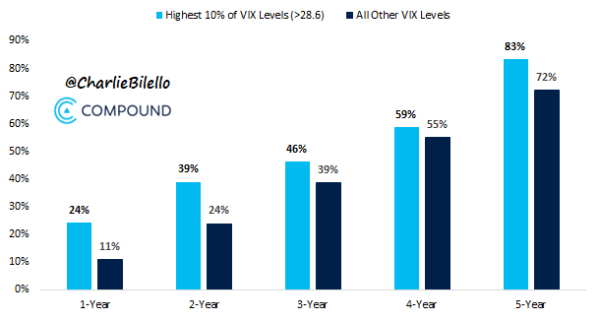

Chart #2 - The VIX, or "fear index", is approaching levels which were historically attractive entry points into equity markets

The VIX index, a gauge of market stress, rose sharply at the end of the week and exceeded the 30 level for the first time since June. The index is back in the top decile of historical data. These are the levels that have often provided buying opportunities in the equity markets for investors over time horizons ranging from one to five years.

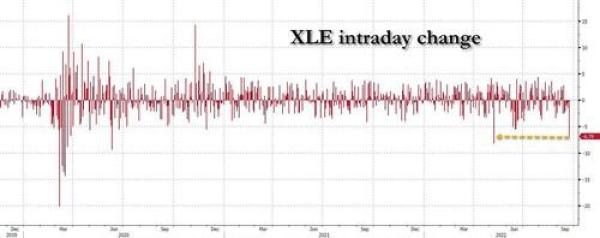

Chart #3 - Oil stocks tumbled

WTI crude oil fell below $80 last week for the first time since January and is on track to lose all gains from 2022. As a result, the SPDR Oil stocks ETF (XLE), which replicates the US oil stock index, plunged nearly 7% in a single session (Friday), its second biggest daily drop since May.

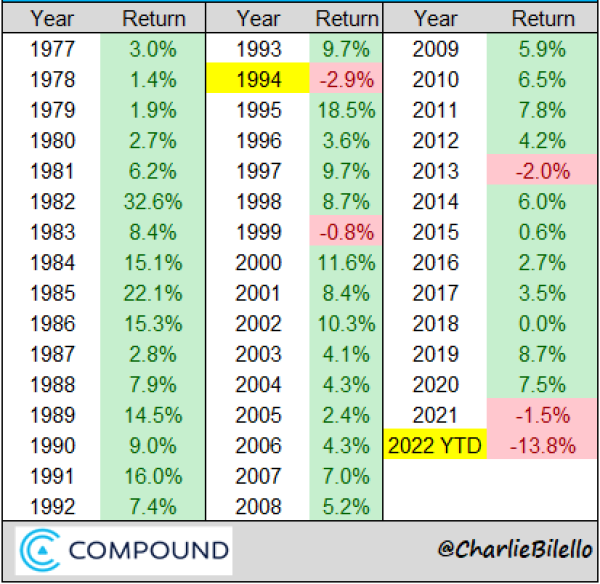

Chart #4 - The carnage in the bond markets continues

Last week, the yield on two-year US Treasuries rose above 4.10%, its highest level since October 2007. The 10-year US Treasury yield reached 3.77%, the highest since November 2008. The inversion of the 2-year to 10-year curve has deepened to minus 52 basis points.

The US bond market is on track for its worst year ever, with the Bloomberg US Aggregate Index down 13.8% year-to-date. This is a decline that is out of all proportion to recent history, since the biggest annual decline recorded to date was -2.9% during the 1994 bond crash.

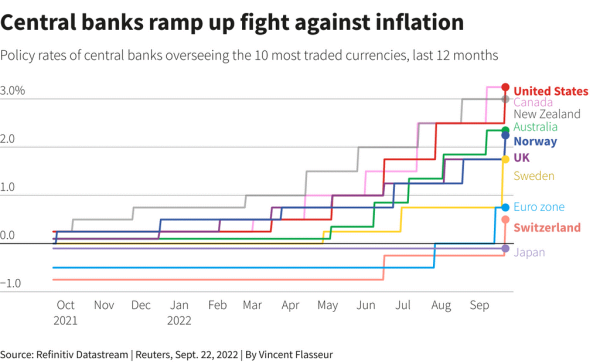

Chart #5 - A very busy week for central banks

Major central banks stepped up their fight against inflation with a cumulative 350 basis point hike last week.

On Wednesday, the Federal Reserve raised US rates by three quarters of a percentage point for the third consecutive time, while the British, Swiss and Norwegian central banks all raised rates sharply the following day.

The central banks of the ten major developed economies have raised rates by a total of 1,965 basis points in the current cycle, with Japan being the exception by maintaining an expansionary policy.

It is worth noting that these hikes come at a time when the risk of recession is clearly on the rise.

Source: Refinitiv Datastream I Reuters, September 22, 2022

Chart #6 - UK Gilts are crashing

The rise in bond yields is not just happening in the US. In the UK, the biggest tax cut since 1972 caused a mini-bond crash on Friday. Yields on UK government bonds (Gilts) rose by 50 basis points, the largest daily increase on record. The market reacted badly to the newly elected Prime Minister's new fiscal policy ("Trussonomics") by selling off both Gilts and the British Pound. It is very rare that a developed country experiences a simultaneous fall in domestic bonds and its currency.

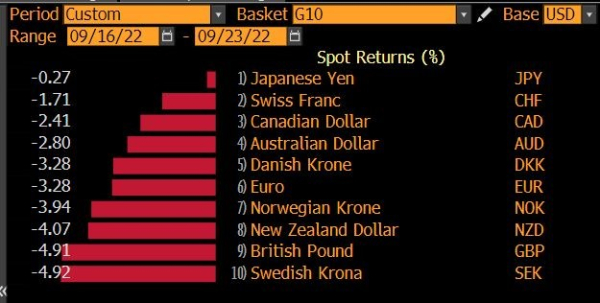

Chart #7 - Pound and other G10 currencies plummet against the dollar

The pound sterling reached its lowest price (against the dollar) in 37 years last week. On Friday alone, it lost up to 3.6% against the greenback. Over the week, the drop was 5%, bringing the pound's devaluation to 27% since the 2016 Brexit vote.

But the British pound was not the G10 currency that depreciated the most last week. Indeed, it was the Swedish krona that posted the biggest weekly decline, even though the Riksbank raised rates by 100 basis points last week, a larger than expected increase. It is clear that we are in a situation of unprecedented dollar strength against the vast majority of currencies.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, bitcoin and software equities are moving like twins. Each week, the Syz investment team takes you through the last seven days in seven charts.

While gold, silver and platinum were the best performing commodities over the past year, they took a hit at the end of last week. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)