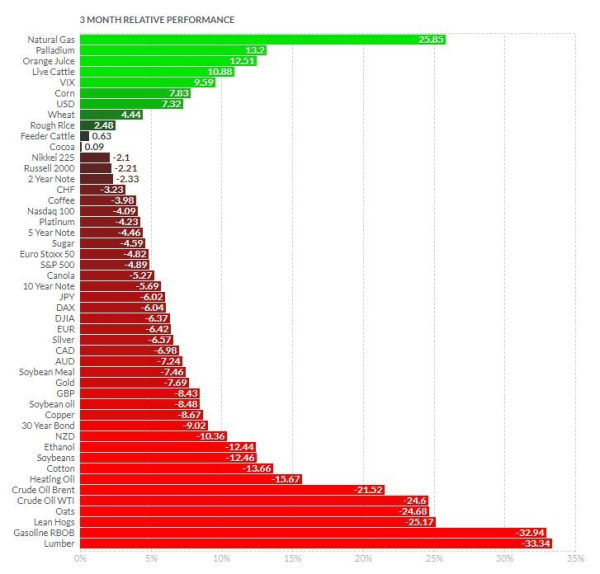

Chart #1 — A never-ending 3rd quarter

Equities, bonds and most commodities recorded very strong losses in the third quarter. On the equity markets, the Eurostoxx 50 (-4.8%), the S&P 500 (-4.9%) and the Dow Jones (-6.4%) are all in the red. The Nikkei 225 (-2.1%) and the Nasdaq 100 (-4.1%) are holding up slightly better. The bond market continues to be highly correlated with the equity markets. The 10-year US Treasury bond fell by -5.7%. The vast majority of currencies show significant declines against the dollar. Commodities gave up a large part of their gains of the first half of the year: gold corrected by 7.7%, copper by -8.7% and oil by 24.6%. The biggest decline was in wood (-33.3%), which could be a bad omen for new home sales in the US. Assets in positive territory include natural gas (+25.9%), palladium (+13.2%), the VIX index (+9.6%) and the US dollar index (+7.3%).

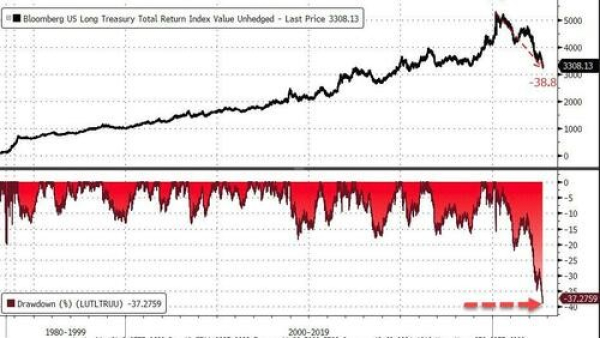

Chart #2 — The steep decline in US long-dated bonds

The global bond market is currently experiencing its worst decline on record. While the bond crash has spread across all global markets and issuer grades, it is the long end of the US Treasury yield curve that is showing the most dramatic decline since the 2020 highs (-37.3%).

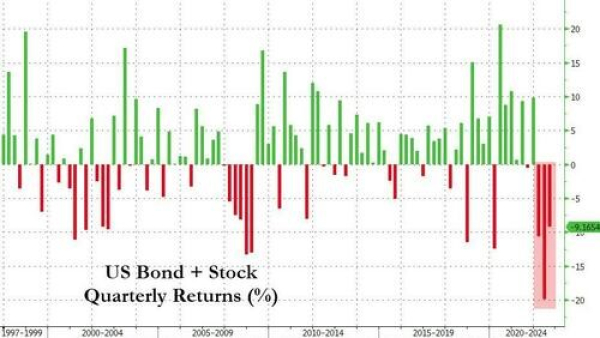

Chart #3 — Balanced portfolios down for a third consecutive quarter

A "balanced" equity/bond portfolio (US markets) recorded another significant decline in the third quarter. This is the third consecutive quarter of decline. Since the highs of 2021, the cumulative decline in the US equity and bond markets is $57.8 trillion. This is the largest wealth destruction on record.

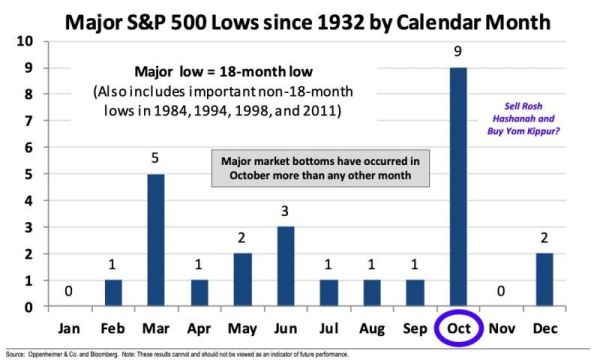

Chart #4 — A market turnaround in October?

October is historically the month when the downturn in the markets ends and begins. It is the month that starts the most buoyant period for risky assets, i.e. the last quarter.

The study of cycles shows that this positive seasonality is particularly marked in mid-term election years - which will be the case this year. But beware: this average is not statistically significant.

Chart #5 — A strong dollar or a weak Europe?

While the dollar index continues to appreciate, a detailed analysis shows a significant performance differential between two categories of countries: those in the G10 and emerging countries (excluding China and Russia). It can be seen that, contrary to other periods of crisis, emerging countries are far more resilient than developed countries.

This is due to the euro and the pound, which suggests that it is the European currencies that are weak, rather than the dollar that is strong.

Chart #6 — A roller-coaster week for UK sovereign bonds

The UK is in the midst of a financial crisis of rare intensity. Last week, the pound hit an all-time low against the dollar, coming very close to parity, while sovereign bonds saw their yields reach their highest level since 2008. The scale of the crisis is such that members of the Bank of England worked through the night on Tuesday to save the UK's pension fund system. Indeed, the collapse of gilt bonds has led to huge margin calls on UK pension funds, triggering forced sales of gilts, further fuelling the decline. On Wednesday morning, the Bank of England had to announce the temporary suspension of the Quantitative Tightening and the implementation of a sovereign bond purchase programme in order to curb the rise in yields. Following this announcement, UK 30-year bond yields, which had previously reached a 20-year high (>5%), fell by 0.75% to 4.3%, the largest daily fall in yields on record.

Daily performance of UK 30-year sovereign bonds (in %)

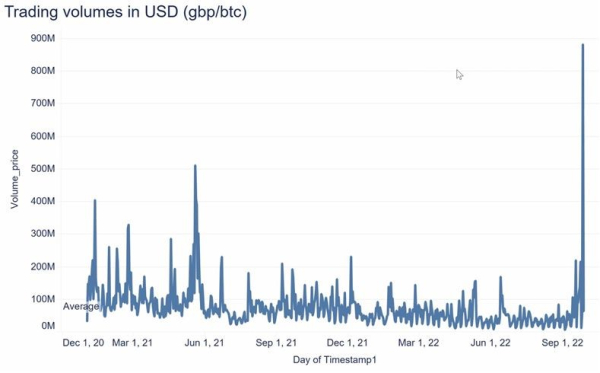

Chart #7 — Will the Brits take refuge in bitcoin?

GBP/BTC trading volume on the Bitstamp and Bitfinex exchanges, which is usually around $70 million per day, reached a staggering $881 million on 26 September (the day of the GBP crisis), an increase of over 1,150%.

Volume (in dollars) on GBP/BTC positions

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Plus, Berkshire Hathaway’s cash peaks as South Korea’s KOSPI rockets. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the USD continues to lead transactions and China stockpiles gold. Each week, the Syz investment team takes you through the last seven days in seven charts.

Meanwhile, the Korean stock market surges to new levels. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)