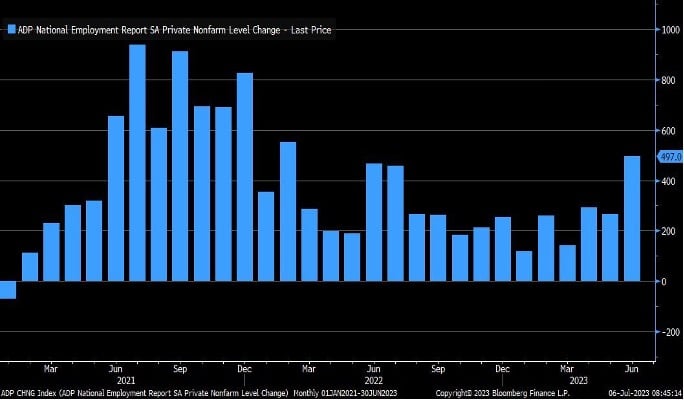

Chart #1 —

US job market overheats

This was the shock figure of the week! Payroll firm ADP announced on Thursday that private sector companies added 497,000 jobs in June, more than double the forecast. Although part of this upward surprise can be explained by the leisure and hospitality sectors, which are still picking up post-pandemic, this figure shows once again that the US job market is overheating, and this after 16 months of monetary policy tightening and 500 basis points of rate hikes. Equity markets reacted badly to this announcement. Indeed, two risks may have been underestimated in the first half of the year: 1) the risk of persistent inflation; 2) the risk of recession. The fact that the job market remains very buoyant is forcing the market to reassess these two risks. Indeed, spare capacity on the labor market is limited, profit margins are high and the economy is doing much better than expected. As a result, wage growth is likely to remain higher than expected, and for longer than initially anticipated. Under these conditions, the Fed may have no choice but to force the economy into a landing (i.e., a recession). Investors therefore reassessed these risks, causing equity markets to fall back slightly at the end of the week.

ADP Report - Monthly job creation in the private sector

Source: Bloomberg

.png)