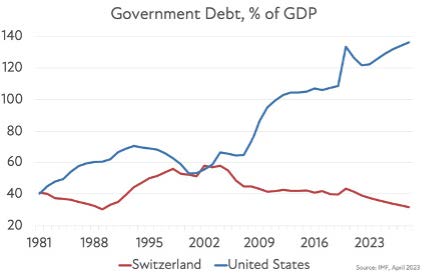

Chart #1 —

US inflation picks up slightly in July

It was the most eagerly awaited figure of the week, that of US inflation in July. Headline CPI accelerated to 3.2% year-on-year, up from 3% in June and slightly below consensus expectations (3.3%). This is the first acceleration after twelve consecutive months of decline. Year-on-year goods inflation slowed in July, while services inflation remained very high at 6.1%.

Core inflation, i.e., excluding food and energy, slowed to 4.7% year-on-year from 4.8% in June, in line with expectations. It should be noted that housing costs contributed around 90% of the core inflation rate in July.

As for the Fed's preferred inflation indicator, the CPI excluding energy, food and housing, it remains well above the Fed's target. It even accelerated again in July (0.2% sequentially and 4.0% year-on-year vs. 3.9% in June).

Following this publication, the short interest rate group attributes only a low probability (20%) to a further increase in the key rate at the US Federal Reserve's September meeting.

Source: Bloomberg

.png)