Why we remain sceptical about witnessing 3 rate cuts by the end of the year

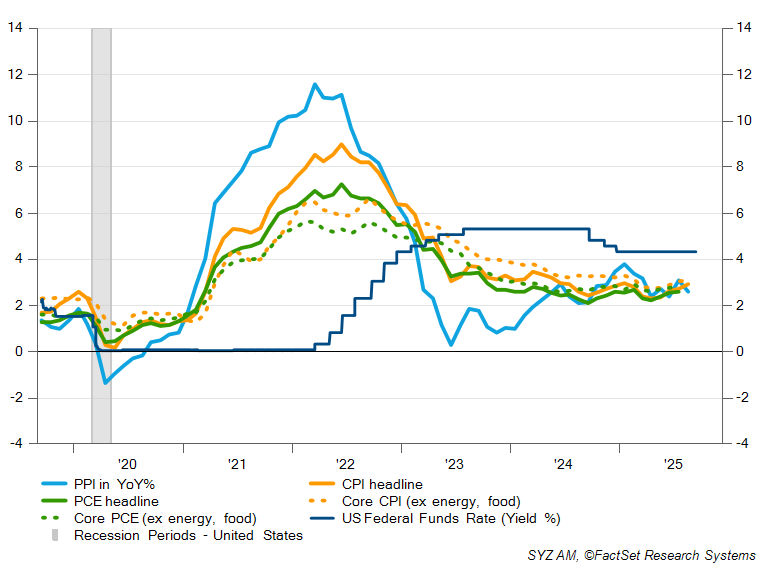

The underlying price pressures from tariffs are still getting through and some are increasing (Foods) while other are abating (mostly discretionary goods). But it is not the “tariff push through” of goods prices that would worry any traditional central banker in the USA, but rather the price pressures in the service sector caused by domestic factors. When we look at measures such as services ex energy or even services less shelter prices, both remained at significantly elevated levels in August at 3.6% and 4% respectively, and thus quite far off the 2% target of the FED.

In combination with the PPI numbers, which came in yesterday significantly weaker than expected on average, those categories that filter into the PCE components – the Federal Reserve’s preferred measure of price pressures is the personal consumption expenditure index – showed mostly an increase in price pressures. Together with today’s CPI numbers, these data point to a core PCE figure of 3.0% for August (compared to August 2024) and the PCE measure for domestic underlying price pressures, the so called “Supercore PCE”, of above 3.3%: This would mark a higher figure than the peaks from last February 2025 or December 2024 when the FED did stop its rate cuts.

Source: BLS, Federal Reserve, FactSet, Syz Group

.png)