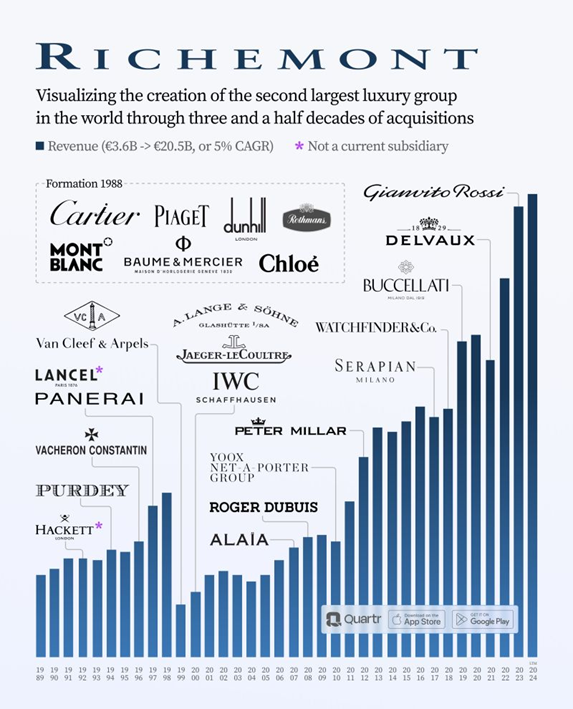

Chart #1 —

US inflation appears to be accelerating again

It was the week's most anticipated figure: US March inflation. The figures surprised most economists by coming in above expectations.

The headline inflation rate was 3.5% year-on-year, compared with the consensus figure of 3.4%. As a reminder, the inflation rate was 3.2% in February. This is the 3rd consecutive month of rising inflation...and the highest since September 2023.

Core inflation, i.e., excluding food and energy, also exceeded estimates: +3.8% year-on-year versus 3.7% expected and 3.76% in February. This is the first increase in core inflation since March 2023. Transport prices rose by +10.7% year-on-year and housing by +5.7%.

As for the "Supercore" index (i.e., excluding food, energy, and housing), it rose by +0.65% sequentially and 4.77% year-on-year. This is the highest rate in 11 months.

The U.S. Federal Reserve and its Chairman Jerome Powell probably didn't appreciate this new series of indicators. These statistics seem to push back the date at which the Fed could lower its key rates even further. Market estimates of the number of rate cuts expected in 2024 have been revised downwards, and a first cut in June is looking less and less likely. The scenario of no Fed rate cut in 2024 is becoming more likely. Indeed, the risk of a 2nd wave of inflation, like that seen in the 70s and 80s, is now being taken very seriously by economists

Source: TradingView

.png)

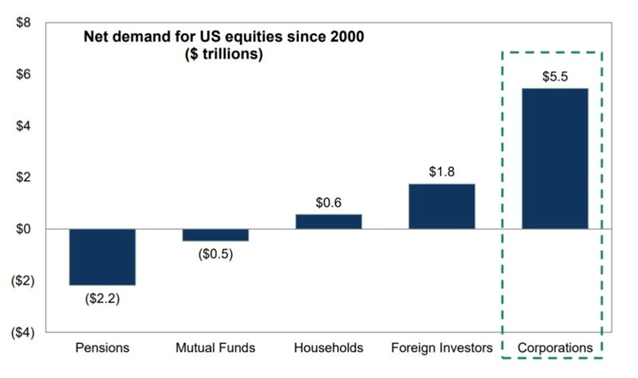

Source: BofA

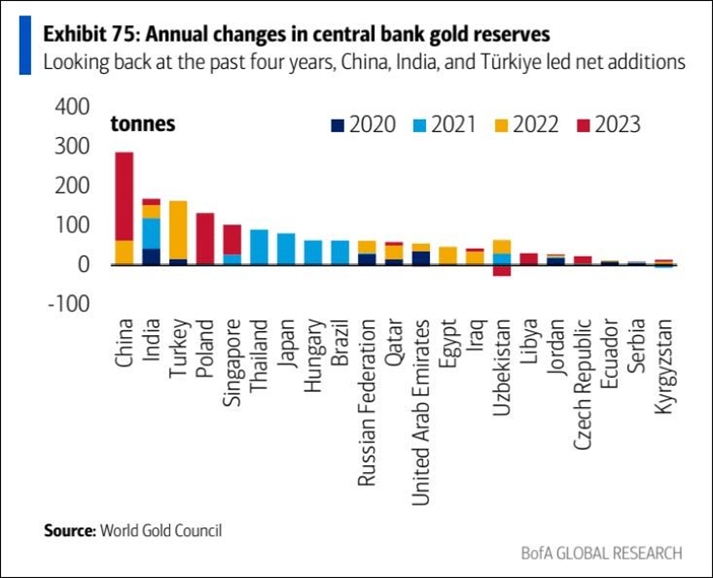

Source: BofA