Before discussing these 10 surprises for 2024, let’s look back at the 2023 surprises that actually happened:

› US inflation has fallen back below 4% (it was 9.1% in June 2022).

› The 60/40 portfolio is back in positive territory (although it has to be said that the correlation between equities and bonds is still very high).

› China has effectively emerged from its strict confines

And then there were the REAL surprises, the ones nobody expected:

› The boom in artificial intelligence and the inexorable rise of the “Magnificent 7”.

› The immense dichotomy between the performance of US mega-cap companies and the rest of the market

› The surprising resilience of the US economy: inflation has fallen sharply, with no rise in unemployment, no recession or even a major slowdown in growth

› China’s disappointing growth and the poor performance of its stock market despite the reopening of the economy.

› Gold is trading at close to $2,000 despite rising real yields and a stronger dollar.

› The slow-motion banking crisis currently raging in the United States

› The collapse of Credit Suisse.

› Bitcoin is (almost) at $40,000

What surprises could be in store for 2024?

SURPRISE #1

A FINANCIAL “ACCIDENT” HAPPENS IN THE U.S. IN Q1, FORCING THE FEDERAL RESERVE TO LOWER RATES HEAVILY. U.S. GOVERNMENT BONDS PERFORM SPECTACULARLY

[PROBABILITY: HIGH]

Such an event could well have occurred in 2023, and now seems to be ignored by the consensus. A financial crash would echo the most significant monetary tightening in the US since the 1980s.

Signs of financial stress abound. These include US banks’ unrealized losses on their bond portfolios (Bank of America’s losses are almost equivalent to its Tier 1 capital, for example), defaults on sub-prime auto loans and credit card defaults. And, of course, all the risks associated with commercial real estate.

These risks are not confined to the United States. Europe, the UK and China are not immune to a financial crisis.

We believe that the probability of such an event occurring is relatively high. In such a scenario, long-duration government bonds and gold would probably be considered safe havens.

SURPRISE #2

THE “MAGNIFICENT 7” BUBBLE BURSTS

[PROBABILITY: MEDIUM]

As we know, the magnificent 7 stocks are up by more than 70% this year, and between them have contributed to more than 90% of the S&P 500’s gains in 2023.

This very strong rise is mainly due to a sharp upward revision of expected earnings. The market has revised earnings expectations upwards by 70%. And forecasts for 2024 are relatively ambitious.

Are these expectations reasonable? The artificial intelligence (AI) revolution is underway, but there are many barriers to adoption. As is often the case, the market tends to be too aggressive in its projections. Any disappointment regarding 2024 earnings could lead to a sharp correction of the magnificent 7.

SURPRISE #3

IA BOOM LEADS TO IPO WAVE

[PROBABILITY: MEDIUM]

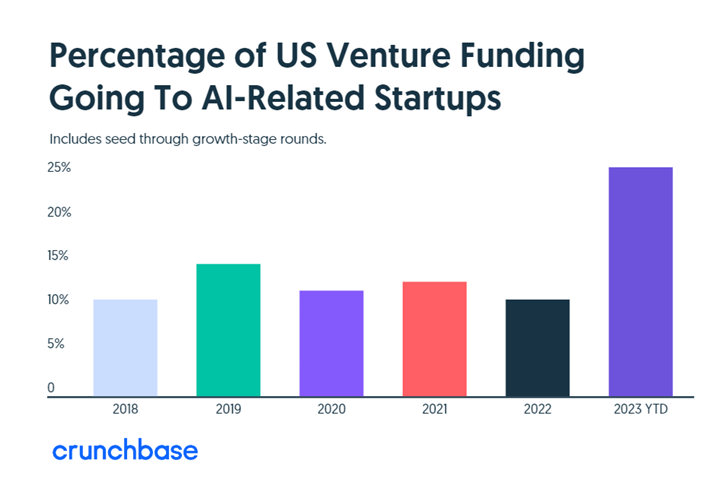

Still in the AI field, a positive surprise this time. Until now, the AI bubble has been concentrated in a few very large market capitalizations.

But perhaps we’re about to witness a phenomenon similar to that of the Internet bubble of 1999/2000: the arrival on the market of a plethora of IPOs that will whet the appetites of speculators - including private individuals.

In view of the substantial venture capital investment in AI, this is a real possibility.

SURPRISE #4

THE SIGNING OF A PEACE AGREEMENT BETWEEN ISRAEL AND GAZA. FOLLOWED BY THE DEAL OF THE CENTURY BETWEEN ISRAEL, SAUDI ARABIA, AND THE UNITED STATES

[PROBABILITY: LOW]

Let’s move on to geopolitics. The horrors of late 2023 finally lead to a peace plan between Israel and Palestine. The arrival of a peacekeeping force in Gaza creates the conditions for the signing of an agreement enabling the creation of a new state.

At the same time, the USA, Saudi Arabia and Israel sign the «deal of the century», the premise of a new Middle East that attracts capital from all over the world.

Unfortunately, the likelihood of such events seems rather remote...

SURPRISE #5

CHINA AND THE UNITED STATES DECIDE ON NEW COOPERATION

[PROBABILITY: LOW]

Another geopolitical surprise that nobody seems to believe in any more is the warming of relations between China and the United States.

Indeed, the two giants are virtually in a state of cold war. And the price is high on both sides.

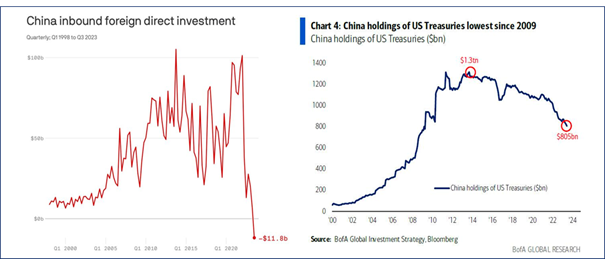

For the first time in 3 decades, foreign direct investment in China is in negative territory.

And as China has fewer and fewer dollars to recycle, its stock of US Treasuries is at its lowest level since 2009. This news comes at a bad time for the United States, at a time when Madame Yellen has never issued so many treasury bills.

Faced with this “lose-lose” situation, the Chinese and Americans could be drawing up the outlines of a new relationship. All assets sensitive to Chinese growth could then benefit (Chinese equities, Renminbi, European exporters, etc.).

SURPRISE #6

WHAT IF INFLATION WERE TO RISE AGAIN NEXT YEAR?

[PROBABILITY: HIGH]

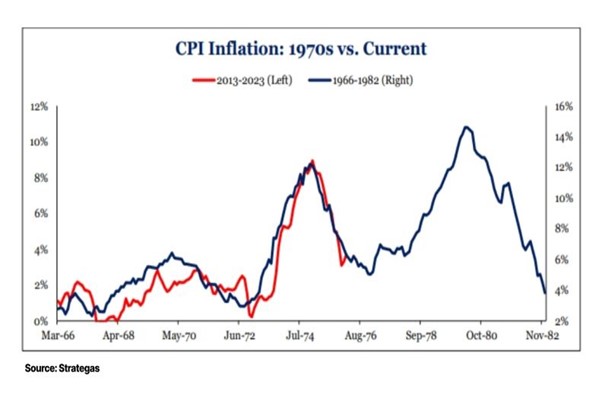

According to Bank of America’s latest survey of fund managers, only 6% expect inflation to rise in 2024. As we know, the consensus is not always right. Despite the significant decline in inflation in 2023, long-term inflationary factors persist: de-globalisation, decarbonisation (shortage of hydrocarbon supply) and demographics (labour shortage leading to upward pressure on wages). In the United States, the job market remains tight. The Auto Workers Union is hoping for an average 33% rise in wages. In Switzerland, the union is calling for an average wage increase of 5%. Inflation could thus experience a second wave similar to that seen in the 70s and 80s. Inflationary assets (e.g., cyclical stocks) could catch up with deflationary assets (e.g. technology stocks).

SURPRISE #7

DUE TO INCREASING DEBT COSTS, THE U.S. FEDERAL RESERVE IMPLEMENTS A YIELD-CURVE-CONTROL MECHA-NISM SIMILAR TO THAT OF THE BANK OF JAPAN. THE DOLLAR PLUNGES AND GOLD REACHES $2,500

[PROBABILITY: HIGH]

By 2023, the cost of debt in the United States will exceed $1 trillion annually. That’s more than the entire defence budget. 40% of tax revenues collected from individuals are devoted to interest on the debt. At this rate, this figure could reach 100% in a few years’ time.

To finance the “Bidenomics”, the US Treasury will increase bond issuance by 25% compared with this year. If bond yields remain at these levels, or continue to rise, the United States is in for a real headache.

This situation could lead the Fed to follow in the Bank of Japan’s footsteps, i.e., to resort to massive purchases on the long end of the curve - the famous Yield curve control (YCC).

A monetary policy decision that would send the dollar plung-ing and could push gold to record levels.

Such a situation could also arise in Europe.

We consider the probability of such an event to be relatively high.

SURPRISE #8

A THIRD CANDIDATE ENTERS THE US ELECTION RACE

[PROBABILITY: MEDIUM]

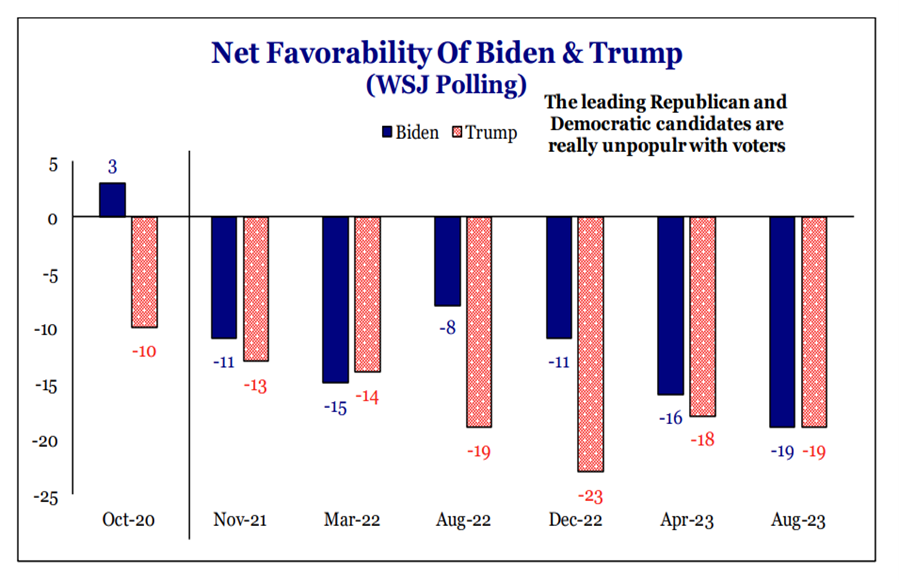

One thing is certain: the American presidential election campaign is set to be a major event in 2024. And it's far from thrilling the crowds.

Opinion polls seem to show that we're heading for another Biden-Trump duel.

But what if a third candidate were to muddy the waters? In fact, it's very rare for both the Democratic and Republican candidates to attract so little support.

A candidate who is close to the center and capable of bring-ing Americans together stands a good chance. Even if such an event has never occurred in 200 years.

Yet some are thinking about it. Such is the case of Democratic Senator Joe Manchin. A campaign fund has even been set up by the "No Labels" party.

Such a development could widen the range of possibilities for the U.S. presidential election, and cause considerable market volatility in the run-up to the polls.

SURPRISE #9

BITCOIN SOARS ABOVE $100,000 AND ENTERS THE WALLETS OF MOST PRIVATE BANKS

[PROBABILITY: MEDIUM]

After the phenomenal rise of 2023, will Bitcoin continue its comeback and reach new all-time highs?

It’s not impossible, as the planets could align in 2024: the approval of several bitcoin spot ETFs, the revival of FTX, the IPO of Circle and the halving of bitcoin in 2024 push BTC above $100,000. Pension funds and private banks are now considering cryptocurrencies as an asset class.

SURPRISE #10

X BECOMES A BENCHMARK FINANCIAL PLATFORM WITHIN A YEAR

[PROBABILITY: LOW]

Let’s finish this article with Elon Musk. Will he surprise us again in 2024? A few weeks ago, he announced a crazy project: to transform X into a one-stop shop for all financial needs. The aim is to simplify and streamline financial transactions, making them as intuitive as sending a tweet.

Perhaps the most audacious part of Musk’s project is his eagerness to replace the traditional banking system with X within a year, which seems more than ambitious.His ability to turn visions into successful projects, combined with the changing financial landscape, suggests that his dreams of Future X could turn into reality.

And make life even more complicated for America’s commer-cial banks...

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)