We turned positive on Chinese equities following the Communist Party Congress in late October. At the time, we believed that the market had interpreted the implications of this historic congress far too pessimistically. Since then, other positive developments have fueled our positive investment outlook on Chinese stocks. Here are 12 reasons to consider this market, which remains underinvested by the vast majority of international investors.

#1 —

A gradual return to normal for Chinese economic activity

Chinese President Xi Jinping caught many investors off guard when his government decided a few weeks ago to do a U-turn on how it was handling the COVID-19 pandemic. While many expected a lengthy reopening process, China quickly lifted most of its restrictions. While the current logical upsurge in cases is expected to create some temporary disruptions and unfortunately many deaths, a normalization of local activity is overall good news for national and international economies.

Source: Bloomberg

#2 —

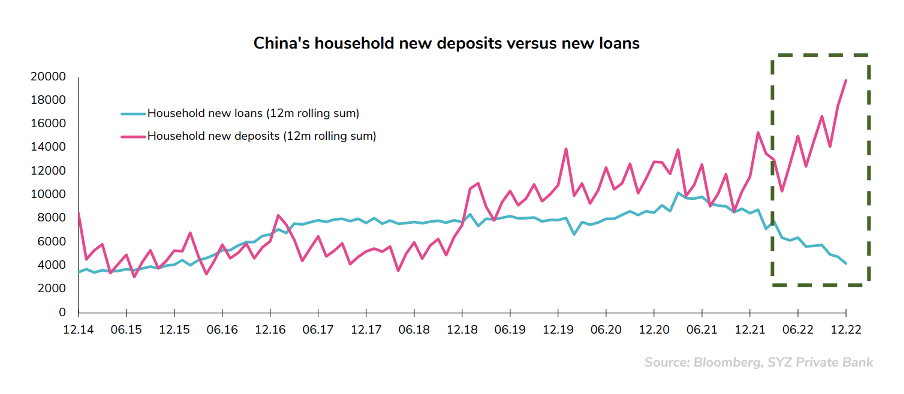

Record savings should translate into a consumption boom

Chinese households have accumulated a considerable savings surplus in 2022, partly due to zero-covid policies and a sluggish property market. With the end of the restrictions, this unprecedented savings surplus should stimulate spending on discretionary goods and services and trigger a virtuous circle by improving employment and income growth.

China's household new deposits versus new loans

Source: Bloomberg

#3 —

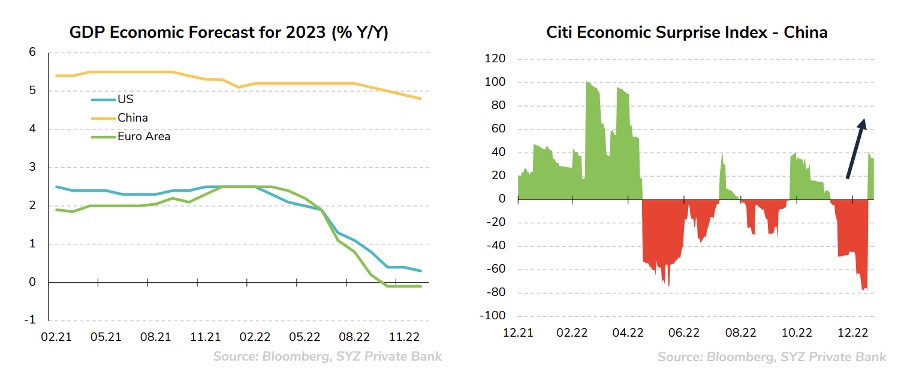

The macroeconomic environment is improving

While most developed economies are on the verge of recession, GDP growth in China could reach 6% in 2023. As the country emerges from its period of confinement, domestic demand should rebound strongly. The same phenomenon was already observed in the US and Europe in 2021.

Source: Bloomberg

Source: Bloomberg

#4 —

Inflationary pressures are much lower than in the US and Europe

In 2022, prices rose by 1.8% in China, compared to 9.2% in the Eurozone and 7.1% in the US. Lower inflation rates allow the central bank (PBoC) to have much more flexibility in its monetary policies than its Western counterparts.

#5 —

One of the few economies without a restrictive monetary policy

The Chinese government has recently adopted more accommodating fiscal and monetary policies to support the economic recovery through household consumption and small business activity. While most central banks in developed markets are trying to curb inflation by raising interest rates, China is following an expansionary monetary policy.

#6 —

Signs of improvement in the real estate market

In 2020, the Chinese government had implemented new rules (e.g. debt limits) to curb speculation in the real estate market in 2020. These new measures caused a collapse of the housing market and the Evergrande crisis in 2021. Regulators have recently shown signs that they may relax these rules, giving some breathing space to struggling developers and reassuring their customers (households).

#7 —

The regulatory stranglehold on "disruptive" sectors is loosening

More than a year ago, Chinese regulators had struck a blow by implementing new rules in some "disruptive" industries, such as the technology sector or the education sector. The cancellation of Ant Group's IPO had weighed heavily on investor sentiment.

The government has recently shown signs that this regulatory frenzy may soon come to an end.

#8 —

Fears of delisting of major ADR stocks likely overestimated

Frequently mentioned in the press, the risk of a Chinese ADR delisting from the U.S. markets has put off many international investors from the stocks they usually hold for exposure to the region. While this risk still exists, it is now probably much lower than many had feared. U.S. auditors recently gained access to these Chinese companies, a crucial and sensitive pointthat would have triggered delisting under other circumstances. Moreover, if China has agreed, it is probably because it believes that the majority of the companies under scrutiny will pass muster, at least the largest ones (e.g. Alibaba, Tencent, JD...).

#9 —

A market too big to ignore

Chinese stocks currently account for 4% of the MSCI ACWI global equity index. This is still well below China's contribution to global GDP of about 20%. China's weight in global equity indices is expected to continue to grow over time. Many international portfolio managers will certainly be prompted to adjust their exposure, which will result in accelerated capital flows to China.

Source: Bloomberg, IMF, World bank, Atlantic Financial Group

#10 —

Continued rise could trigger a "short squeeze"

From 2014 to 2021, short sales averaged 12% of the Main Board. In 2022, that number averaged 17.6%, up 42% from the seven-year average.

Further increases in Chinese stocks could force some short sellers to buy the shares in order to close out their positions, pushing the markets higher and potentially generating additional short selling.

#11 —

Valuation levels remain attractive on a historical and relative basis

Chinese stocks have been cheaper than their U.S. counterparts since 2008, while technology stocks have been trading at a historical discount on the Nasdaq lately.

#12 —

A way to diversify global equity portfolios, especially when the dollar weakens

In recent history, Chinese stocks have tended to outperform when the U.S. dollar depreciates. Given a less dollar-friendly environment this year (narrowing credit spreads), this scenario could very well happen again in 2023.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)