The resilience of the global economy and financial markets

While the world feared it was heading for an economic and financial crisis similar to that of 1929, nothing of the sort has happened. Despite Lehman and the many shocks that have occurred over the last 15 years (European debt crisis, US debt ceiling, pandemic, etc.), global nominal GDP has grown by 57% over the period, from $64 trillion to over $100 trillion. In most developed countries, unemployment is close to historic lows.

With the return of confidence and the credit boom, the world has experienced one of the strongest waves of innovation ever seen: blockchain, artificial intelligence, robotics, the human genome, foodtech, electric cars, the energy transition, etc. are fueling growth and are sources of productivity gains and progress.

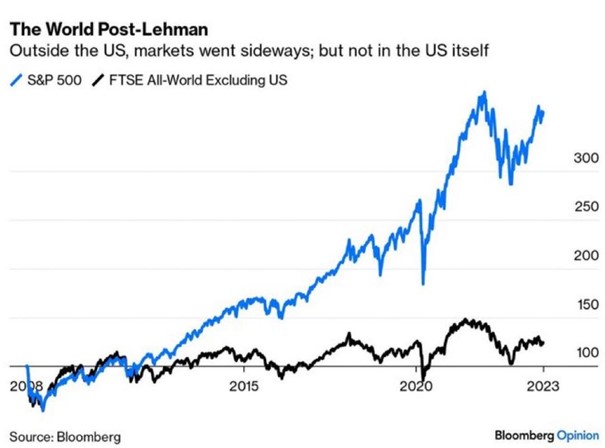

As for real estate and personal property assets, they have undergone one of the most euphoric phases in their history. Since the day Lehman went bankrupt , the S&P 500 has risen by more than 400% (total return dividends reinvested). Ironically, between 2008 and today, US equities have outperformed the rest of the world by a phenomenal margin, even though it was the United States that caused the great financial crisis in the first place.

S&P 500 index vs. the rest of the world since the Lehman crisis

The bond market, government bonds and credit, experienced one of the biggest bubbles in its history.

The property market experienced an unprecedented boom in most developed countries. Venture capital and private debt markets have also grown strongly. The last 15 years have also seen a proliferation of digital assets. Bitcoin, born out of the ashes of the great financial crisis, is now making its mark on the financial markets.

The development of intuitive trading applications and easy access to financial information via social networks have contributed to the enthusiasm of 'small' investors for the markets.

Addiction to money printing and debt

However, the almost idyllic picture described above conceals a rather worrying reality: the price that had to be paid to save the global economy and the financial markets. While the collapse of Lehman Brothers was primarily due to poor risk management, the final blow to the now-defunct investment bank came from the collapse of the sub-prime mortgage market, itself triggered by excessive leverage on the part of individuals and banks. Years of fiscal indiscipline and an overly accommodating monetary policy were the main causes of this over-indebtedness.

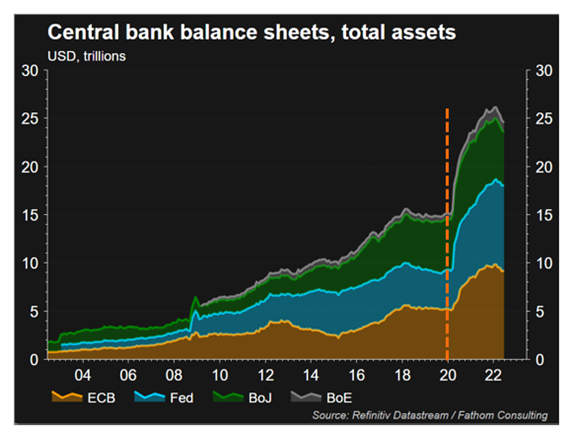

Unfortunately, governments and central banks decided to solve a debt crisis by issuing more debt and printing even more money. Following the great financial crisis of 2008, most of the G10 countries implemented an expansionary monetary policy, including the famous quantitative easing (QE). In the space of 15 years, the balance sheets of the G4 central banks have grown almost fivefold.

Aggregate size of balance sheets of 4 central banks (ECB, Fed, Bank of Japan and Bank of England) in trillions of dollars

As mentioned above, the policies put in place have certainly enabled us to get out of deflation and prevent the global economy from collapsing. But QE also has many drawbacks and risks: the markets' addiction to liquidity inflows, the proliferation of numerous bubbles (growth stocks, cryptos, bonds, property markets), the widening of inequalities (leading to social crises, referendums such as Brexit, populists coming to power as in Italy, etc.) but also, and above all, the explosion of debt, since it has cost virtually nothing for years.

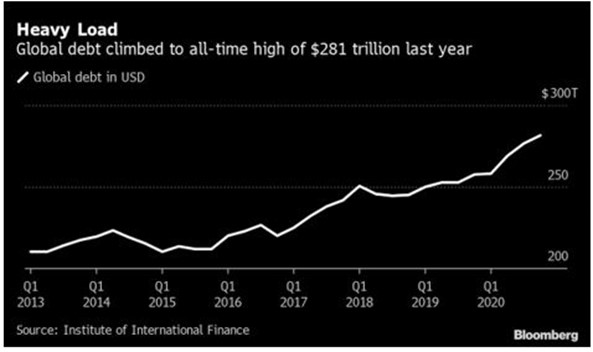

Global debt hit a new high of $281 trillion last year

The 2008 debt crisis, which mainly affected households and banks, has given way to another type of debt overhang, that of nations. For years, this over-indebtedness did not lead to an increase in the cost of debt. During the crisis, the vast majority of governments were able to resort to massive fiscal support while benefiting from a fall in bond yields, "miracle" achieved thanks to the phenomenal expansion of central bank balance sheets described above.

But since 2021, the headwinds increased: strong monetary growth against a backdrop of limited supply of goods and services has generated record inflation, driving up interest rates and bringing the QE experiment to an end. Russia's invasion of Ukraine and the sanctions that followed are now forcing many countries to call on fiscal support to help businesses and households cope with the energy crisis.

Japan, which was the first to use QE and has the highest debt/GDP ratio in the G10 (250%), has for several quarters been using the "Yield Curve Control" mechanism, i.e., buying a large proportion of long bonds, despite the rise in inflation and the sharp fall in the yen. Due to its huge debt burden, Japan wants to avoid a rise in bond yields, thus demonstrating the limits (and dangers) of excessive QE. Last summer, the United Kingdom was faced with the beginnings of a sovereign crisis that also threatened its pension fund system. Through a monetary injection and a process similar to Yield Curve Control, the Bank of England managed to save face. But for how long?

Other G10 countries could soon face the test of the markets. Like Japan, Italy, France and even the United States could one day be forced to resort to Yield Curve Control.

A slow-motion bank run

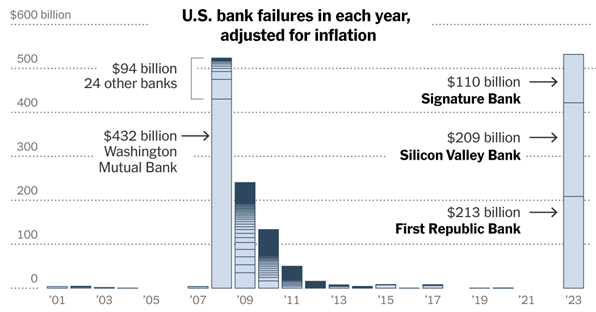

15 years after Lehman, the United States is undergoing another banking crisis. Adjusted for inflation, the three banks failed in 2023 (SVB, Signature and First Republic Bank) are larger in size than the 25 that collapsed in 2008.

Aggregate size of balance sheets of 4 central banks (ECB, Fed, Bank of Japan and Bank of England) in trillions of dollars

Source: The New York Times

How can such bankruptcies be explained when the US economy seems to be in relatively good health?

1. THE COLLATERAL DAMAGE OF RISING INTEREST RATES

In recent years, as the financial world was awash with liquidity, deposits at banks have risen sharply. After the global financial crisis (2008), commercial banks were required to maintain a liquidity coverage ratio of over 100%. This means that they must always have enough "high quality liquid assets" to cover deposit outflows in a crisis scenario.

Banks have invested a large proportion of their liquid assets in bonds. With the Fed raising interest rates and QT (quantitative tightening), the market value of bonds held by banks has fallen sharply, resulting in large (unrealized) losses for the banks.

2. THE FLIGHT OF DEPOSITS

As reserves, the value of bonds held on the balance sheet, shrink, banks face another problem: funding (i.e., available deposits) is drying up. American households can obtain a risk-free interest rate of over 5% by buying Treasury bonds rather than depositing money in banks. For example, SVB deposits yield only 2.3%, whereas 6-month US Treasury bills currently yield 5.3%.

This sets off a vicious circle: the more funding dries up, the more the banks have to pay down their debts, resulting in losses that force them to raise capital. The resulting fall in their share prices can trigger a "bank run" that further jeopardises funding. And so on. This is exactly what happened at SVB...

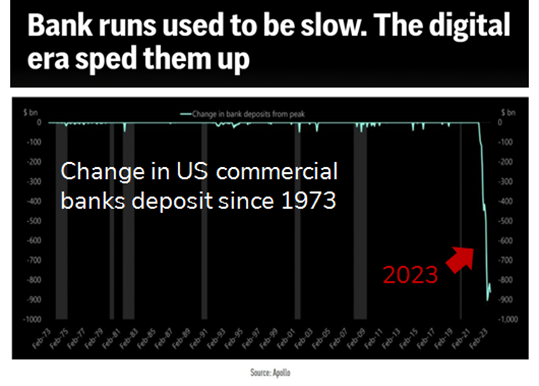

When SVB collapsed in March, the Fed was quick to put in place mechanisms to contain the crisis. However, total deposits continue to flee US banks. Since the start of the rate hike cycle, US banks have recorded almost $900 billion in capital outflows, by far the largest on record. In fact, this is the first bank run of the digital age...

Bank runs used to be slow. The digital era sped them up

Source: Apollo

Source: Apollo

Deposits have been transferred mainly to money market funds, a sign that some savers are losing confidence in banks. This loss of confidence is not confined to the United States (e.g., Crédit Suisse).

The flight of deposits is creating funding problems, while banks continue to face very large unrealized losses on their bond portfolios. Use of the Fed's emergency bank financing facility continues to rise and has just reached a new record of $108 billion. The banks that almost collapsed a few months ago are now borrowing record levels of debt from the Fed at very high rates (around 5.5%).

15 years after Lehman, could another US banking crisis take place?

The failure of the SVB in March should be seen as an extreme and hopefully isolated event. Indeed, while all banks were affected by the rise in interest rates and the withdrawal of some deposits, the SVB was affected more than the others because of its heavy reliance on deposits (89% of liabilities) and its exposure to the technology sector.

However, the double shock of bond losses on balance sheets and the flight of customer deposits creates a risk for many US banks.

From a macroeconomic point of view, the difficulties in the US financial system could lead to even tighter credit conditions, which would be negative for economic growth.

Cycles of interest rate rises have often led to financial and/or macroeconomic accidents. While many fundamentals remain supportive for financial markets (earnings revisions, consumer resilience, etc.), we are currently at a stage in the economic cycle that requires a degree of vigilance. As Mark Twain said, "History doesn't repeat itself, but it does rhyme"...

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)