#1 —

The invasion of Ukraine

This is, without a doubt, the most dramatic and important development of 2022. While a Russian incursion into Ukraine seemed plausible at the beginning of the year, President Vladimir Putin's decision to wage a full-scale war beyond the separatist Donbas region stunned the world. Beyond the human tragedy of the conflict, the sanctions imposed by the West have far-reaching consequences for the global economy. This episode of history comes at a time when the supply of raw materials is already insufficient to meet demand. Russia produces and exports the vast majority of these raw materials: oil, natural gas, industrial metals, precious metals and agricultural raw materials. The global economy is therefore facing a raw materials supply shock, with consequences for both growth (risk of decline) and inflation (risk of increase). But the ramifications of this conflict could extend well beyond 2022. This conflict seems to have given rise to a new world order characterized by an East-West divide. While the United States, Europe and Australia have shown solidarity in the sanctions, 84% of the world's population does not apply them. And relations between China, Russia and India have been strengthened.

#2 —

The surge of inflation

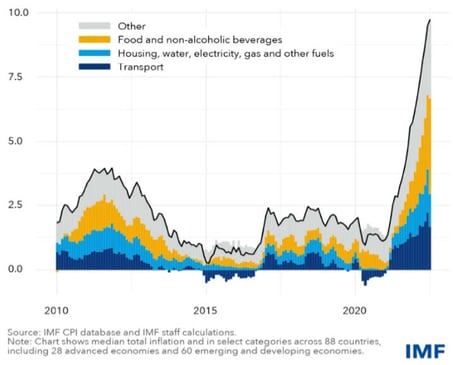

Inflation has continued to surprise on the upside in 2022, reaching multi-decade highs around the world. In September, U.S. consumer prices peaked for the year with a 9.1%increase in prices from a year earlier, reaching a 40-year high, driven by rising gasoline, food and housing prices. The U.S. continues to face high rent and wage inflation. In Europe, year-over-year inflation reached 11.5%, its highest level since the monthly statistic was first calculated in 1963. While the immediate impact of the conflict on the global economy is expected to be limited (the Russian economy accounts for less than 2% of global GDP), rising commodity prices could fuel higher, or at least more persistent, inflation.

Inflation drivers. Food and energy prices continue to fuel the global inflationary surge (percentage, median inflation rate)

Source: IMF

#3 —

The end of easy money

On March 16, the Fed's FOMC tightened interest rates for the first time since December 2018. While Chairman Jerome Powell initially called post-covid inflationary pressures "transitory," Fed officials have moved away from that position. Throughout the first half of the year, they signaled their intention to implement multiple rate hikes as well as reduce the size of the Fed's balance sheet. As expected, the Fed continued to raise rates and reduced its balance sheet by half a trillion dollars. Investors adjusted their expectations accordingly, expecting a rapid and abrupt rate hike cycle in the near term, with potentially negative consequences for growth and therefore rates thereafter. The European Central Bank (ECB) had no choice but to normalize its monetary policy as well. The adjustment of monetary policy has been global, with Japan being a notable exception.

The consolidated balance sheet size of G4 central banks has fallen by -$3.1 trillion in the last 7 months

Source: BofA

#4 —

From rate fears to recession fears

From a macroeconomic perspective, global GDP has continued to grow above the long-term trend, but growth forecasts have been revised downward throughout 2022, while a recession in 2023 now appears to be looming. The market has thus shifted from rate fears (or bond yields weighing on equity valuations) to recession fears. Indeed, rising food and energy costs may dampen consumer spending, while companies may be forced to cut back

on hiring and spending if rising wages and energy costs weigh on profitability. Economic indicators point to a sharp slowdown in US growth. In Europe, the energy crisis is likely to trigger a recession over the winter.

#5 —

One of the worst years for U.S. stocks since 2008 but one of the best for commodities

As of the end of November, the performance of most equity markets is in negative territory. Developed market equities are down 12.2% year-to-date while the MSCI Emerging Markets Index has fallen 21.1%. Brazil's Ibovespa index (up 7.3% in local terms) is the best performer ahead of the U.K. (+2.7%). The S&P 500 is down about 14.4% year-to-date. This is the worst year for stocks since 2008. In terms of style, the global value index (-5.6% year-to-date) has strongly outperformed the global growth index (-26.7%).

Commodities are the best performing asset class. At the end of November, the Bloomberg Commodity Spot Index was up 11.6%. However, not all commodity segments performed positively. Industrial metals ended the period in negative territory as Covid's blockades in China weighed on industrial activity and threatened to curb metal imports. The performance of precious metals - gold and silver - was also slightly negative. Oil, which was up nearly 60% towards the beginning of the summer, lost much of its lead.

#6 —

A record decline for diversified equity and bond portfolios

The simultaneous decline in equity and bond markets weighed on the performance of multi-asset portfolios. 2022 will go down in history as one of the few years in which both equities and sovereign bonds experienced double-digit losses. After a two-decade bull market, bonds collapsed in 2022 as the market gradually incorporated higher inflation and rate expectations. Looking at the performance history since 1928 for the S&P 500, 10-year U.S. bonds, and a 60/40 (stock/bond) portfolio, there have only been 5 years in which the S&P 500 and 10-year Treasury bonds have declined simultaneously (1931, 1941, 1969, 2018, 2022). This year is the only year in history where the S&P 500 and 10-year U.S. Treasury bonds are both down more than 10%.

Worst years for a US 60/40 portfolio at the end of November

Source: Charlie Bilello

#7 —

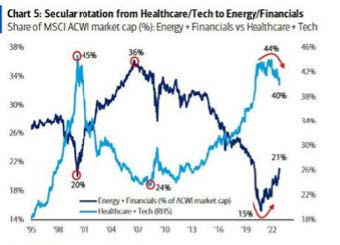

The big rotation

Inflationary pressures and rising rates are bringing the era of quantitative easing (QE) to an end. Rising bond yields have weighed on so-called "long duration" stocks. This includes technology mega-caps, which were by far the biggest winners of the QE era. The GAFAs (Facebook, Apple, Amazon, Netflix, Google) experienced significant declines in 2022 due to a dual effect of 1) valuation compression (due to rising bond yields and declining global investor appetite for growth stocks) and 2) a significant slowdown in revenue growth, as 2022 largely benefited the "reopening economy" sectors while penalizing the themes that had benefited from the lockdown. At the same time, sectors benefiting from rising commodity prices and rising bond yields outperformed. As a result, the sector allocation within the major equity indices underwent some changes over the year, although the technology and communications sectors continued to dominate by a wide margin.

Rotation from growth sectors to value sectors

Source: BofA

#8 —

The King dollar

The dollar rose sharply in 2022. Expectations of faster monetary tightening in the U.S. helped the greenback rise, up 7.8% for the year at the end of November. Surprisingly, the Russian ruble is one of the best performing currencies of 2022, up 22.9%. The Venezuelan bolivar (-58%) and the New Ghana Cedi (-56%) are the worst performers. The Brazilian real (+7.3%) and Mexican peso (+6.5%) appreciated thanks the strength of the commodities market.

#9 —

The UK crisis

2022 was an "annus horribilis" for the UK with the death of the Queen, major political unrest and then a financial crisis of rare magnitude. In the last week of September, the pound hit an all-time low against the dollar, nearing parity, while sovereign bonds saw their yields reach their highest level since 2008. The scale of the crisis was such that members of the Bank of England worked through the night to save the British pension fund system. Indeed, the collapse of government bonds led to huge margin calls on pension funds, triggering forced sales of government bonds, which further exacerbated the decline. The next morning, the Bank of England was forced to announce the temporary suspension of quantitative tightening and the implementation of a sovereign bond purchase program to stem the rise in yields. Following this announcement, UK 30-year bond yields, which had previously reached a 20-year high of >5%, fell 0.75% to 4.3%, the largest daily decline in yields on record. Since then, the pound and gilt yields have stabilized.

#10 —

A new crypto winter and not the least

"Crypto winters" are part of the history of digital assets, and the one in 2022 is indeed painful. There have been two bear markets in a row: the first phase took place in the first six months of the year as macroeconomic risks (the end of easy money) triggered a major devaluation of cryptocurrencies - including bitcoin. The second phase of the correction was much more specific to crypto-currencies with a purge of the excesses that have taken place over the past few years. After the demise of Terra Luna and Celsius, a new scandal rocked the crypto sphere in November. FTX, the second largest crypto exchange platform in the world (and the first in the US) was indeed an icon of the digital asset world. FTX raised capital from some of the biggest names in venture capital and institutional management - Sequoia, Tiger, Blackrock, SoftBank, Singapore's sovereign wealth fund Temasek, and the Ontario Teachers' Pension Fund to name a few. The FTX digital wallet is used by millions of users worldwide. After growing exponentially from $1 billion to $32 billion in just over 12 months, FTX lost it all in the space of 72 hours. This latest scandal has severely dented investor confidence in cryptoassets, pushing the total market capitalization below $1 trillion (down from a high of $3 trillion in 2021).

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)