Key messages

1) The current market environment of rising correlation between equities and bonds invites investors to consider other approaches than the traditional 60/40 portfolio.

2) One alternative is to replace part of the bond and equity allocations with less liquid investments invites investors. However, these alternative investments have traditionally been difficult for non-institutional investors to access due to the lack of suitable products.

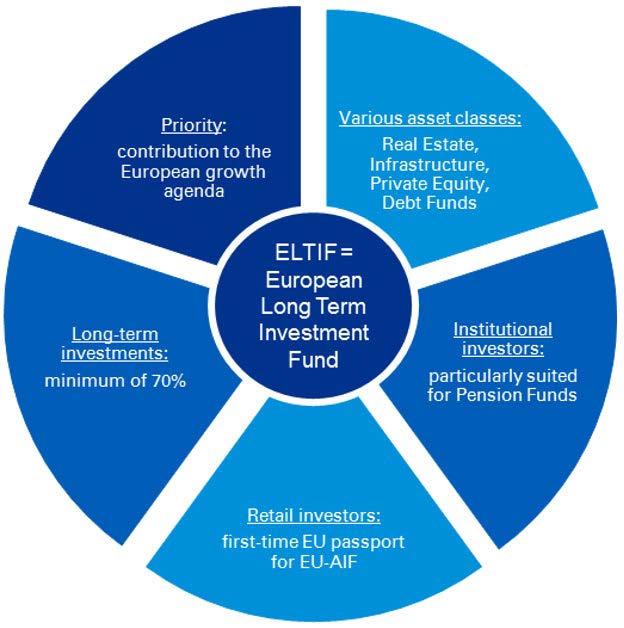

3) The newly created "ELTIF" (European Long Term Investment Funds) offers individuals the possibility to invest in private assets (private equity, private debt, infrastructure, etc.), thus increasing diversification and risk spreading. All with a low minimum amount and including some specific protections for investors.

The traditional diversified equity and bond portfolio has enjoyed years of exceptional performance. But the current market environment invites investors to consider new management approaches. Indeed, in a regime of high inflation, the diversification properties of the bond portfolio are much less effective than in the past since the correlation between stocks and bonds tends to be positive.

What new options are investors and savers considering? The first is to accept a higher risk profile (and therefore higher volatility of returns) in order to be able to achieve the performance levels that used to prevail. Another alternative is to replace part of the bond and equity allocations with less liquid (or even much less liquid) investments such as hedge funds, real estate funds, private debt, or venture capital.

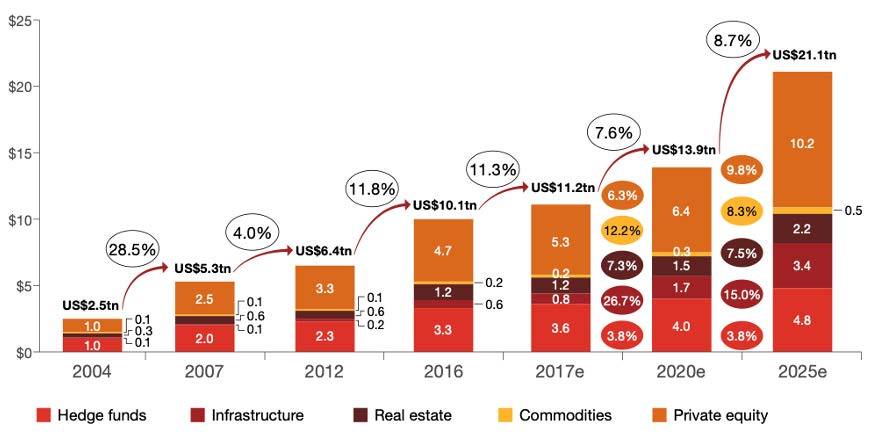

It is worth noting that alternative investments have experienced remarkable growth over the past decade. Just before the great financial crisis of 2008, they represented about $5.3 trillion. By the end of 2020, alternative investment firms were managing some $13.9 trillion in assets. This amount could grow to more than $21 trillion by 2027.

Alternatives by type in US$tn (Base case scenario)

Source: PwC Asset and Wealth Management Research Center analysis.

However, these alternative investments have traditionally been difficult for non institutional investors to access due to the lack of suitable products, high minimum thresholds, complexity of the underlying investments and low liquidity. But the situation is changing.

.png)