Two weeks ago, we explained in a FOCUS note ("The tip of the iceberg") the lack of depth in the US market. We highlighted the fact that the rise of the S&P 500 since the beginning of the year is only based on the performance of a few large technology companies.

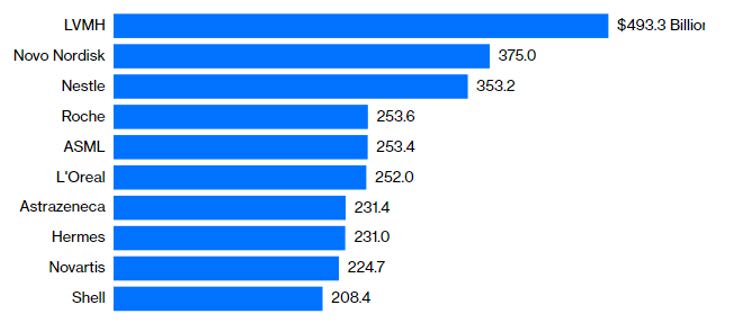

Even if the effect is less marked, a similar phenomenon can be observed in European equities. Admittedly, the old continent does not (yet) have mega-cap companies worth more than a trillion dollars, as is currently the case in the United States with the GAFAs (Google, Apple, Microsoft Corp, Amazon, etc.). However, it is possible to isolate ten or so very large-cap stocks (over 200 billion euros) that are increasingly attracting the attention of foreign investors.

These ten stocks now account for almost one fifth of the market capitalization of the benchmark Stoxx 600 index. By 2020, investment bank Goldman Sachs had coined

the acronym GRANOLAS for 11 pan-European stocks: GlaxoSmithKline, Roche Holding, ASML, Nestlé, Novartis, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP and Sanofi.

The great "Granolas" companies

Three years later, the ranking of the largest capitalizations has changed somewhat. GlaxoSmithKline, Sanofi and SAP have dropped out of the Top 10, while Hermès and Shell have entered.

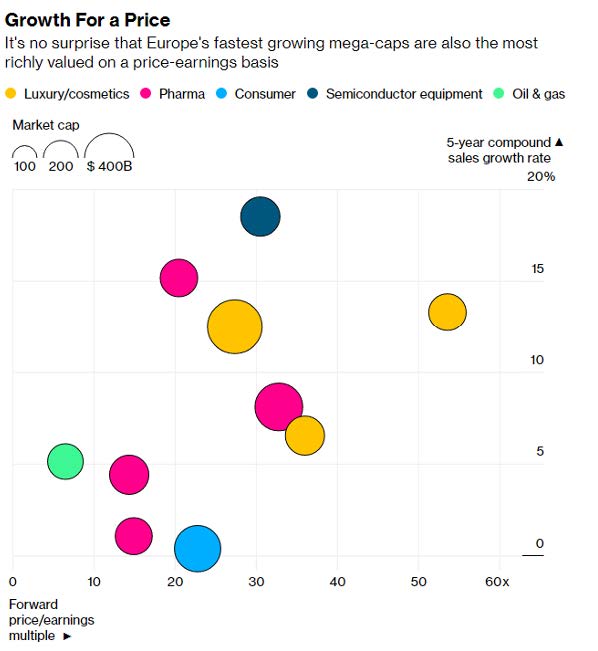

But the characteristics of these stocks remain the same: strong balance sheets, strong earnings growth that is not sensitive to the economic cycle and high dividend yields. Unlike the US, Europe is not dominated by technology. Instead, the luxury, healthcare and consumer sectors account for the lion's share of the Top 10.

For the first time in history, a European company has seen its market capitalization exceed 400 billion euros: LVMH Moet Hennessy Louis Vuitton SE, whose operating profit reached 21 billion euros in 2022. The other GRANOLAS are not so far behind: the Danish pharmaceutical company Novo Nordisk A/S has reached a capitalization close to 350 billion euros, while the Dutch semiconductor equipment company ASML NV is worth 230 billion euros. Ten European companies now have a market capitalization of more than $200 billion, crossing the threshold of "megacapitalization. Ten years ago, there were only three.

.png)