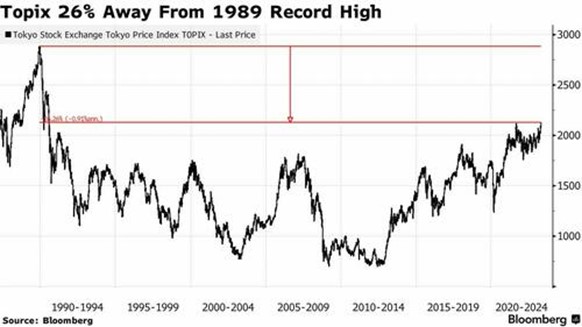

Improved macroeconomic outlook

The Japanese equity market is the third largest in the world. Due to the high weight of export stocks, the Japanese stock market reacts to global economic conditions more sensitively than other developed markets. The fact that the US and Europe are on the verge of recession, while China is struggling to recover from years of containment, should not, at first glance, be seen as a positive for the Japanese economy.

However, the pandemic and the war in Ukraine have created the inflationary pressure that the Bank of Japan was looking for after 20 years of quantitative easing to counter falling prices.

In April, the inflation rate in Tokyo accelerated sharply to +3.8% year-on-year. The return of inflation is a game changer for businesses and consumers. After decades of deflation during which most economic agents systematically postponed spending, the fact that prices are rising again is about to change consumption patterns and boost nominal GDP.

Goldman Sachs forecasts real GDP growth of 1% for the years 2023 and 2024. This may seem low, but it is above potential growth of 0.7 percent, in contrast to the U.S. and Europe, where growth is expected to decelerate below potential rates. Nominal GDP growth is well above what Japan has experienced over the past two decades.

Wage growth is expected to be close to 2.8% and support consumption. Consumer sentiment is improving. With the country just emerging from confinement, tourism is picking up while businesses are planning strong capital spending.

BoJ's monetary policy remains accommodating

With inflation returning, many investors are speculating that the Bank of Japan (BoJ) will abandon its ultra-accommodative policy. However, it seems unlikely that

the central bank will be able to make a 180 degree turn. Indeed, it holds more than 100% of Japanese GDP in JGBs (government bonds), which makes a normalization of monetary policy very complicated.

Despite the return of inflation, the BoJ's monetary policy under new Governor Ueda is likely to remain relatively accommodative even as other G7 central banks are in tightening mode. Even in the case of a slightly less accommodative policy, the Japanese equity market could benefit as a stronger yen will facilitate capital repatriation to Japan.

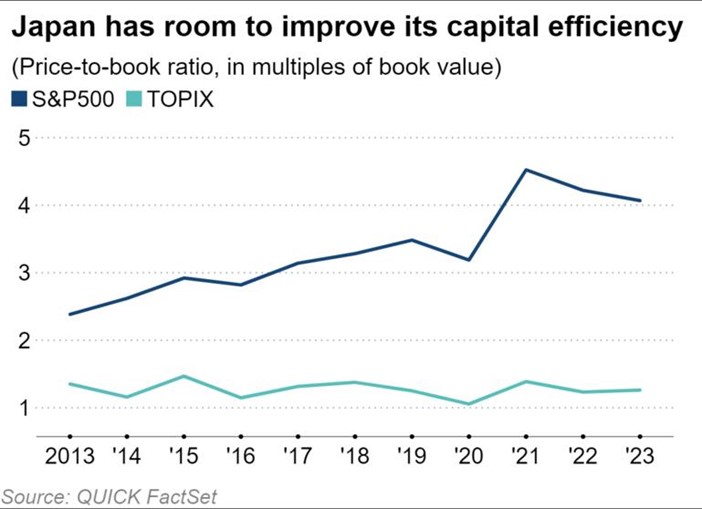

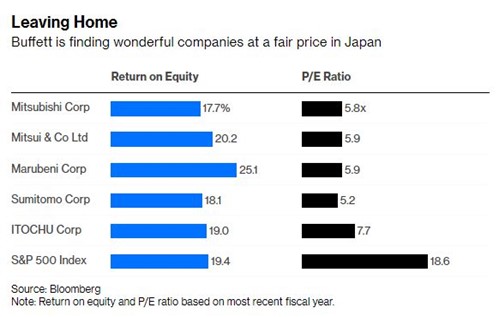

A better corporate governance

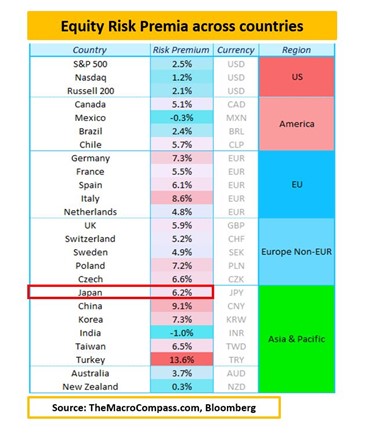

Japanese (non-financial) stocks are flush with liquidity. But the propensity of companies to hoard, rather than deploy or return cash to shareholders, has long contributed to the undervaluation of Japanese stocks. This situation is changing.In April 2022, the Tokyo Stock Exchange (TSE) overhauled the market structure, reducing the number of divisions from five to three and tightening listing criteria to discourage cross-shareholdings and increase free float. The approximately 10 to 20 per cent of listed companies that do not meet the new criteria have until March 2025 to improve their performance before facing delisting. The TSE has also asked Japanese companies to reduce their discounts (see chart below comparing price to book value ratio in Japan vs. the US)

.png)