As a reminder, U.S. commercial real estate is a very broad asset class, encompassing offices, retail space, industrial facilities, multi-family residential units and shopping centers. The commercial real estate market plays a vital role in the U.S. economy, supporting over 7 million jobs and contributing nearly $1,000 billion to U.S. GDP. It also generates significant tax revenues for local and state governments. Additionally, the value of real estate assets influences the overall wealth and financial stability of individuals, businesses, and institutional investors.

The Big short 1.0

During the US housing collapse of 2007/2008, some high-profile investors, such as John Paulson and Michael Burry, made huge profits by shorting residential mortgage-backed securities (RMBS) or buying ABX CDS on various subprime residential and commercial mortgage-backed securities. Their financial success was portrayed by Christian Bale in the film "The Big Short" (2015).

The Big Short 2.0

Ten years after the Big Short, a version 2.0 was launched by investors such as Carl Icahn. Back then, the idea was to sell short securities backed by shopping malls located in economically distressed areas, where stores were in danger of closing one after the other, leading to a cascade of defaults. The Big Short 2.0 was mainly implemented by shorting the CMBX Series 6, a synthetic tradable index referencing a basket of Commercial Mortgage-Backed Securities (CMBS) with substantial exposure to shopping centers, a segment of the real estate market that was already struggling years before the pandemic.

While the market had hardly changed for years, it imploded in the wake of the Covid-19 pandemic. The sudden halt in the economy led to widespread defaults by retail outlets. The rise of e-commerce and changing consumer preferences have impacted all shopping centers in recent years. But it is the malls located in the most economically fragile areas that have seen their footfall and occupancy rates fall, prompting some investors to short these properties. Some of them recorded considerable gains thanks to this operation. These include Carl Icahn ($1.3 billion profit) and Daniel Mcnamara, who were working for MP Securitized Credit Partners at the time.

The Big Short 3.0

After the residential sector (Big Short 1.0) and malls (Big Short 2.0), version 3.0 focuses primarily on offices. To short a specific segment of commercial real estate, you need to short a dedicated index. For malls, it is the CMBX 6 index. For hotels, the benchmark index is CMBX 9. For offices, a Goldman Sachs note cites the CMBX 15 index, which has a 33% exposure to the office sector. To be precise, the investment bank highlights the BBB- tranche, which is the one with the highest convexity to underlying price variations.

Sector exposure of the various US real estate mortgage indices. CMBX 15 has relatively high exposure to offices and low exposure to hotels and retail.

Source: Intex, Goldman Sachs Global Investment Research

Note that the CMBX 15 BBB- index is currently trading close to its lowest level since its inception.

Bloomberg CMBX 15 BBB-

Source: Bloomberg

Office real estate is in crisis

The “Big short 3.0" began in 2020, the year of COVID-19. Several factors explain the sector's current difficulties. First and foremost is the widespread adoption of remote working practices, which of course accelerated during the pandemic. With the implementation of "Work From Home" policies, many companies have decentralized their working environments, resulting in a reduced reliance on traditional office space. As a result, office property values have fallen in some markets, and occupancy rates have dropped significantly.

Changing demographics, such as the preferences of younger generations and evolving work-life balance expectations, have also influenced demand for office space. Millennials and Generation Z are often looking for workplaces that offer collaborative environments, flexible floor space and proximity to utilities. This has led to a shift towards modern, tech focused office spaces that meet the changing needs and preferences of the workforce.

Another challenge for commercial real estate is rising bond yields, which imply much higher refinancing rates as previously granted loans mature. According to Morgan Stanley, nearly $500 billion in loans will mature in 2024, and a total of $2.5 billion in debt will mature over the next five years.

Many companies have downsized their offices or opted for flexible working arrangements, such as hot desking, to reduce costs and adapt to remote working preferences. This has weighed on demand for traditional office space, leading to oversupply in some regions, with negative impacts on rental income and property values.

Changing demographics, such as the preferences of younger generations and evolving work-life balance expectations, have also influenced demand for office space. Millennials and Generation Z are often looking for workplaces that offer collaborative environments, flexible floor space and proximity to utilities. This has led to a shift towards modern, tech focused office spaces that meet the changing needs and preferences of the workforce.

Another challenge for commercial real estate is rising bond yields, which imply much higher refinancing rates as previously granted loans mature. According to Morgan Stanley, nearly $500 billion in loans will mature in 2024, and a total of $2.5 billion in debt will mature over the next five years.

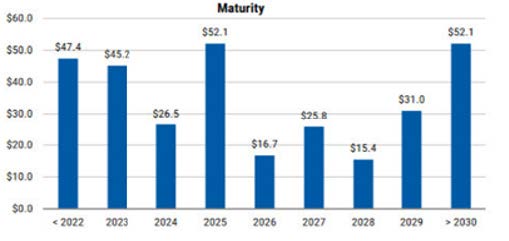

CMBS repayments by maturity (in billions of dollars)

Source : Trepp, Morgan Stanley Research

Most CMBX indices are currently falling at a rate not seen since the COVID crash or the Lehman bankruptcy. Vornado Realty, a real estate trust (REIT), is now trading at its lowest level since 1996. The stock has fallen from $66 in January 2020 to less than $16 in June 2023.

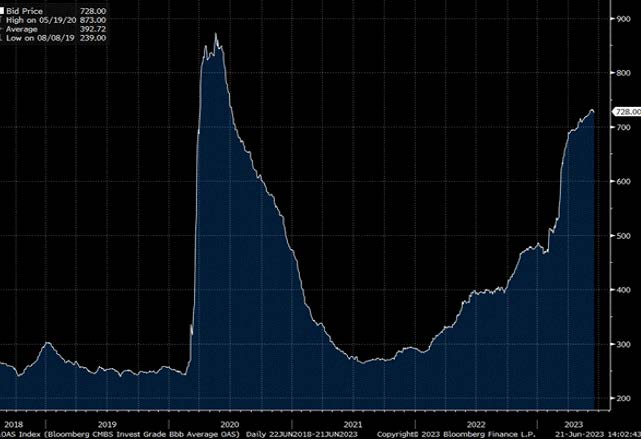

Meanwhile, yield spreads (OAS for "Option adjusted spreads") on BBB- CMBSs versus US Treasury yields have begun to diverge significantly. Widening OAS spreads are indicative of increased risk as perceived by the market, signaling concerns about tenant creditworthiness, vacancy rates and potential declines in property values. Investors and creditors keep a close eye on OAS spreads, as they reflect market sentiment and influence financing conditions for office building acquisitions and refinancings.

Bloomberg CMBS BBB OAS

Source : Bloomberg

The impact of Big Short 3.0 on the financial industry

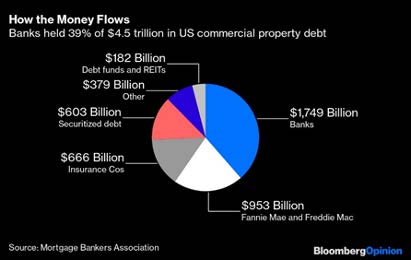

Banks are heavily involved in the financing of commercial real estate, including loans for the acquisition of office buildings. It is estimated that banks hold around 39% of the $4.5 trillion in commercial real estate debt, leaving them vulnerable when default rates start to rise.

Who holds US commercial real estate debt?

Source : Bloomberg

Declining property values and increasing vacancies could lead to a reduction in the collateral value used for office loans. This could result in higher default rates and potential losses for banks. Non-performing loans and foreclosures in the office real estate sector could have a negative impact on banks' asset quality, profitability and capital adequacy ratios, jeopardizing the financial stability of weaker players.

Smaller regional banks are more exposed to commercial real estate risks, as they concentrate their lending on this category. Two-thirds of their loan book is concentrated on commercial property, compared with one-third on residential. In contrast, the major banks have a much more diversified loan portfolio.

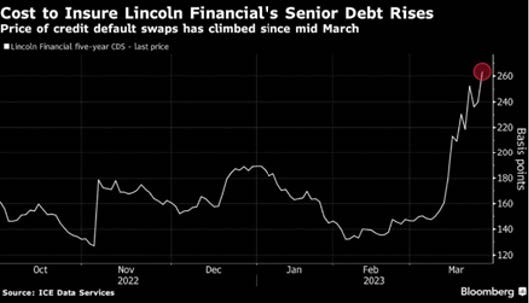

Insurance companies also have significant exposure to US real estate debt, with $666 billion of exposure to commercial real estate. An example of stress linked to this sector's exposure to real estate: the cost of insuring the senior debt of Lincoln Financials, an insurance company, has recently risen sharply (see chart below).

CDS on Lincoln Financials senior debt

Source: Bloomberg

Finally, shadow banks - financial institutions without a banking license and therefore less subject to strict financial regulations - are also exposed, in amounts that are difficult to estimate

Conclusion

As the age old saying goes, tightening monetary policy is like fishing with dynamite: when the explosion occurs, it decimates everything nearby. The small fish rise to the surface first. But it may be some time before the whale or whales appear. With the collapse of several banks (Silicon Valley Bank, Signature Bank, First Republic Bank) in the first half of the year, the impact of Fed policy tightening is beginning to be felt. But should we regard these banks as whales or just small fish? At this stage, it's very difficult to say. However, we believe we have entered a new period of uncertainty. Commercial real estate could well be the whale of 2023.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)