Investment preferences and risk tolerance

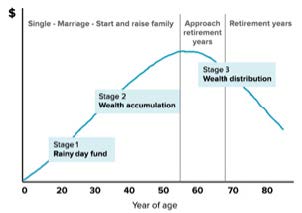

Investors’ financial priorities change they move through the various stages of life. Baby boomers have reached the stage where priority is given to planning for a comfortable retirement. For Generation Xers, the priority is to accumulate wealth in order to finance their children's education and meet their various financial responsibilities. As for millennials and generation Z, they are in the ascending phase of their financial life cycle; they are concentrating on their professional career development and building a solid financial base.

An individual's financial life cycle (ages are averages)

Source Image : Stockspot

Generation X, in particular, is expected to experience substantial asset growth. According to a Deloitte study, their assets could almost quadruple to $22 trillion by 2030. However, this generation faces unique challenges. It is referred to as a 'sandwich generation', juggling the financial obligations of caring for ageing parents with the needs of children.

The financial setbacks suffered by Generation X during the great financial crisis (2008) have had an impact on their appetite for risk. They tend to be both cautious and independent investors, showing a degree of skepticism towards the unpredictability of the market.

Millennials, a generation that numbers around 1.8 billion worldwide, are expected to exert a substantial financial influence. UBS estimates that the wealth of millennials

will grow five times faster than that of baby boomers. Projections indicate that by 2030, they could control $20 trillion.

Until now, millennials have been somewhat hesitant when it comes to investing in the stock market. This reluctance is not surprising, given that many of them graduated from university and entered the world of work during the difficult period of the Great Recession. The S&P 500 had lost 57% of its value by the time the oldest millennials were in their twenties. Debt also plays a role; in the US, the 25-34 age group has already accumulated an average debt of $40,000 per person (source: Business Insider).

Research has shown that millennials are cautious about traditional investments such as equities. A Bankrate survey found that only 23% of millennials see the stock market as the best place to invest their savings over the next decade. Instead, a significant portion of this generation prefers cash as a long-term investment choice, a sentiment not shared to the same extent by Gen Xers and Baby Boomers. When it comes to investment knowledge, 42% of millennials consider themselves experts in the field. Only 23% of baby boomers can say the same (Raconteur 2019).

We also note that cryptocurrencies are perceived as an attractive asset class for many millennials. A study by Bitget (2023) indicates that 46% of millennials own cryptos, a higher proportion than Baby Boomers, Gen Xand Gen Z . One characteristic that separates millennials from Gen X is their penchant for short-term goals and near-instant return on investment. So maintaining a long-term perspective on investment can be difficult for this generation. A dimension that takes on even greater significance with Generation Z. This age group prioritizes lifestyle spending over savings goals. Some 61% of Generation Z consumers have bought at least one item using the "Buy now, pay later" service.

Baby boomers, currently aged between 59 and 77, are mostly retired or close to retirement age. With life expectancy increasing, they face the prospect of a retirement that could last 20 years or more. This generation has strong purchasing power and controls more than 50% of all wealth in the United States. As a result, their investment decisions and preferences have a considerable impact on the financial markets and the economy.

Their long-term approach aims to preserve their purchasing power while protecting their capital against market downturns. Boomers are generally attracted to balanced portfolios and income-generating investments, such as REITs and high-dividend stocks.

Boomers' investment preferences favour equity markets. According to a Gallup survey conducted in 2023, nearly 66% of American adults aged 65 and over hold individual stocks, mutual funds or retirement savings. A significant proportion of baby-boomer investors (around 10%) are invested entirely in equities, defying the rules of financial prudence that recommend risk diversification by including other asset classes such as bonds. Many baby boomers abandoned the idea of diversification because the stock market seemed to be the only place to get attractive returns when interest rates were close to zero.

As interest rates rise, the investment preferences of savers nearing retirement may change. Some baby-boomers may consider allocating part of their savings to less volatile investment vehicles. There is also a risk that retiring baby boomers will convert a significant proportion of their savings into cash, which could reduce overall demand for risky investments such as equities.

The rise of technology in the financial sector

Each generation adopts new financial technologies according to its level of experience. Millennials have a strong affinity for 'high-tech' investment tools and are

loyal to brands that embrace technological advances. Millennials prefer to access information and investment opportunities via financial applications, online trading platforms and investment-related social networks. With just a few clicks, they can quickly review potential investments, receive financial advice and allocate their capital in funds or securities. In this context, technology is a natural part of their investment journey.

Interestingly, Gen Xers, who bridge the gap between baby boomers and millennials, are adopting technology at a similar rate to millennials. Some 54% of Gen-Xers are said to be digital enthusiasts, spending around 40 minutes more per week on social networks than Millennials. This generation's openness to technology could be attributed to the fact that they were exposed to rapid advances in adulthood.

Baby boomers are also adept at using new technologies. Around two-thirds of baby boomers aged 65 and over are now active online. A survey by Australian investment platform Moomoo found that 47% of investors aged 60 and over are more likely to use online platforms than traditional advisers and brokers.

Finally, when it comes to AI, 67% of millennials believe that recommendations made by artificial intelligence are an integral part of any investment platform, while Gen Xers and baby boomers are more hesitant; only 30% believe that computerized recommendations are essential.

Sustainability and impact investing

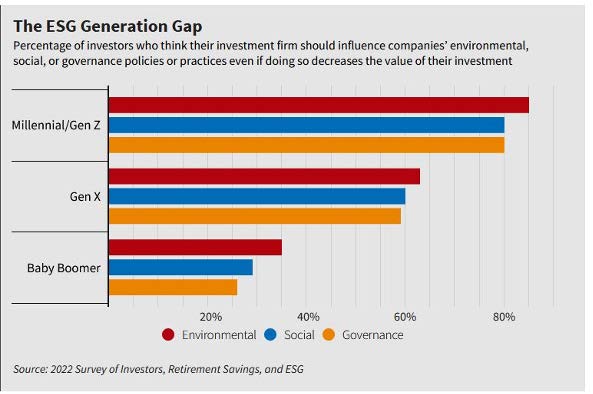

Millennials, known for their ethically based financial decisions, have significantly influenced the growth of sustainable and impact investing over the past decade. Industry reports indicate that millennials are the largest generation of investors in sustainably managed investment funds

Source Image : Forbes

A notable difference in investment behaviour becomes apparent when millennials are compared with Generation X and Baby Boomers. Around 60% of the millennials surveyed said they had invested at least a quarter of their savings in environmental, social and governance (ESG) investments. By contrast, only 49% of Generation Xers and 45% of Baby Boomers had such a proportion of ESG investments. For millennials, the aim is to leave a positive impact through their investments. Boomers and Gen-Xers aim to align their financial decisions with their values (Natixis global survey, 2021).

Younger investors are more willing to allocate funds to environmental and social objectives, even if the cost is higher.

A 2022 Stanford investor survey found that 83% of respondents believe their personal views should be taken into account when mutual fund managers vote on environmental or social issues. Furthermore, when it comes to accepting potential losses to promote corporate environmental practices, younger investors in their twenties and thirties are prepared to lose between 6% and 10% of their investments, while baby boomers are more reluctant to take any losses.

Conclusion

Each generation has its own investment behaviour: baby boomers may gradually switch from equity markets to less volatile asset classes. Gen Xers are cautious about risky assets. Millennials favour sustainable investment. Generation Z is very short-termist. Understanding these unique approaches allows us to offer tailored financial advice and interact meaningfully with investors of all ages. Despite their differences, baby boomers, Gen Xers, millennials and Gen Zers have one thing in common: they tend to invest in what they know and like.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)