Market trends

and performance

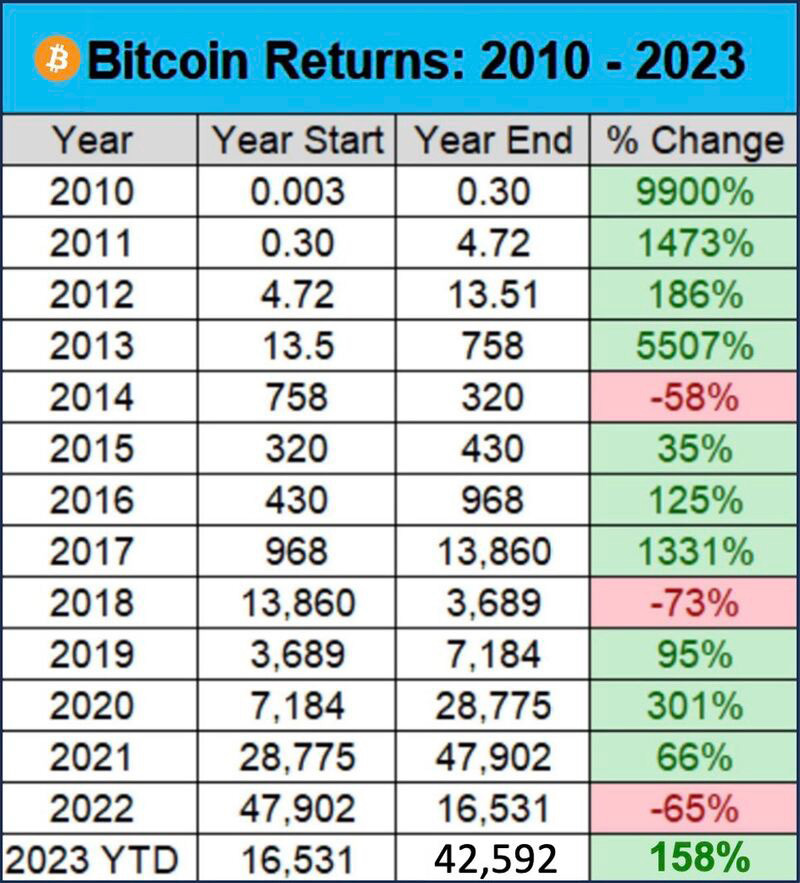

In 2023, the cryptocurrency market saw a significant revival, with its total market cap increasing from $871 billion to $1.7 trillion. Bitcoin spearheaded this growth, jumping 164% from its January low of $16,680, to trade above $40,000 in December, outperforming traditional assets like gold which rose 10%, and the S&P 500, which gained 20%. Bitcoin’s market share of the total cryptocurrency market also rose above 50%, according to CoinGecko data.

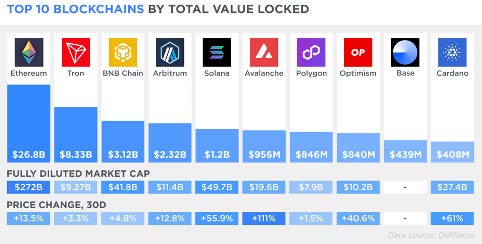

Ethereum maintained its second-place market cap, with a 66% increase in price. Other cryptos like Solana (SOL) also grew substantially, with SOL surging by approximately 267% since the beginning of the year. This surge was largely attributed to Solana's significant strides in the decentralized finance (DeFi) sector, where it emerged as the fourth largest blockchain in terms of Total Value Locked (TVL).

The term TVL means the total value in $US Dollar of all assets deposited into the project’s smart contracts. TVL is com-monly calculated in US dollars but could be converted to other currency. Although not perfect, the metric is used to measure the overall ‘health’ of the DeFi and cryptocurrency markets.

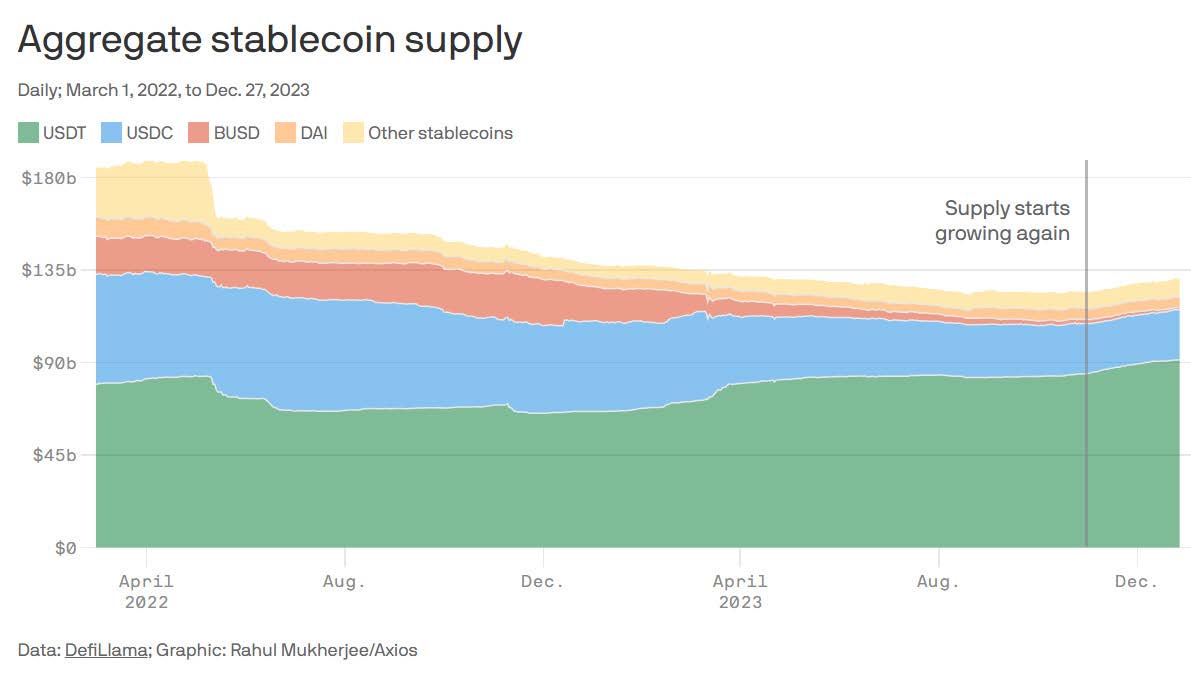

Stablecoins, cryptocurrencies whose value is pegged to a real-world asset like the dollar, reached new highs in market cap. Tether, the largest of such coins, saw its market cap soar to an all-time high of over $90 billion.

The year marked a period of recalibration for Non-Fungible Tokens (NFTs) following the immense hype they garnered in previous years. Despite many NFT projects showing illiquidity, with 70% having a floor price of zero up to April 2023, the NFT market rebounded in November. This revival saw its best performance since May 2022, with trades nearing half a billion dollars, a 110% monthly increase, and a 258% rise in sales.

Source: Charlie Bilello

Technology advancements

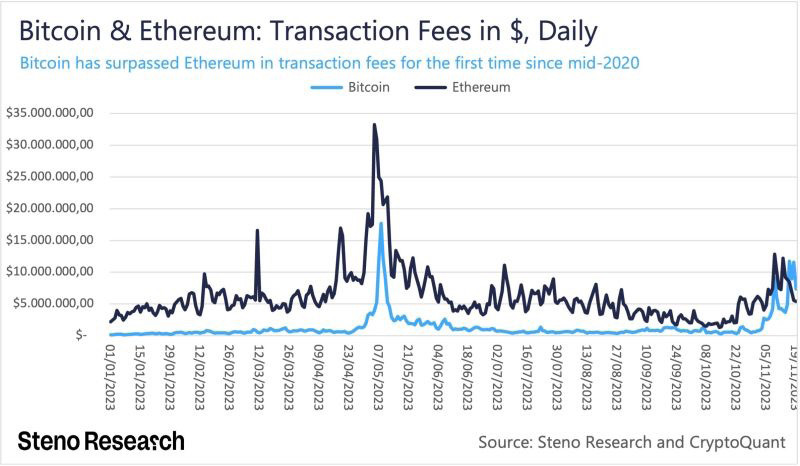

Technological innovation in the crypto space continued to accelerate in 2023. The introduction of Bitcoin Ordinals,

the equivalent of non-fungible tokens (NFT) on the Bitcoin blockchain, was a game-changer. This technology allowed users to embed digital artifacts directly within Bitcoin trans-actions. During its first 200 days, the Ordinals ecosystem saw impressive user engagement, with 1.14 million digital artifacts inscribed despite a broader bear market in NFTs. In August, PayPal launched a U.S. dollar-denominated stablecoin, PayPal USD (PYUSD), fully backed by U.S. dollar deposits and short-term U.S. treasuries. This launch represented a significant step in enhancing the usability and reach of digital currencies in web3 environments.

Source: Steno Research & CryptoQuant

Crypto’s ETF Applications

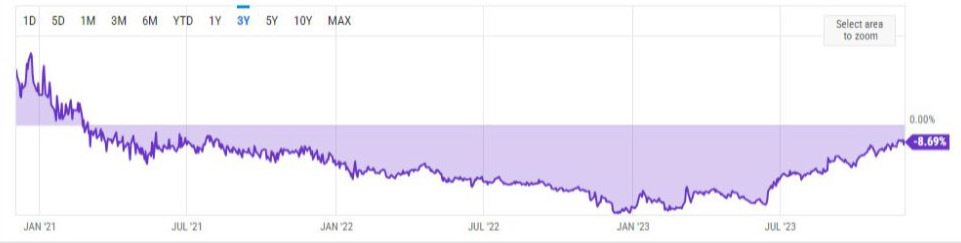

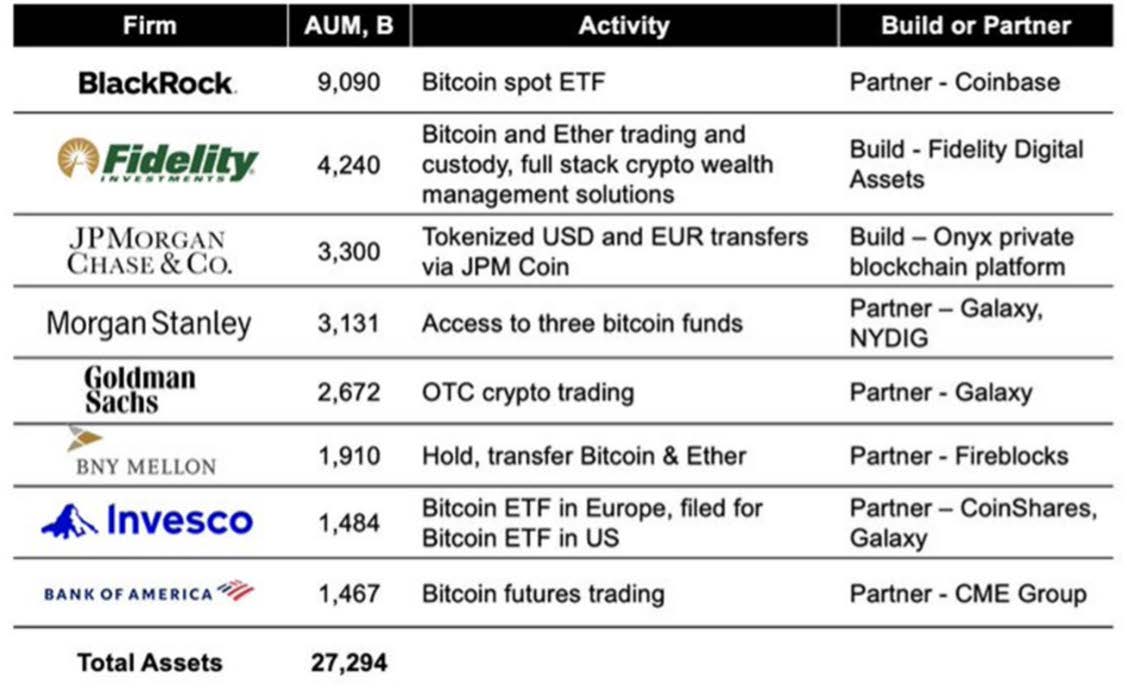

Grayscale's long-standing battle with the SEC over its Gray-scale Bitcoin Trust (“GBTC”) culminated in a lawsuit victory, enabling the listing of GBTC as an SEC-approved exchange-traded product. The court determined that the SEC had acted arbitrarily and capriciously by denying spot ETFs while approving futures-based ETFs. This played a pivotal role in encouraging institutional adoption. BlackRock, the world's largest asset manager, along with Fidelity and Bitwise, filed for Bitcoin ETFs, emphasising the growing acceptance of cryptocurrencies as a legitimate asset class among traditional financial institutions. Additionally, 21Shares and Cathie Wood's ARK Invest also stepped into the spotlight by filing for the first U.S. Spot-Ether ETF. These developments, akin to the launch of gold ETFs in the early 2000s, create avenues for traditional capital to invest in "digital gold," drawing new investors into the cryptocurrency market.

GBTC discount to NAV narrows as ETF hopes intensify

Other Legal and Regulatory developments

2023 saw significant legal and regulatory shifts in the cryptocurrency sector. The SEC's lawsuit against Binance and CEO Changpeng Zhao led to a notable $4.3 billion settlement and Zhao's resignation. This settlement was one of the most significant in the crypto space, underscoring the intense regulatory focus on major players in the cryptocurrency market.

Sam Bankman-Fried, the founder of FTX, faced legal reper-cussions as he was found guilty of fraud and conspiracy charges. This verdict marked a rapid and dramatic decline for a once-prominent figure in the crypto world.

At regional level, the European Union introduced the Markets in Crypto-Assets (MiCA) regulation, setting a global precedent for crypto regulations. MiCA aims to provide a harmonised framework for crypto assets, enhancing investor protection and ensuring market stability. Additionally, the G20 adopted the IMF and FSB's Synthesis Paper as a roadmap for crypto asset regulation, providing a unified framework for G20 countries and a key step towards standardising crypto regulations.

2024 Themes

THEME 1

An alignment of planets for Bitcoin?

The implication of the SEC’s approval of a Bitcoin Spot ETF

The launch of U.S. Bitcoin ETFs in 2024 will greatly impact the crypto landscape. With 11 applications filed and the positive SEC decision, these ETFs might shift perceptions of crypto-currency's risk and viability. The approval of these ETFs could lead to a substantial influx of funds, potentially leading to an increase in demand for Bitcoin. This change may be gradual due to investor adaptation and external factors like potential US recession and geopolitical risks. Long-term, this could foster greater Bitcoin accessibility and adoption, positively influencing the broader crypto market.

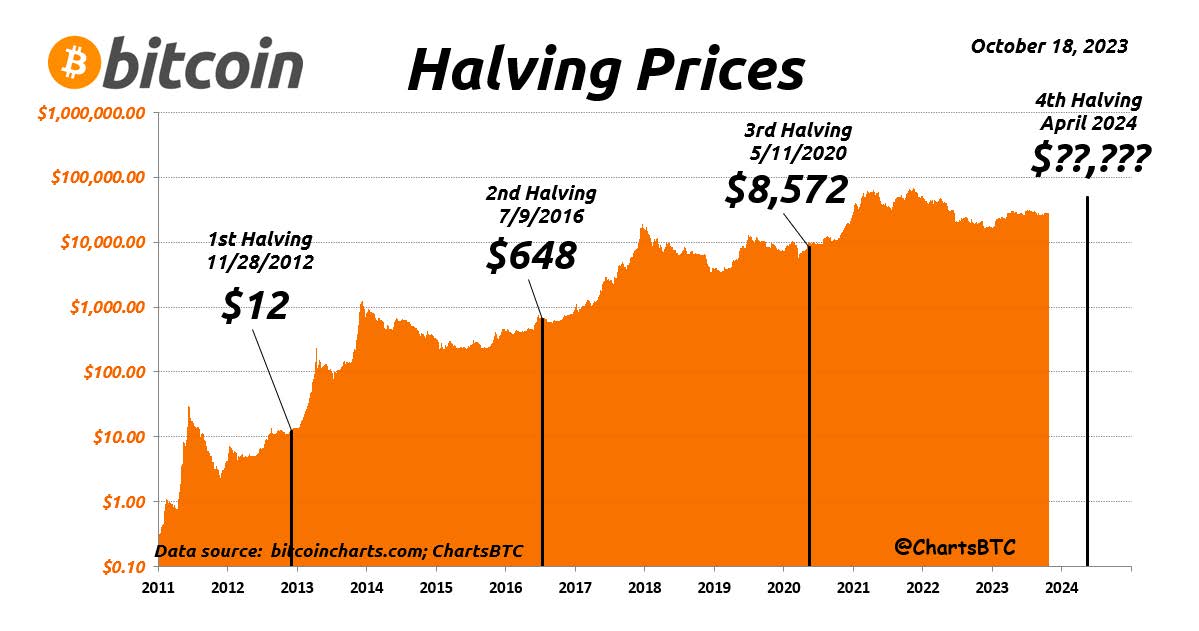

Bitcoin halving effect

Another key factor is the Bitcoin halving event slated for April 2024, which is set to reduce Bitcoin's daily issuance by 50%, according to K33 Research. This halving, historically significant for Bitcoin's valuation, is expected to decrease the annual new bitcoin supply by around $6.2 billion. The reduced supply, coupled with steady demand, might substantially elevate Bitcoin's market price.

Stubborn holders

Approximately 70% of Bitcoin's supply is held by steadfast enthusiasts that typically buy more during price dips and resist selling even in market downturns. This behaviour keeps sell-side pressure low in the Bitcoin market, as these holders are not inclined to sell even at current elevated rates, supporting a steady or increasing price trajectory. Low supply versus rising demand is precisely what gives bitcoin value.

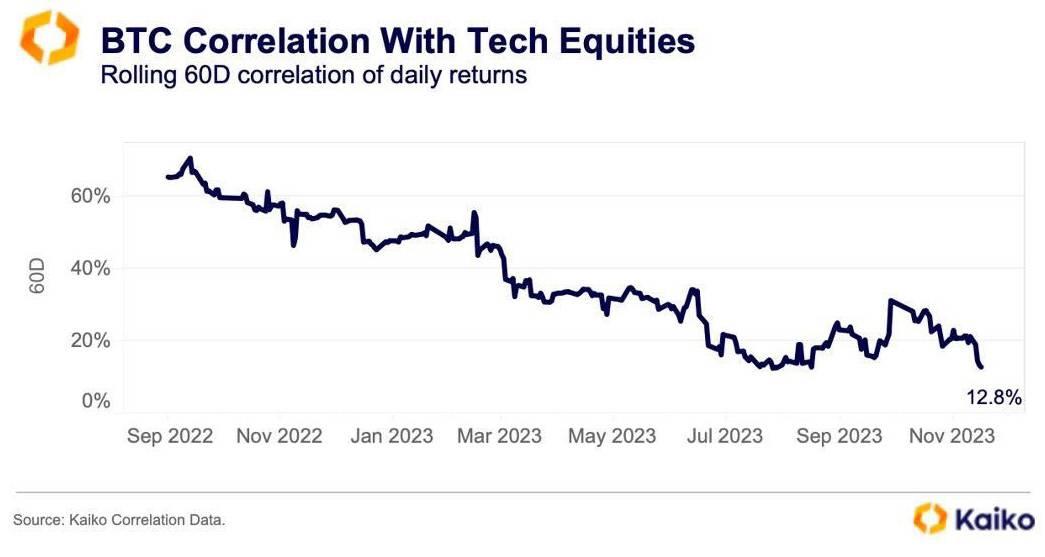

Bitcoin’s diversification appeal

Bitcoin's declining correlation with U.S. equities enhances its appeal as a diversification asset. The unusually high correla-tion during 2021-2022 was influenced by factors like interest rates, growth focus, and macroeconomic hedging. Currently, with a stable cost of capital and a decoupling from traditional asset yield dynamics, Bitcoin is showing a reduced correlation with traditional assets. This trend implies an increased potential for achieving portfolio diversification through cryp-tocurrency investments. Bitcoin price correlation with Nasdaq price currently stands at 2-year low.

Source: BingX Blog

THEME 2

Ethereum (ETH) revenue might surge and experience a major Blockchain upgrade

In 2024, Ethereum's revenue is predicted to more than double, reaching $5 billion. This increase is due to its role as a global supercomputer hosting thousands of crypto applications. Users pay fees to use these applications, generating significant cash flow for Ethereum. As crypto apps gain mainstream popularity, the demand and usage of Ethereum's network are expected to surge, positioning it as one of the fastest-growing large-scale tech platforms globally.

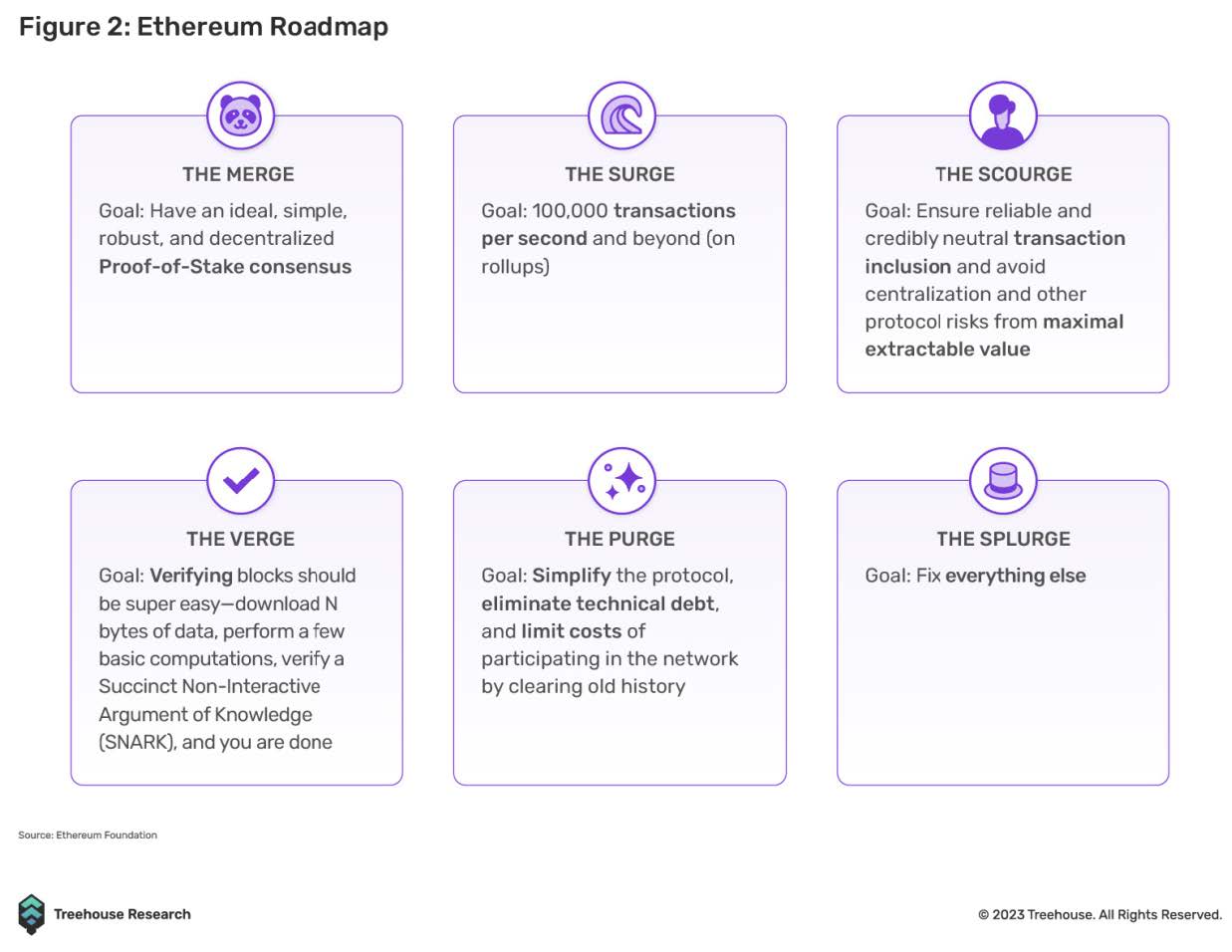

A key development for Ethereum in 2024 could be the implementation of "EIP-4844," an upgrade aimed at drastically reducing transaction costs. Currently, average fees on low-cost Layer 2 blockchains are around $0.14 per transaction. EIP-4844 aims to reduce this cost below $0.01, enabling a broader range of activities on the Ethereum network, including micropayments, social media, and large-scale gaming.

This upgrade is expected to facilitate the emergence of main-stream crypto applications, marking a significant milestone in the crypto space.

Note that an Ether spot ETF is also a possible bullish outcome for Ethereum in 2024.

Source: Ethereum Foundation

THEME 3

Solana (SOL) to benefit from DeFi TVL returns

In 2024, Solana could potentially become one of the top three blockchains in terms of market cap, Total Value Locked (TVL), and active users, outperforming Ethereum as DeFi TVL returns. This growth will likely propel Solana into the spot-light of the spot ETF market, with numerous asset managers poised to file for Solana-based ETFs. Additionally, Solana's price oracle, Pyth, is projected to surpass Chainlink, the leading decentralized oracle network build on Ethereum Blockchain, in Total Value Secured (TVS), driven by Solana's increasing TVL and innovative features like its "pull" architec-ture and confidence interval system.

Total value locked (TVL) is a metric used in the cryptocur-rency sector to determine the total U.S. dollar value of digital assets locked, or staked, on a particular blockchain network via decentralised finance (DeFi) platforms or decentralised applications (dApps).

THEME 4

Stablecoin expansion

In 2024, the stablecoin market is predicted to reach a new record high, surpassing $200 billion, driven by the launch of Markets in Crypto Assets (MiCA) regulated stablecoins in Europe, the growth of yield-bearing stablecoins, and rising trading volumes. USD Coin (USDC) is expected to overtake Tether (USDT) in market share, reflecting a growing institu-tional preference already seen on newer Layer 2 (L2) chains. A Layer 2 blockchain refers to network protocols that are layered on top of a Layer 1 solution. Layer 2 protocols use the Layer 1 blockchain for network and security infrastructure but are more flexible in their ability to scale transaction processing and overall throughput on the network.

This shift might be accelerated by potential legal actions from the U.S. Department of Justice against Justin Sun & Tron for terror financing, Know Your Customer (KYC) infractions, and market manipulation, affecting Tether's market position. Stablecoins are considered one of crypto's killer apps, rapidly growing from nearly zero to a $137 billion market in just four years. They could potentially one day surpass Visa in settling more transaction volume.

THEME 5

A rebound in NFT activity

In 2024, the NFT market is expected to reach new heights in monthly volumes, fuelled by a resurgence of speculators in crypto and attraction to leading NFT collections on Ethereum, enhanced crypto games, and innovative Bitcoin-based NFTs. The introduction of Bitcoin's Ordinals protocol and emerging Layer 2 chains will boost activity on the Bitcoin network, narrowing the ETH-to-BTC primary NFT issuance ratio to approximately 3-1, according to Vaneck.

Additionally, according to Bitwise, high-profile figures like Taylor Swift may adopt NFTs as a unique fan engagement tool, offering exclusive experiences, access to new music, and even partial song ownership through royalties. This trend is in line with other major artists and platforms like Spotify exploring NFT integration for exclusive content access, sig-nalling a significant expansion and diversification of the NFT ecosystem.

THEME 6

Binance will lose its leading position for spot trading while CoinBase’s revenue are projected to double

Bitwise predicts that Binance will relinquish its #1 position in spot trading. This change is expected after Binance's $4 billion settlement with US regulators and an ongoing DOJ investigation. As a result, competitors like OKX, Bybit, Coin-base, and Bitget are well-positioned to challenge Binance's dominance. Coinbase’s international futures market is expected to significantly increase its market share. Concurrently, Bitwise anticipates Coinbase's revenue to double in 2024, jumping from $2.8 billion to $5.7 billion. This growth is expected to be driven by an emerging bull market in crypto, along with Coinbase's expansion of its product range and its potential role as the primary custodian for spot Bitcoin ETFs.

Conclusion

If 2022 was a year of challenges for cryptocurrencies and 2023 marked their striking comeback, 2024 is anticipated to be a period of expanded acceptance and deeper integra-tion in the global financial landscape. Developments like the recent approval of Spot Bitcoin ETFs, Solana's growth, and the stablecoin market's expansion, coupled with major legal and regulatory shifts, are driving this transition. As we step into 2024, cryptocurrencies are not just rebounding from past challenges but are also gearing up to become an integral part of the broader financial system, promising an exciting year ahead.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

President Donald Trump signed an executive order relating to cryptocurrencies. The US is now one step closer to the creation of a strategic bitcoin reserve. Overview below.

"There are decades where nothing happens; and there are weeks where decades happen." - Vladimir Ilyich Lenin

Solana and Ethereum are two dominant blockchains in the crypto sector, each boasting robust DeFi ecosystems and a plethora of diverse applications. The two blockchains are often seen as competitors. How do they compare?

.png)