According to modern portfolio theory, there is only one free lunch in management: diversification. The principle? By increasing the number of positions in a portfolio, it is possible to improve the famous risk/return ratio. In other words, diversification makes it possible to reduce the risk of the portfolio without sacrificing performance. Why? Most securities or assets have a correlation with each other that is less than one, i.e. their movements are not totally synchronous. Thus, when one asset suffers a loss, this loss can be offset by the price change of another asset.

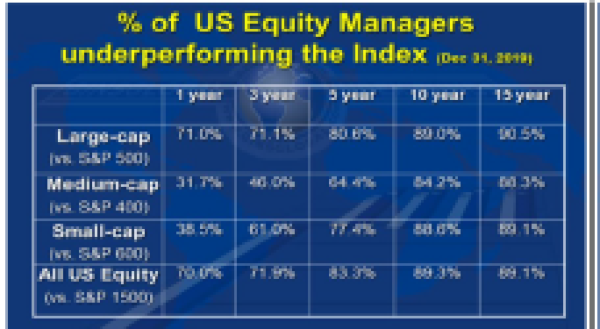

Over the past five decades, diversification has been inherent in portfolio construction. There has even been a tendency to over-diversify, with securities being included in a portfolio solely to mitigate volatility and not for their intrinsic qualities. According to many observers, this over-diversification is one of the main reasons behind the relative underperformance of most investment funds...and the growing success of ETFs.

These arguments echo Warren Buffet's warnings against diversification. For him, it is a protection against ignorance. In his view, it makes no sense to invest in too many stocks because it becomes impossible to analyse their fundamentals in detail. For Warren Buffet, the reduction of risk comes from a very good knowledge of his files, hence the need to manage concentrated portfolios.

How should equity portfolios be constructed? Should we favour the diversification advocated by modern portfolio theory or conviction management as recommended by Warren Buffet?

Dare to manage portfolios with conviction!

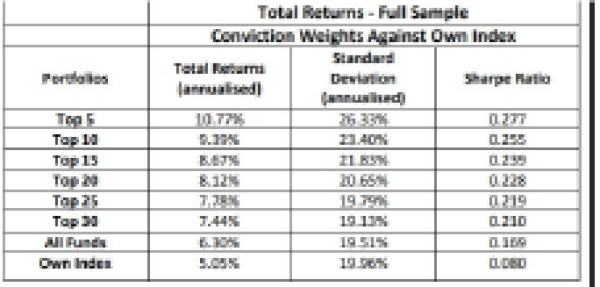

In a paper published in 2012 ("Diversification versus Concentration... and the Winner is?"), Danny Yeung, Paolo Pellizzari, Ron Bird and Sazali Abidin demonstrated that there is indeed a link between the level of diversification and portfolio performance.

The study suggests that fund managers are often unable to leverage their stock-picking skills due to over-diversification of portfolios. Using quarterly data from 1999 to 2009, the authors of the study created portfolios with different levels of diversification. Thus, some portfolios are invested only in the 5 largest holdings, others in the 10 largest, etc. The performance and risk levels are calculated for each of these portfolios (see table below).

The study concluded that in trying to achieve a high level of diversification, managers tend to include in the portfolios securities in which their conviction is relatively low. The result is a dilution of performance and a weakening of the Sharpe ratio (performance per unit of risk). The study also showed that the outperformance of concentrated portfolios is sustainable.

Twenty or so stocks may be sufficient to reduce the specific risk

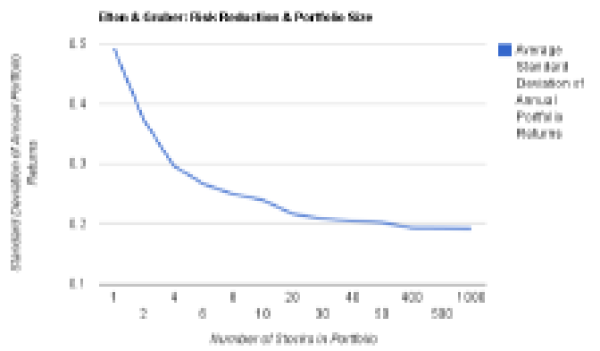

In Elton and Gruber's book "Modern Portfolio Theory and Investment Analysis", the authors concluded that the average risk (as measured by the standard deviation) of a single stock portfolio is 49.2% and that increasing the number of stocks to 1,000 can reduce this standard deviation to an incompressible low limit of 19.2%. They also showed that a portfolio of 20 stocks already reduced its risk to about 20%.

Therefore, while adding 20 stocks already reduces the risk of the portfolio by almost 30 percent, increasing the number of stocks from 20 to 1,000 reduces the risk of the portfolio only slightly. Thus, in the case of an equity portfolio, the benefits of diversification are realised after adding a relatively small number of stocks.

In practice, for example, holding six oil companies or six banking stocks that tend to be relatively correlated with each other because of similar sensitivity to changes in the price of oil or interest rates does not add to portfolio diversification. It makes more sense to hold only the stock that an analyst considers to have the greatest upside potential.

Active share as an indicator of future outperformance

-

Active share is a measure of the percentage of a portfolio's holdings that differs from its benchmark.

A manager is considered truly active (i.e. making significant bets against the index) when the active share is above 60%. Historical performance data indicates that fund managers with a high active share tend to outperform their benchmarks.

What is the link between high active share and above-average relative performance?According to some studies, funds with a high active share (and therefore with a high degree of concentration) share the following characteristics

- Long-term investment prospects: the concept of market "myopia" has shown that markets are much more difficult to predict in the short term than in the long term. Managers who have a propensity to invest over time tend to outperform;

- Better access to information: managers who hold fewer stocks in their portfolios can allocate more time and resources to analysing these companies and develop a better understanding of the stocks they invest in, avoiding panic in downturns

- Greater conviction on their active bets: an informational advantage, such as a deep fundamental understanding of a company or sector, gives active managers the confidence to focus their portfolios in areas of the market where they have deeper knowledge. In addition, the decision to build a concentrated portfolio usually comes when the portfolio manager feels he/she knows enough about his/her holdings to more than offset any potential risk.

If conviction-based portfolio management leads to better relative performance, why don't most managers adopt this approach?

There are several explanations for this:

Career risk: as JM Keynes said, "it is always more comfortable to fail conventionally than to succeed unconventionally". In the fund management business, a marked underperformance for two years in a row can lead to the manager's ouster. In order not to jeopardise their careers, most managers prefer to stay close to their benchmarks and invest in stocks and sectors that enjoy a consensus;

- Biased remuneration formulas: for the most part,the fund management business model is based on fees calculated as a percentage of assets under management. This formula encourages managers to focus on the growth of fund assets rather than performance. Indeed, since unit holders do not tend to pay back the fund in case of poor performance, managers are not inclined to take too much risk. On the other hand, few managers consider closing the fund to new clients when the fund size becomes too large. To avoid these capacity problems, most managers prefer to invest in large benchmark weights, whose potential for appreciation is often less attractive than some "outside the box" ideas;

- The regulatory aspect: In the US, the Prudent Man Rule pushes fund managers to avoid risk through diversification. In Europe, fund managers are guided by specific regulations designed to prevent fund assets from becoming too concentrated (e.g. the 5/10/40 rule within UCITs).

Assembling concentrated funds

The concepts mentioned above are well known to institutional investors and asset allocators. When it comes to selecting external managers, some have found an interesting compromise between the possibility of outperforming indices via conviction - and therefore more concentrated - portfolios and the need to reduce the risk of the mandate entrusted to them.

Indeed, it has been observed that the strong convictions that appear in these concentrated portfolios are often the prerogative of individual managers - in other words, these conviction funds rarely overlap.

These asset allocators therefore had the idea of assembling several high conviction funds, i.e. made up of 15 to 25 stocks. This approach tries to reconcile the two worlds - on the one hand a high expectation of outperformance (because the probability of long-term outperformance of these high conviction managers is higher than other funds) and on the other hand a diversification effect that reduces the overall risk of the portfolio. The diversification effect is moreover marked since these concentrated funds have a low correlation between them (which would not be the case for funds close to the index). This approach has the merit of improving the risk/return ratio of the overall mandate.

There is, however, a downside. These concentrated, high-conviction funds tend to be invested in smaller-cap, less liquid stocks. In times of market stress, these strategies can be put to the test as the combination of concentration and low liquidity can sometimes cause problems for the manager. It is therefore imperative for asset allocators to invest in these conviction funds with a long-term horizon.

Conclusion

The long-held belief that diversifying stocks within an equity portfolios is the best way to minimise risk has led to an increase in the average number of stocks held in funds. But holding too many stocks tends to dilute the performance contribution of the best ideas.

Reducing the number of stocks in a portfolio does not necessarily reduce its diversification, as long as the portfolio is constructed appropriately and with a focus on idiosyncratic stock risk.

In general, we believe that concentration and diversification can go hand in hand. Through a bottom-up analysis of stocks, which aims to understand all aspects of a company's business and valuation, portfolio managers can take larger positions in the most promising stocks without taking excessive risks because 1) the manager has an informational advantage; 2) the factors influencing the selected stocks are weakly correlated.

When applied effectively, conviction management increases the probability of portfolio outperformance.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)