The rise of ETFs

ETFs (Exchange Traded Funds) are becoming increasingly popular. They combine the advantages of a mutual fund (diversification) with those of stocks (they can be traded on the stock exchange at any time) while offering a much lower TER (total expense ratio) than funds. Since their inception in 1993, the vast majority of ETFs have followed a so-called passive investment strategy. In other words, ETFs seek to replicate the performance of an equity, bond or commodity index without seeking to outperform. But in recent years, a new type of ETF has become increasingly popular. These are actively managed ETFs. Their objective is not to replicate the performance of an index, but rather to outperform it.

A new SEC rule as a game changer

The financial industry has long refrained from launching this type of product for regulatory reasons. Indeed, an ETF manager should be fully transparent about the complete portfolio breakdown, whereas a traditional investment fund manager can only publish the most important positions once a month. As a result, many active managers were shying away from launching ETFs because this transparency requirement exposed them to the risk of "front-running," a practice that involves having knowledge of the upcoming purchase of a fund and getting ahead of that trade. But in 2019, the SEC introduced a new U.S.-specific rule allowing ETFs to become "semi-transparent," i.e., publish their portfolios less frequently and "mask" individual positions by replacing them with a "proxy."

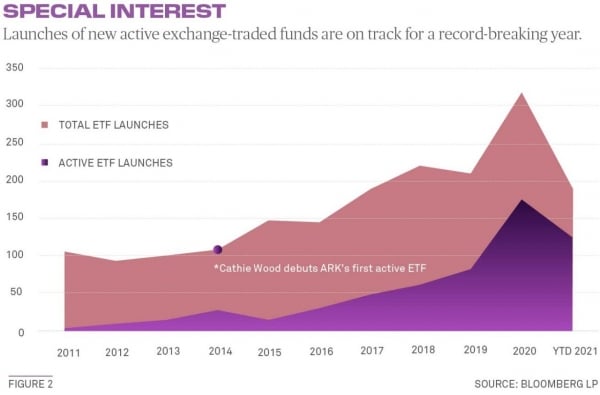

Since this regulatory change, actively managed ETFs have experienced strong growth. By the end of 2021, their assets under management amounted to $400 billion. Admittedly, this represents only a very small share (5%) of the approximately $9 trillion of ETFs available worldwide. But the momentum is undeniable. In 2021, 188 new ETFs were launched in the United States and two-thirds of them were based on active strategies.

Source: Bloomberg

The Ark Invest mania

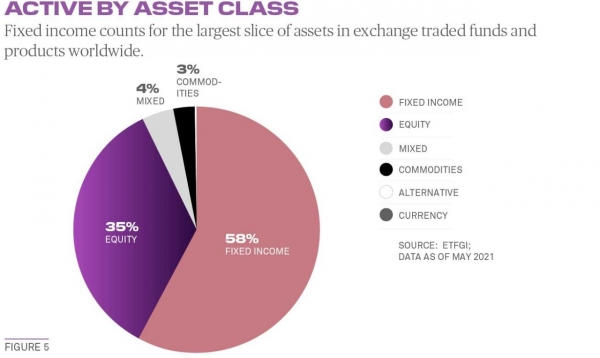

The icon of active ETFs is Ark Invest. Cathie Wood, the company’s founder and CEO, was quick to recognize their growth potential. Easier to access and less expensive than investment funds, they combine the best of both worlds: active management and instant liquidity. This new type of ETF enables asset management firms to target a wider range of investors, particularly retail investors. To convince this often neophyte audience, Cathie Wood has surfed the wave of themes, including innovation and technology. Ark Invest Innovation raised more than 15 billion in assets last year, despite a very disappointing performance. Because Cathie Wood excels at marketing by using the required level of transparency as an advantage: she has made her research public, hosts podcasts and posts her beliefs on Twitter. So much so that emulators have started to emerge. Many investment fund managers have decided in the last year to offer some of their active strategies via ETFs. This is the case for DFA, Putnam, Fidelity and T-Rowe Price. Franklin Templeton and J.P. Morgan have announced their intention to do so this year. But if equities are well represented in the universe of actively managed ETFs, it is the bond strategies that take the lion's share. PIMCO launched the famous "MINT" ETF 10 years before the regulatory change. This ETF now has a market capitalization of 14 billion.

Source: Bloomberg

What’s next for actively managed ETFs?

Will the boom in active ETFs last? The crash of Ark-managed ETFs is likely to put off many investors. And for asset management companies, it is essential not to "cannibalize" their investment fund offerings because ETF management fees are much lower. The regulatory framework also imposes certain limits on the investment universe: the securities held must be tradable on stock exchanges at the same time as the ETF, which de facto eliminates foreign equities, OTC bonds or small caps with low liquidity. Management companies therefore have the possibility of sorting out and marketing actively managed ETFs only for certain strategies.

What about Europe? Surveys confirm the interest of institutional and retail investors for this new breed of ETF. But European regulations still require ETFs to disclose all their positions on a daily basis. A gap that will probably have to be filled one day.

Source: Bloomberg

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)