In his 2012 book, “Anti-fragile: Things That Gain from Disorder”, Nassim Taleb offered the following definition:

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it anti-fragile. Anti-fragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the anti-fragile gets better.”

In the financial world, the definition of anti-fragile assets remains uncertain for most of us and varies with the evolution of financial markets. For example, U.S. and European sovereign debt, the Swiss franc, gold, silver and bitcoin are considered among the “anti-fragile” assets by many investors.

However, the recent market decline and increased volatility seem to disqualify some of these assets. As Warren Buffet once said, “Only when the tide goes out do you discover who’s been swimming naked”. While the Nasdaq’s performance over the past 12 months is now close to 0%, most “anti-fragile” assets have done even worse. U.S. 10-year bonds are down nearly 2%, European bonds (expressed in dollars) are down 11% and gold is down 1%. As for bitcoin, it is also in negative territory on a rolling 12-month basis.

In short, the assets that are supposed to provide a counterbalance to a portfolio during phases of increased equity market volatility have not lived up to their promise. This has led to a de facto search for new anti-fragile assets.

One candidate seems to stand out: Chinese sovereign bonds denominated in local currency - the so-called Chinese Government Bonds (CGBs).

CGBs have in fact decoupled from other bond markets in 2021 (+17% gain while global bond markets suffered last year). This very good performance can be explained by the combined effect of the stability of the renminbi (CNY) which has been supported by favorable fundamental and political factors and the decline in local government bond yields.

- Indeed, China’s economic cycle is not aligned with that of other developed countries. Unlike the U.S., which is planning to tighten monetary policy, China is about to intensify its monetary easing efforts in the first half of the year in light of slowing growth. In China, the Central bank (PBoC) had already announced a 50 basis point reduction in the effective exchange rate starting December 15 and a recent Central Political Bureau meeting also indicated that there would be more monetary policy easing. While inflation rates in the U.S. and Europe are at their highest levels in 30 years, China’s inflation rate is falling. All these elements support Chinese sovereign debt, despite some major problems such as the property developers’ debt crisis (Evergrande).

This highlights a theory that has been supported for some time by some, including the independent research firm Gavekal: in an inflationary world where central banks pursue competitive devaluation policies, the anti-fragile assets can be found in the bond markets of countries whose central bank seeks to maintain a strong currency policy - which is indeed the case in China.

- While bond yields in most G7 countries are low or close to zero, Chinese government bonds offer yield to maturity varying between 2.5% and 3%, with almost no credit risk (A+ rating from S&P and A1 from Moody’s).

- In addition to the positive yield spread, the prospect of lower rates (if the PBoC eases monetary policy in 2022) and currency appreciation (attractive real spreads, current account surplus, strong export data, possible easing of trade tensions with the U.S.) can enhance performance.

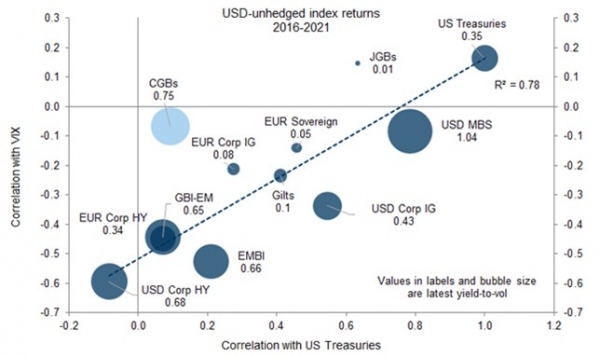

- Importantly, CGBs have low correlations not only with government bonds in USD and EUR but also with emerging debt, which makes Chinese government bonds in CNY a particularly an interesting diversification tool within a globally diversified bond portfolio. But the diversification benefits go beyond fixed income investing. As shown on the chart on next page (source: Goldman Sachs), CGBs stand out from other bond assets thanks to their very low correlation with the VIX volatility index, while their correlation with US Treasury bonds is close to zero. This is a marked difference from their Japanese counterparts (JGBs) which have a low correlation with the VIX index but a high correlation with US bonds. CGBs are therefore an interesting diversification tool for multi-asset class portfolios.

- Last but not least. Despite all these tailwinds, the average allocation of international investors to CGBs remains low. One explanation: these bonds have little or no presence in global bond indices and in central bank reserves. However, this situation is evolving as China entered the FTSE Global Bond Index in October 2021. Central banks, especially those in emerging markets, are now allocating a portion of their international currency holdings to China, mainly in the form of CGBs.

Institutional investors will have no major difficulty introducing these bonds into their portfolios since liquidity in this market is abundant (the equivalent of $10 trillion).

As with any investment, there are certain risks to consider. Among them: a temporary depreciation of the CNY in case of government intervention, restrictions on access to foreign investors in case of geopolitical tensions, future interest rate hikes if inflation surprises on the upside, etc.

But if we consider the triumvirate of yield, risk and correlation, Chinese sovereign bonds do indeed seem to fit the profile of anti-fragile assets that could be quite useful in 2022 and beyond.

Chart: USD-unhedged index returns 2016-2021

Source: Goldman Sachs

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)