The world’s biggest (oil) company

Founded in 1933 and headquartered in Dhahran, Saudi Aramco is by far the world's largest oil exploration and production company. It supplies more than a tenth of the world's oil and currently generates more than $1 billion a day in revenue. Under a 60-year concession from the Kingdom of Saudia Arabia to Aramco which has access to 270 billion barrels, more than 20% of the world's oil reserves and more than ten times those of ExxonMobil's. Aramco also has nearly 294 trillion standard cubic feet (scf) of natural gas reserves. Reports suggest that Aramco is the world's second largest producer of crude oil (behind Venezuela) with an output of 10.2 million barrels per day. Aramco is one of the few companies that continues to invest to increase its production capacity. Its ambition is to go from a capacity of 12 million barrels per day to 13 million. As far as natural gas is concerned, the objective is to increase capacity by 50% by 2030. Capex in 2022 is expected to be between 40 and 50 billion dollars this year versus 32 billion last year. This amount includes investments in hydrogen and renewable energies.

Saudi Aramco is not only an upstream giant, but also owns downstream assets, such as the Sadara Chemical Company - a $20 billion joint venture with Dow Chemical - and the largest chemical plant ever built at one time. Sadara uses oil and gas to produce a range of specialised chemical components found in many end products, such as cosmetics and automotive parts. The plant illustrates Aramco's and therefore the Saudi government's commitment to developing higher value-added industries such as petrochemicals, which can build on the Kingdom's natural resources rather than replace them. Amin Nasser, CEO of Aramco, presented the Sadara plant as a demonstration that Saudi Aramco is a key player in Saudi Arabia's economic diversification.

Expanding refining globally is another long-term challenge for Aramco. The state-owned company already operates international and domestic refining joint ventures, such as Motiva in partnerships with Shell) or Saudi Aramco Total Refining and Petrochemical with Total.

By acquiring stakes in foreign refineries, the Saudi company wants to secure market shares in countries where demand growth is strong such as China, India and Indonesia.

The expansion of Aramco's downstream assets shows that the Saudi leadership has realised that it has so far lost considerable value by exporting commodities and importing higher value-added finished products. The focus on petrochemicals shows how the development of the "new economy" promoted by Prince Mohammed Bin Salman (MBS) is financed by hydrocarbons. The strategy: exploit and preserve their main resource - oil and gas - for at least the next 20 years and use the revenues to develop new sectors.

Aramco is a significant contributor to the Saudi economy: 45% of Saudi Arabia's GDP, 90% of the country's export revenues and almost 90% of budgetary revenues come from Saudi Aramco. But Aramco is not only the largest Saudi company. It is also a benchmark for the Kingdom. Indeed, the state-owned company employs a considerable number of people (about 67,000 employees). It is also seen by many as a model of the more dynamic and open society that MBS is trying to promote.

Founded in the early 1930s in a partnership with US Standard Oil, the company prides itself on hiring the brightest young Saudis - a symbol of meritocracy in a tribal culture. It strives for the highest standards of operational excellence, has a multinational workforce and has accounting and governance structures that rival those of oil majors such as ExxonMobil. Within the Dhahran compound, men and women have worked side by side for decades with a lifestyle similar to that of Western companies.

The gigantic dividends paid to the Saudi state are reinvested into the sovereign fund PIF ("Public Investment Fund") following the example of Norway via its "1.2 trillion dollar Government Fund". The PIF invests part of its $450 billion in assets under management in large multinationals and in particular in so-called growth companies such as Tesla, Uber and Softbank. It should be noted that PIF has publicly stated that it wants to invest significantly in ESG-labelled securities - without, however, giving any details on the size of these investments.

In December 2019, Saudi Aramco shares were listed on the Riyadh Stock Exchange (Tadawul) and raised US$25.6 billion, making it the world's largest IPO, succeeding Alibaba Group in 2014. The free float is 1.7%, implying that 98.3% of the capital remained in state hands.

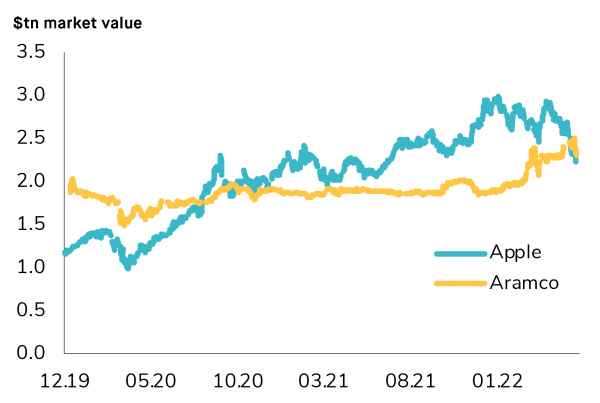

This month, Saudi Aramco became the world's largest listed company, with a market capitalisation of USD 2,430 billion, de facto dethroning Apple (see chart below). This change is as much a testament to the excellent management of Aramco than to the plunge in technology stocks.

Saudi Aramco overtakes Apple

Source: Bloomberg

Strengths and weaknesses of Aramco's business model

Aramco's production cost per barrel is only $10 compared to its American competitors, which have production costs 2-8 times higher.

The productive investments made, whether in hydrocarbon production capacities or those linked to the company's diversification, are also part of Aramco's strengths. It is worth noting that Aramco has perhaps the healthiest balance sheet in the industry, with net debt (debt minus cash) divided by about 6%.

The revenue redistribution model in the Kingdom has both advantages and disadvantages for minority shareholders.

First, Aramco pays "royalties" on revenues generated on a variable rate basis: 20% when the price of oil trades below $70, 40% between $70 and $100 and 50% above $100. Although Aramco's share price is highly correlated to the price of oil, this tiered royalty rate provides some downside protection for the shareholder as the royalty rate paid decreases when the oil price falls.

In addition to royalties, Aramco pays significant taxes in the Kingdom. The current tax rate is 50% tax on profits. This rate was 85% before the IPO in 2019. One of the difficulties in analysing the upside potential and risks to Aramco's stock is that there is a question mark over the long-term stability of this tax rate. If the government suddenly decides to accelerate some of the spending related to the country's economic diversification, or if the price of oil collapses, will it be tempted to increase the tax rate?

Record results in the first quarter

On 15 May, Aramco announced an 81% jump in net profit for the first quarter of 2022. Soaring oil prices and improved downstream margins (refining and distribution) propelled net profit to $39.5bn, up from $21.7bn in the same period in 2021. This is the best quarter since the IPO in 2019.

The oil giant also announced that it would increase its capital by issuing 20 billion shares for free to shareholders, on the basis of one share offered for every ten held. A dividend of $18.8 billion will be paid in the second quarter.

A new IPO coming soon?

Saudi Aramco is considering an IPO of its trading arm in what could be one of the world's largest listings this year. Goldman Sachs, JPMorgan and Morgan Stanley are currently considering an IPO of Aramco Trading Co with a target valuation of more than $30 billion. Aramco could sell a 30% stake in the division. Most of the world's major oil companies have preferred not to list their business units for fear of revealing confidential information. There is therefore no certainty that Aramco Trading will be listed. Other Aramco subsidiaries are already listed, including chemical manufacturer Saudi Basic Industries and Rabigh Refining & Petrochemical. The refining company Luberef could also be listed.

In addition, Saudi Arabia has begun preliminary discussions on a new Aramco share offering, which could raise more funds than the historic offering of two years ago.

Risks and opportunities

In the current context, MENA (Middle East and North Africa) equity markets are outperforming global indices and the MSCI Emerging Markets Index by a significant margin.

Most MENA countries are benefiting from the direct and indirect effects of rising hydrocarbon prices on economic growth in the region. Saudi Aramco is the blue-chip stock par excellence in this investment universe, which remains relatively niche for international investors. Aramco's stock is up 21% since the beginning of the year.

In terms of valuation, Aramco (2222.SR) is currently trading on a P/E multiple of 15 times expected earnings per share for 2022 and 16 times 2023, i.e. PEs comparable to those of ExxonMobil or Chevron. The dividend yield is 3.4% but is expected to increase due to higher dividend payouts.

In the near future, Aramco could continue to benefit from high oil prices. However, there are risks to this investment.

In addition to its high correlation with energy prices, the stock is of course not considered ESG friendly. In fact, Aramco is the world's largest emitter of greenhouse gases. It is estimated that the company alone is responsible for 4% of cumulative emissions since 1965.

The stock also faces geopolitical risks. Saudi Arabia has had an ambivalent relationship with the US, to say the least. Of course, oil is the basis of the US relationship with Riyadh. But tensions persist. Saudi Arabia continues to maintain good relations with Russia, while President Biden and MBS do not seem to be on the best of terms, often based on human rights issues and mostly since the U.S. government raised its concern about MBS’s implication in the assassination of the Saudi-American journalist Jamal Khashoggi. It is difficult to anticipate how these relations will evolve in the coming years.

Saudi Aramco is also facing security issues related to the war waged by the Saudi-led military coalition against the Houthi rebels in Yemen, which has repeatedly targeted the Kingdom. In 2019, drone attacks claimed by the Houthis on two Aramco facilities in eastern Saudi Arabia temporarily halted half of Saudi Arabia's crude oil production. In March, a Houthi attack on Aramco facilities caused a further "temporary" drop in production.

Finally, an important technical element: the stock is only listed in Saudi Arabia. Investors must therefore go through an intermediary who has access to Tadawul.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)