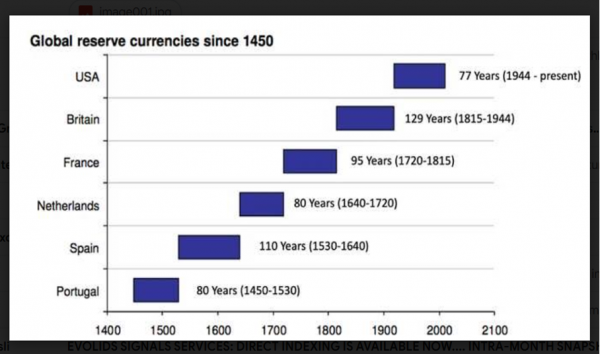

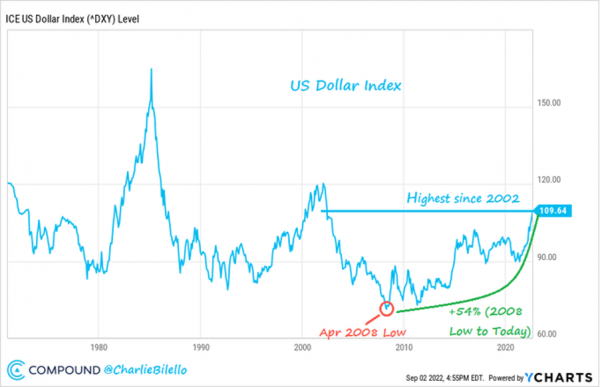

As mentioned above, the US dollar has been the world's reserve currency since the 1970s. However, multiple geopolitical and economic factors could challenge this supremacy.

The de-dollarization trend is not a new phenomenon. In the 1990s, in response to U.S sanctions, Venezuela tried to break out of the status quo by switching from U.S dollars to Chinese yuan for oil payments. Rapid globalization also poses a threat to the greenback, as many countries with bilateral trade relations would like to be able to use their own currencies for trade. However, the great financial crisis of 2008 put an end to any desire against the greenback, as investors sought the security offered by the current reserve currency.

But today, the rise of China as a major world power, the exclusion of Russia from the SWIFT system and the implicit disagreement between the US and Saudi Arabia may well accelerate the trend towards de-dollarization.

Over the decades, the Saudi kingdom has been one of the United States' most important allies in the Middle East - largely through the "oil for dollars" agreement. Economically, Saudi Arabia has been the largest supplier of crude oil to the United States. Geopolitically, the Kingdom has been a U.S. proxy in the Middle East to counter its great rival, Iran. But over the years, this relationship began to deteriorate.

The United States has gradually reduced its dependence on oil imports by building up its own strategic reserves. In the 1990s, the United States imported about 2 million barrels per day of Saudi crude. This figure fell to only 500,000 barrels per day by 2021. Politically, Saudi Arabia is clearly not happy with Biden's Middle East policy. Biden's decision to unilaterally withdraw his support for Saudi Arabia in the Yemen war has alienated the Kingdom from the U.S. administration. Biden's stated intention to salvage the nuclear deal with Iran has probably sealed any hope for improved relations.

Since Russia launched its assault on Ukraine in February, Saudi Arabia has refused to pay attention to Biden's calls to extend crude supply quotas to limit rising oil prices.

But this indifference to Western calls has an underlying reason that goes beyond the dispute with the United States: it is the growing cooperation between China and Saudi Arabia, which is not limited to the energy sector. Under the umbrella of its Belt and Road Initiative, China has expanded its potential presence in the Kingdom through bilateral cooperation in infrastructure, trade and investment.

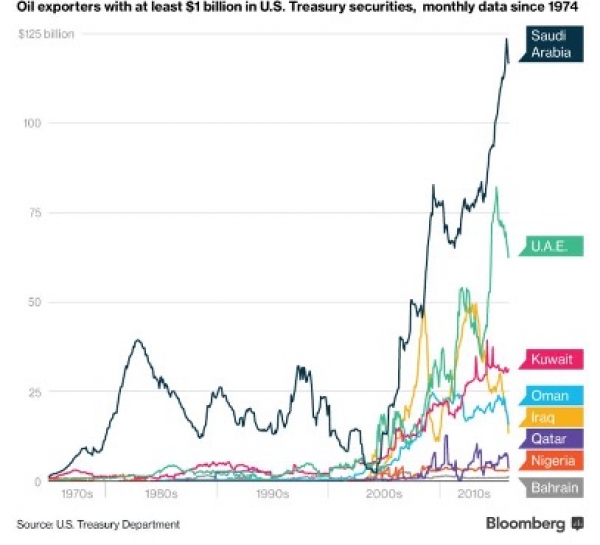

According to the American Enterprise Institute, cumulative Chinese investment in the Saudi economy reached $43 billion in 2021. China imported an estimated 542 million tons of crude oil in 2020, accounting for 25% of the Kingdom's global oil exports. According to some sources, the Kingdom's sovereign wealth fund (PIF) may soon start investing in Chinese companies. Saudi Aramco is reportedly close to entering into a partnership with a Chinese petrochemical consortium. All these factors seem to indicate that Saudi Arabia is increasingly turning to China. The de-dollarization of trade and investment would obviously facilitate their bilateral relations.

It is worth noting that the United Arab Emirates are well aligned with the Saudis. Their cooperation with China is also growing strongly. And they are obviously ready to cut their production whenever OPEC+ decides to do so. It is also interesting to note that Egypt, another ally of Saudi Arabia, has just launched its first yuan-denominated bond.

Like the Gulf countries, economies such as Russia and Iran have also moved closer to Asia. Russia, for example, is turning to the CIPS system - a transaction system that clears international settlements and trades in Renminbi - to be able to export its oil to Asia under Western sanctions. China and India now account for 40% of Russian oil exports. In India, Russian crude accounts for about 17% of imports - up from less than 1% before the invasion. Even Iran has begun exporting crude to China under US sanctions without using the US dollar for payments.

Some economists believe that this trend is not sustainable, drawing parallels with Venezuela's failed attempt at de-dollarization in the 1990s. But the context is very different this time. First, Asia is much less dollarized than Latin America. Also, Asian economies are much larger in size and impact on monetary policy. Even a step towards "semi-dollarization" could diminish the influence of the United States and undermine the awesome mechanics of the petrodollar. With consequences beyond the energy exporting countries. If the dollar loses its importance in trade, many central bank governors may be prompted to rethink the logic of accumulating reserves, as well as the wisdom of allocating part of their central bank's balance sheet to U.S. Treasury bonds.

The US government is obviously aware of these risks and is concerned about the defiance of the OPEC+ alliance. A US Senate committee has been working on a bill called "No Oil Producing or Exporting Cartels" (NOPEC) to amend US antitrust law. Such a bill would give the Attorney General the power to expose OPEC+ countries to prosecution for possible collusion. The proposal has so far failed. Saudi Arabia has already warned in 2019 that such a bill, if passed, would prompt it to trade its oil in different currencies. Sanctions on Russia and China's growing influence in Eurasia are setting the stage for a very gradual move away from the petrodollar, NOPEC or not.

.png)