Electricity prices continue to soar in Europe. One-year forward contracts are breaking new records this week, exceeding 600 euros per megawatt-hour in Germany for the first time, while they are approaching 800 euros per megawatt-hour in France (the equivalent in megawatt-hour of an oil barrel price of 1,000 dollars...).

One-year electricity futures contracts in France (white line) and Germany (blue line)

Source: Bloomberg

Nuclear power is at the heart of the crisis

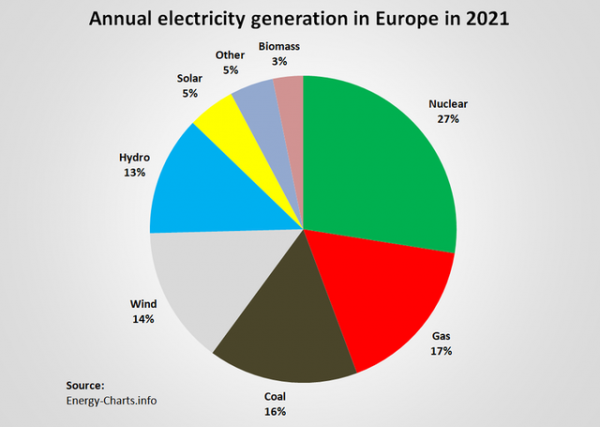

To better understand the reasons for this almost vertical ascension in electricity prices, it is interesting to analyze the sources of electricity production in Europe. As the chart below shows, Europe is heavily dependent on its nuclear reactors. Even though these nuclear power plants only account for about 11% of Europe's power generation capacity, they were by far the largest suppliers of power to the European grid in 2021, producing 27% of the continent's electricity.

Electricity production in Europe by energy type

Source: Energy-charts.info

Half of Europe's nuclear capacity is in France because the other major European countries (including Germany) have been phasing out nuclear power - a strategic mistake. But of the 56 French reactors, 25 are currently shut down for maintenance, while five others are operating only to a limited extent. French nuclear power has never produced so little in 30 years. According to a study by Gavekal, French nuclear capacity is currently just over 50%. In other words, a quarter of European nuclear capacity is currently out of service.

Moreover, there is no indication that French nuclear capacity will return to adequate levels any time soon. Indeed, EDF, the national electricity company, is in dire financial straits. Years of state intrusion into the national electricity market have pushed EDF into a state of near-bankruptcy with a negative EBITA of 13 billion euros in 2021. Years of accumulated losses have prevented EDF from raising the capital required to maintain the existing fleet of reactors and invest in the additional capacity generation that would have made it possible to meet rising electricity demand. In the immediate future, and despite the renationalization by the State, EDF may not be able to bring its reactors back on line on schedule before winter.

Gas reserves likely to be insufficient

The decrease in nuclear production capacity has resulted in increased demand for the second source of energy production, gas-fired plants. In the past, this source fulfilled its backup role perfectly. The reserve capacities were such that any deficiency in nuclear power was easily compensated. But since the Russian invasion of Ukraine and the subsequent sanctions, the situation is completely different. With the disruption of natural gas supplies from Russia, gas prices in Europe have risen by more than 2,800% in the past two years.

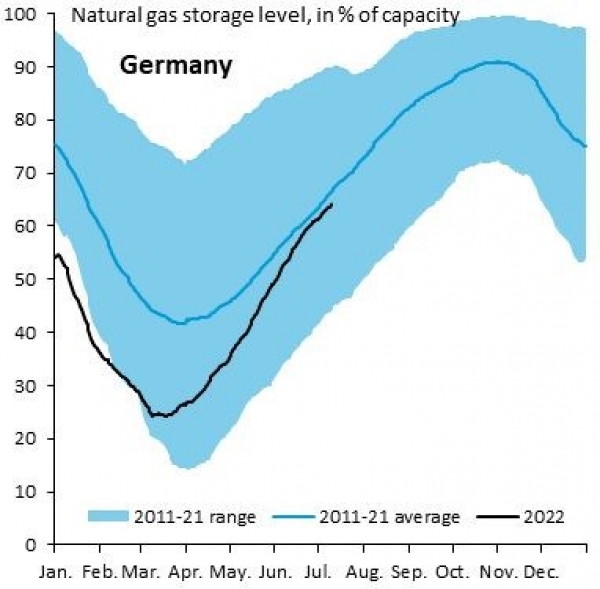

Recent announcements of gas restocking - particularly in Germany - have been interpreted by some as a sign that the situation may improve before this winter. Gas storage levels in Germany are indeed on track to reach 90% capacity before the end of the fall. This is the level that is normally required for Germany and many European countries to get through the winter without supply problems. But this assumption is only valid if the Nordstream pipeline - which transports gas imported from Russia - is operating at full capacity. However, this famous pipeline is currently only operating at 20%. It can also be completely cut off at any time. Last Friday, Gazprom announced its intention to close the pipeline for 3 days, officially for maintenance. The frequency of these voluntary shutdowns on the part of Russia could accelerate during the winter.

As a result, even with storage levels close to 90 or 95% in the coming months, Germany will probably not have enough gas this winter. If Russia cuts supplies further, the current storage level will not be able to cover 3 months of gas needs.

Level of natural gas storage in Germany

Source: Robin Brooks

Of course, the old continent has the possibility of obtaining gas supplies from outside Russia. Europeans have increased their imports of LNG (liquefied natural gas) from the United States, Qatar and even... Australia. But these "extras" are obviously extremely expensive. As for clean energies (photovoltaic, wind, etc.), they are not yet able to bridge the gap.

Does Europe have other alternatives?

Coal is not an attractive option

The risk of gas shortages this winter has prompted some European countries, including Germany, to announce that they will bring coal-fired power plants back on line. In addition to environmental concerns, this option is far from cheap. First, coal prices in Europe have risen by more than 150% in one year, reaching a level about five times the average price between 2010 and 2020. Second, its high carbon intensity is also very expensive, as the price of carbon emissions in Europe is currently almost six times its average for the period 2010-20 (source: Gavekal).

Another issue emerged during the summer: transportation costs. Due to the heat waves, the water levels of the main European rivers (including the Rhine) reached their lowest levels in 50 years. As a result, many barges are no longer able to transport goods, including coal. The barges that are able to do so have increased their rates for transporting coal by almost 400% in recent months.

Water levels are also having a negative impact on hydropower sources, which are the 4th largest source of electricity generation.

A perfect storm

The European electricity market is therefore facing a dangerous spiral: nuclear reactors with insufficient capacity, exploding gas and coal prices, while renewable energies (hydro, wind, solar, etc.) are not yet able to take over. Taken individually, each of these issues would be manageable. But the fact that these crises are occurring at the same time makes the situation exceptionally bad.

While many observers are looking to Russian pipelines as the main trend indicator for electricity prices, the timing for nuclear power plants to come back online will play a major role in this energy crisis. Salvation must come from France, as Berlin has just refused to extend the life of the country's last three nuclear power plants to save natural gas, pointing out that this would only represent 2% of German consumption. EDF plans to restart six reactors in the next four weeks. If it succeeds, forward electricity prices this winter should fall. If it fails, electricity prices in Europe will be dependent on Russian natural gas and therefore likely to remain economically prohibitive.

What consequences for the European economy?

The surge in electricity and natural gas prices is not yet fully visible in the bills sent to consumers and businesses. Targeted subsidies have so far cushioned some of the energy shock, even though the rise in energy prices is already clearly visible in the inflation figures, especially since the fall in the value of the euro is only making imported fuels more expensive. As the chart below shows, European inflation is much more dependent on energy than that of the US.

The different contributors to price increases in the US and Europe between January 2021 and June 2022

Source: Franklin Templeton

Many political leaders are currently preparing their respective countries for a very complicated winter. Unless there is a sudden upswing in nuclear power and/or gas imports from Russia, the European continent will have no choice but to implement a number of emergency measures: the first steps include a more or less significant reduction in consumption through voluntary savings in households, industry, services and public administration. If this is not enough, many countries will have to resort to restrictions and rationing, which could affect the industrial production apparatus as well as means of communication and transport. The ultimate step would be a ban on the use of gas except for vital services (emergency services and production of basic consumer goods).

Such a scenario would of course increase the risk of recession on the old continent, as Europe will simply not have enough energy to keep its economy running at full capacity, which will affect both industrial activity and consumption. The likely rationing and very high prices paid for energy will weigh on European competitiveness, wiping out the competitive advantage gained by the falling euro. The recession that Europe is likely to face this winter will not give any respite to inflation: the decline in growth accelerates the depreciation of the euro, which increases the cost of imported goods and services - including energy.

The growing risk of stagflation leads us to be particularly cautious about European assets. However, we also believe that some of the bad news are already priced in and that this crisis will also create attractive investment opportunities.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)