Pitfall #1 — Getting allocation is a challenge

First, it is important to remember that access to IPOs is limited to a small number of investors. Unless you are a major client of a brokerage firm or a large bank, it is very complicated to get allocations. And for those lucky enough to be served, the allocation is often too small to have a significant financial impact on the portfolio.

For those investors who are able to receive significant allocations, the performance is not always there. This was highlighted by Dimensional Fund Advisors (DFA), a fund manager who conducted a study of more than 6,000 U.S. IPOs from 1991 to 2018 to measure the performance of these IPOs over two different time horizons: short term and medium term.

Pitfall #2 — Biased short-term returns

DFA's study shows that closing prices achieved on the first day of listing generally exceed the IPO offer price. However, there is a selection bias that distorts the average performance recorded by investors. Indeed, access to IPOs with high performance is generally very difficult. Only institutional investors and very wealthy private clients participate. IPOs that are easier to access have much lower initial gains.

Pitfall #3 — Disappointing medium-term returns

Since many investors are not able to benefit from these initial performances, DFA has been interested in the performance of IPOs in the secondary market. How do IPOs perform in their first year?

Most of the IPOs in the sample are in the small-cap group. Large-cap and mid-cap IPOs represent 24% and 19%, respectively, of total IPO capital raised during the sample period.

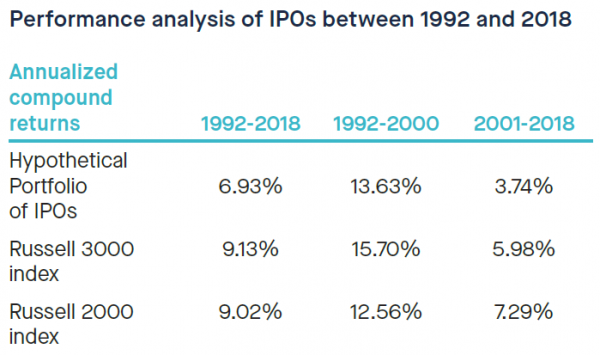

DFA evaluated IPO performance by constructing a market capitalization-weighted portfolio of IPOs issued in the previous 12 months and rebalanced monthly. This methodology excludes the performance of the first day of listing in order to mitigate the selection problem inherent in the IPO allocation process. The performance of this hypothetical portfolio was compared to the Russell 2000 and 3000 indices over the entire sample period as well as over two sub-periods covering the years 1992-2000 and 2001-2018.

The portfolio consisting of IPOs underperforms the Russell 3000 Index over both the overall period and the two sub-periods. For example, IPOs generate an annualized return of 6.9%, 13.6% and 3.7% over the full period, the 1st sub-period (1992-2000) and the 2nd sub-period (2011-2018), compared to 9.1%, 15.7% and 6% for the Russell 3000 Index over the same time horizons.

Compared to the Russell 2000 Index, the hypothetical IPO portfolio underperforms over the entire period (6.93% vs. 9.02%) and over the 2001-2018 sub-period (3.74% vs. 7.29%). On the other hand, it outperformed (13.63% versus 12.56%) over the 1992-2000 period.

This underperformance can be explained by fundamentals. In aggregate, the companies in the IPO portfolio had lower growth and return on equity than the Russell indices.

Source: DFA - Past performance is not a guarantee of future results.

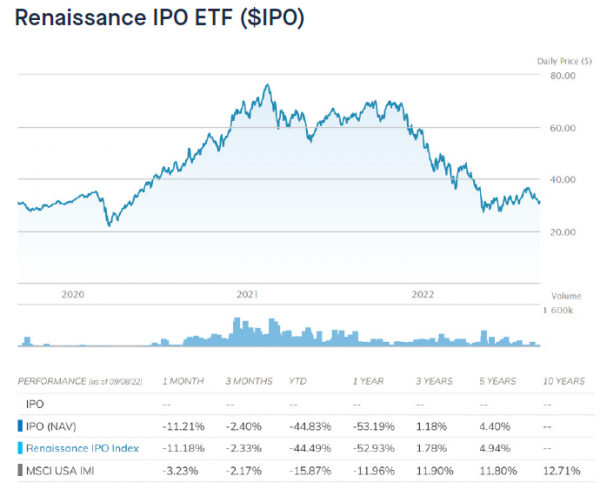

While this study covered a period between 1992 and 2018, the more recent performance of stocks that went public in less than 3 years has been very mixed. As the chart below shows, the Renaissance IPO ETF ($IPO) had generated spectacular returns in 2020 and 2021 but has since collapsed (-44% year-to-date). The ETF clearly underperformed the US market over the 1-year, 3-year and 5-year periods.

Pitfall #4 — Emotion often takes over

As mentioned in an article by Debbie Carlson ("7 Reasons You Shouldn't Buy an IPO"), investors who buy IPOs are very often influenced by hype or fads. In fact, many companies take advantage of the market's attraction to certain types of stocks to list their company at the highest possible valuation. In the 2000s, we saw an avalanche of IPOs of "dot com" companies. Investors rushed to buy the latest Internet company and were ready to pay any price to have access to the stock on the first day of listing. More recently, electric cars (Rivian), plant-based food companies (Beyond Meat), VTC transportation companies (Uber, Lyft) or delivery companies (DoorDash) have become the darlings of Wall Street. Their post-IPO performance has been very disappointing overall.

Pitfall #5 — Watch out for valuation levels

In the first days and weeks of trading, the price of hot new IPOs can rise sharply, driving valuations to unreasonably high levels, with exorbitant price-to-earnings ratios.

On November 10, 2021, Rivian, a company specializing in electric SUVs, went public. The euphoria of investors was such that Rivian reached a market capitalization of $100 billion, more than that of General Motors and Ford. Even though the 2021 revenue was only $55 million and the operating loss was more than $4 billion... At these valuation levels, what appreciation potential can investors expect? At the time of writing, Rivian shares have lost 65% since the company’s peak valuation...

The overvaluation of a recently floated stock is not often attributable to the company itself or the investment bank that led the IPO. It is the euphoria of the first hours or days of trading that most often creates these extreme valuation levels.

Pitfall #6 — The importance of research

One piece of advice for investors is to consider IPOs as just another stock. It is therefore essential to perform

an in-depth analysis, i.e. to understand the competitive advantages of the company, the threats from competitors, the prospects of the sector in which it operates, the quality of the management and of course the valuation levels of the company. This indispensable work can help investors to sort through the many IPOs available.

Pitfall #7 — The end of the "lock-up" period

One of the main characteristics of IPOs is the famous "lock-up" period, i.e. the months during which the shares held by pre-IPO shareholders and insiders cannot be sold. But these locked-up shares can usually be released after 180 days. For stocks that have experienced strong gains, the end of the lock-up period can be an opportunity for an insider to cash in and take profits, creating selling pressure on the stock. It is also an opportunity for investors who have done their homework to buy the stock at a better price...

Conclusion

Investors considering buying securities at the IPO should be aware of the risks involved and the disappointing relative performance of these securities over the short and medium term. However, there are also very exciting opportunities for those who can access and subscribe at an attractive price.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Imagine an economy that keeps growing, companies making record profits, and markets hitting new highs, yet millions of skilled workers struggle to find jobs. AI now handles tasks that humans used to do, faster and cheaper than any employee. Productivity rises, but wages and household income lag. Growth is happening, but people are being left out. How will society adapt when success no longer depends on human work?

Rising tensions in Iran are sending shockwaves through energy and financial markets. Global oil flows, inflation expectations, and market sentiment are all under pressure. In this climate of uncertainty, careful observation and strategic positioning are key.

Memory chips underpin every layer of the modern technology stack, yet the market that produces them has entered a period of structural constraint with no near-term resolution. The implications for companies dependent on predictable hardware access are becoming increasingly material.

.png)