For more than three decades, the Federal Reserve Bank of Kansas City has hosted the annual Jackson Hole Economic Policy Symposium, where dozens of central bankers, policymakers, academics and economists gather.

Jackson Hole is a valley located between the Gros Ventre and Teton mountain ranges in the US state of Wyoming, near the border with Idaho. Those lucky enough to hike there encounter elks, bison, golden hawks and bears.

At last week’s symposium, bears and hawks were center stage...

Higher for longer

Many economists were expecting a non-event. The latest inflation figures suggested a rather balanced message from Fed Chairman Jay Powell. He was expected to be an "iron fist in a velvet glove", i.e. firm on the continuation of monetary tightening but also showing some signs that the Fed is ready to slow down the rate hikes if the economic data (inflation as well as growth) justify it.

However, Jay Powell's very short speech - 10 minutes as opposed to the usual half hour - was interpreted as a hawkish one, i.e. resolutely turned towards a longer and more important monetary tightening than the market had hoped for.

Quoting both former central bankers Paul Volcker and Alan Greenspan, Jerome Powell presented his speech in the form of 3 distinct lessons:

- It is up to central bankers to take responsibility for low and stable inflation (in other words, there is no inevitability. Even if the supply deficit is the main cause of rising inflation, the central bank must act on demand to bring inflation down);

- Public expectations of future inflation can play an important role in determining the future path of inflation. Jerome Powell also mentioned that "inflation is on almost everybody's mind right now, which highlights the risk that the longer the current episode of high inflation continues, the more likely it is that expectations of higher inflation will take hold. In a way, this is a wake-up call that shows that the Fed is very determined to carry out its mission to bring inflation back towards the central bank's objective (2%);

- The Fed must continue its efforts until the job is done, underlining - once again - the determination of the US central bank to control rapid price growth.

Jay Powell added that continued tight monetary policy is likely to be necessary for some time and that history "warns against premature easing" of monetary policy.

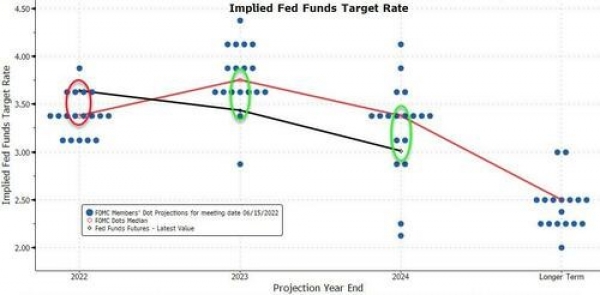

In conclusion, Mr Powell tried to convince investors that the rate cuts in 2023 that are currently expected by the market are too optimistic. As the chart below shows, the dichotomy between the Fed's projections and those of the market was striking before Jackson Hole. For its part, the Fed intends to raise rates for a relatively long period of time with no intention of lowering them anytime soon. However, the markets were expecting very short-term rate hikes that will give way to rate cuts as early as 2023.

US interest rates expected by the market and projected by the Fed BEFORE Jackson Hole

Source: Bloomberg

It would seem that Mr Powell does not see it that way and took advantage of the Symposium to clarify his message...

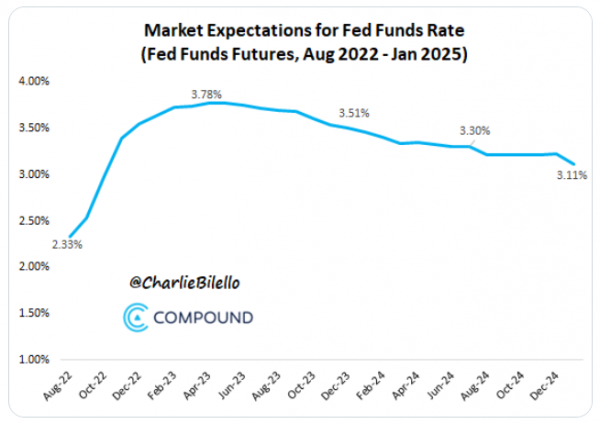

The market adjustment was almost instantaneous. On Friday, just after Mr Powell's speech, the yield curve indicated that investors now expect the Fed to raise interest rates to 3.8% by February 2023, compared to expectations of 3.3% at the beginning of the month. In terms of sequencing, markets now assign a high probability to the following scenario:

- 75bp increase in September 2022;

- 25 basis point increase in November 2022;

- 25 basis point increase in December 2022;

- 25 basis point increase in February 2023.

The first rate cut would not occur until late 2023 or early 2024.

Source: Charlie Bilello

Powell warns of some pain ahead

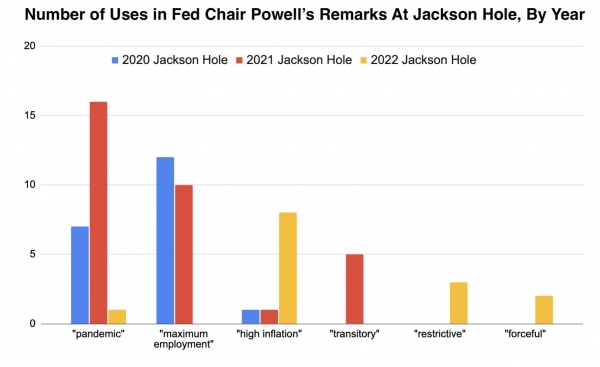

The focus on inflation - compared to the Fed's other priority, the labour market - can be seen in the table below which counts the words used in the Chairman's speech. In the recent past, employment was the focus before the pandemic and "transitory inflation" (!) took over. This year it was indeed the phrase "high inflation" that was most used in his speech, while employment was not mentioned once.

Number of times Mr Powell quoted the following words in his Jackson Hole speech in 2020, 2021 and 2022

Source: Bloomberg

The priority given to the fight against inflation at the expense of growth was hammered home during Powell's speech. Indeed, the Fed Chairman also issued a clear warning to the American public: prepare for hard times. For Mr Powell, reducing inflationary pressures will likely require a prolonged period of below-trend growth with a deteriorating labour market. Even though much of the inflation is supply-side, it is the Fed's job to bring down demand to restore price balance, he said.

But if higher interest rates, slower growth and higher unemployment bring inflation down, households and businesses should be prepared to pay the price, Powell warned.

To avoid an overly negative reaction from the markets, Mr Powell nevertheless addressed a message to the doves: "Later, when the stance of monetary policy tightens further, it will probably become appropriate to slow the pace of rate hikes". A "consolation prize" that proved insufficient...

Mr Powell's speech did not please the financial markets

Tight monetary policy at the expense of growth - a formula that investors are not happy with. Since the publication of July's inflation figures, markets had begun to anticipate the Fed's famous "pivot", i.e. a forthcoming inflexion in monetary policy, which had led to a rally in risky assets. Jackson Hole dashed these hopes and the impact on the markets was immediate - the bears are back!

US stocks fell sharply after Powell's speech. The S&P 500 index fell 3.4%, while the Nasdaq Composite, dominated by technology stocks that are more sensitive to interest rate expectations, lost 3.9%. This was the biggest daily decline for both indices since mid-June.

US stocks fell sharply after Powell's speech

Source: FT

Friday's drop in US stocks was particularly broad-based, with about 99% of S&P 500 companies down on the day. Investors believe that higher interest rates and a continued economic slowdown will weigh on corporate earnings later this year.

Surprisingly, the bond market showed little reaction to Mr Powell's speech. Long-dated bond yields and two-year yields remained stable.

Why did stocks and bonds react so differently? One possible interpretation is that the bond market seems to expect that the Fed's restrictive policy will weigh on growth and inflation leading to aggressive interest rate cuts later on.

The equity market is not convinced by these assumptions and does not seem to give much credibility to Mr Powell who has tightened too much in 2018, stimulated too much in 2021, and is now trying to emulate Paul Volcker at a time when core PCE inflation (released last week) is at its lowest level (4.6%) since October.

Conclusion

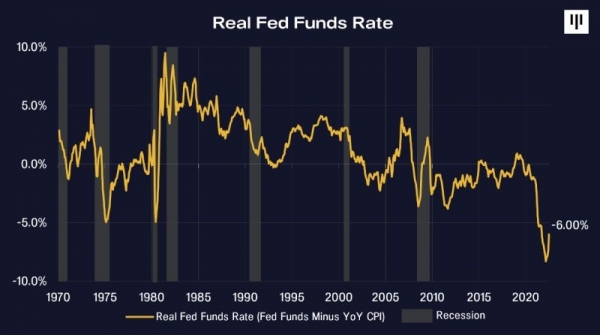

We continue to believe that US monetary policy will remain tight for some time to come. Admittedly, the pace of rate hikes may slow down, but this does not mean that the Fed is about to "pivot" because 1) real rates remain very negative (see chart below); 2) economic data for July do not point to an eminent economic recession; 3) financial conditions (equity markets, credit spreads, etc.) have eased throughout the summer. In other words, the Fed has a free hand to make the necessary rate hikes.

Real Fed Funds Rate in the US

Source: Pantera

We should also bear in mind that the pace of QT will be doubled from September onwards (up to $95bn per month of Fed balance sheet reduction).

The current monetary policy conditions are therefore not favourable to risky assets, even though earnings growth expectations are being revised downwards and the price/earnings multiple of the S&P 500 cannot be seen as cheap (18x earnings expectations for the next 12 months). We reiterate our cautious message on equities.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)