TREND 1 —

From deflation to inflation

The assumption of transitory inflation still seemed plausible in 2021: a stabilization of energy prices and favorable comparison effects could have allowed inflation to normalize. But Russia's invasion of Ukraine and the resulting sanctions are complicating matters considerably. While rising rents and wages are already contributing to an inflationary spiral in the US, the surge of crude oil prices and new supply chain bottlenecks are likely to keep inflation at an uncomfortably high level for much longer.

For the global economy and the financial markets, the shift to an inflationary world implies profound changes, whether in monetary policy, the behavior of the various economic agents or the asset classes and sectors to be favored.

TREND 2 —

From "Quantitative Easing" to "Quantitative Tightening"

As a direct consequence of the previous theme, monetary policy is at a tipping point. Indeed, the Fed has reached the end of its quantitative easing (QE) experiment. There is even talk of QT ("Quantitative Tightening"), i.e. a sale of bonds held by the Fed and/or the non-reinvestment of maturing bonds. For many investors, the transition from QE to QT is a very dangerous move. Indeed, there is a very strong correlation between QE and the increase in many financial assets (stocks, credit but also real estate markets). Will the reduction of the Fed's balance sheet lead to the simultaneous bursting of multiple financial bubbles?

This is a risk to consider. But the markets cannot remain under monetary support forever. With a booming job market and an inflation rate well above the Fed's target, it seems logical that the U.S. central bank wants to end this "experiment". QE has created many imbalances (assets overvaluation, over- indebtedness and over-leverage, social inequalities, etc.). With the end of QE, most countries will have to implement the necessary structural reforms. But they will also have to make greater use of fiscal policy, possibly through higher corporate taxes and on their wealthiest citizens.

TREND 3 —

From "Wall Street" to "Main Street"

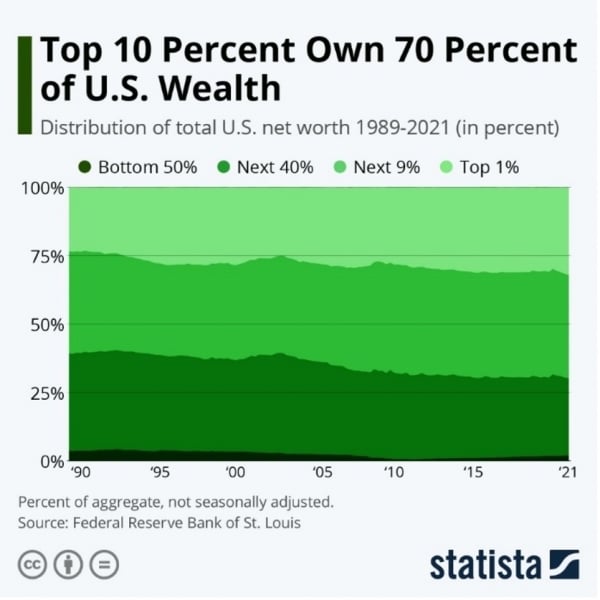

Among the imbalances created by years of QE is the growing wealth and income gap between the wealthiest households and the middle and working class. In the US, the share of total wealth held by the richest 1% has risen from 24% in 1989 to 32% in 2021. The richest 10% are now in possession of almost 70% of the country's total wealth. This is a consequence of the stock market bubble and the rise in property prices. The widening of inequalities is a phenomenon observed in many countries and which has already led to social unrest (yellow vests in France, Arab Spring, etc.) and populist votes (Brexit, rise of far-right parties, etc.). Will the end of QE curb this trend?

Top 10 Percent Own 70 Percent of US Wealth

Distrobution of Total US net worth 1989-2021 (in %)

Source: Statista

Another phenomenon that has been observed over the last few decades - and which also contributes to an increase in inequality - is the fact that labour productivity and wages have not followed the same trajectory. This dichotomy has had a (downward) impact on the rate of inflation and a positive impact on corporate margins, as the share of profits accruing to capital has risen to historically high levels at the expense of the share accruing to labour. One of the reasons for this divergence has been the use of "offshoring". As we shall see in section 8, a change in trend seems to be emerging, with positive consequences for domestic wages and negative consequences for corporate margins.

TREND 4 —

From bond markets to risky assets

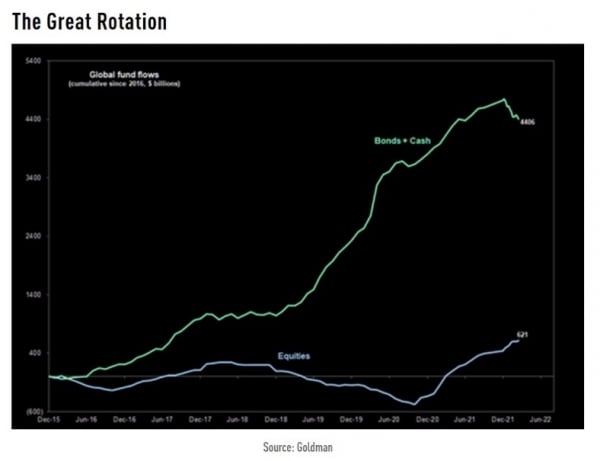

With the return of inflation, are we finally going to see a big rotation between asset classes? It would seem so. A study of the inflows and outflows of investment funds shows that the ultra-expansive monetary policies have essentially benefited the bond markets. By eliminating the remuneration of cash, central banks have generated gigantic buying flows into corporate bonds, emerging market debt, junk bonds, etc. But with the sudden rise in inflation, these bond investments are generating negative real returns, leading to a rapid shift from bond funds to equity funds. For the first time in more than a decade, flows into bond funds are now negative (more redemptions than inflows) while equity fund subscriptions continue to grow. Investors seem to be betting that equity markets will provide a much better hedge against inflation than bonds.

It is also possible to envisage flows into other asset classes, notably commodities and real assets (see point 6), instruments that are currently poorly represented in most portfolios, at best.

The Great Rotation

Source: Goldman

TREND 5 —

The new FAANGs

The years of sluggish growth, low inflation and monetary easing have benefited growth stocks, especially the digital giants - the so-called FAANGs. Their very high growth rate, superior business models and aggressive share buyback policies are among the factors that have driven years of stock market outperformance. It is interesting to note that the prospects of the end of QE already seem to be weighing on the relative performance of the FAANGs, as other market segments are now attracting investors' favor. We are now talking about the new FAANGs: Fuels (oil stocks), Aerospace and Defense (upcoming increase in military spending, particularly in Europe), Agriculture (shortage of agricultural commodities), Nuclear and New Energies (to reduce dependence on fossil fuels) and the G of "gold" (precious metals but also metals needed for the energy transition).

While capital expenditures have been directed for decades towards the fields of technology, biotech or clean energy, raw materials and certain parts of the "old economy" are nowunderinvested. And a return to more balanced situation will certainly take many years because this shortage does not only concern current resources. For example, the world is currently facing a shortage of geologists, who would be very useful to work on new oil and gas drilling and the identification of new mines. These are all elements that could prolong the current outperformance of these sectors.

TREND 6 —

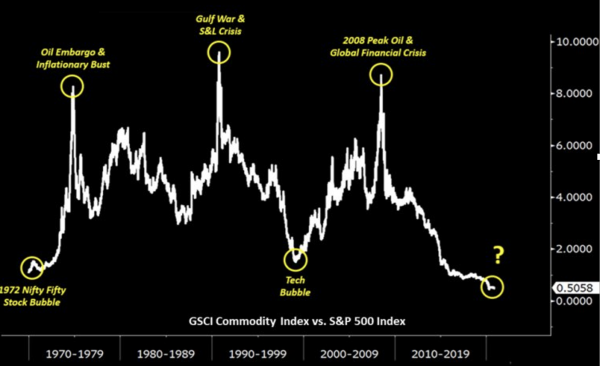

From "paper" to "real" assets

An analysis of the asset allocation of most portfolios (both private and institutional) seems to show an over- representation of "paper" assets (stocks, bonds) to the detriment of real assets (real estate, infrastructure, natural resources, etc.). But rising inflation should encourage investors to increase their exposure to real assets and alternative products. Commodities are often seen as the best hedge against inflation. Assets such as real estate and infrastructure have returns that are often indexed to inflation. Some of these assets also benefit from a scarcity effect that supports valuation levels.

Commodities to equities ratio

Source: Incrementum AG, Crescat Capital, Bloomberg

TREND 7 —

National security becomes a priority again

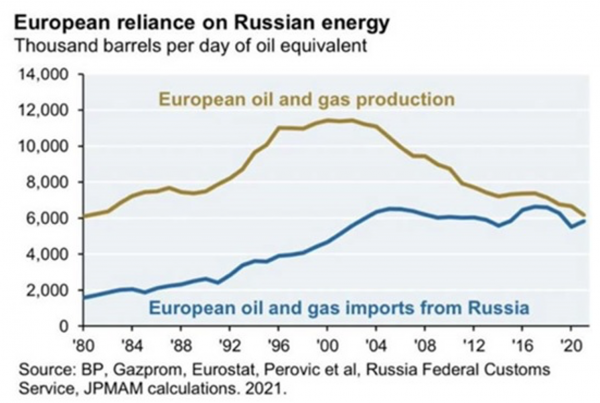

Wars have often been major turning points in history. Energy policy should be no exception. Over the past decade, Europe has pursued a noble goal: carbon neutrality by 2050 with the development of renewable energies, the rejection of shale gas investments and a phasing out of nuclear power. Meanwhile, President Putin has anticipated the growing need for energy imports from Europe. Russia has increased its oil and natural gas production capacity and doubled its nuclear power capacity. The figures speak for themselves: in 2016, 30% of the natural gas consumed by the European Union came from Russia. In 2021, this figure will be around 47%. This dependence on Russian gas has certainly given wings to Putin's belligerent ambitions. And it will force Europeans to rethink their energy policy. Of course, renewable energies are a long-term solution. But in the medium term, ecological priorities could be put on hold somewhat in order to secure and diversify energy sources. American and Qatari gas imports are one option. Nuclear power is another.

European reliance on Russian energy

Thousand barrels per day of oil equivalent

Source: BP, Gazprom, Eurostat, Perovic et al, Russia Federal Customs Services, JPMAM calculation. 2021.

TREND 8 —

From globalisation to relocalisation

The accelerating phase of globalisation that began in the 1990s has led to de-industrialisation and the export of supply chains of physical goods from developed countries to the rest of the world. But globalisation has its limits.

An interconnected world becomes more efficient and productive but also less resilient. For example, the blockage of a major port in China due to the discovery of a positive case of COVID-19 can have an impact on dozens of other countries. Similarly, the production of high-tech devices consisting of thousands of parts may be delayed because a few parts are not available from a foreign supplier.

In the wake of the pandemic, governments in developed countries have become aware of their vulnerability to the risks associated with globalisation and the delocalisation of supply chains. As a result, the next decade may be characterised by a reshoring of manufacturing. This trend should improve the resilience of processes, but could also have consequences for labour costs and thus inflation.

Emerging economies could suffer from a possible de- globalisation.

TREND 9 —

US Treasury bonds lose some of their reserve currency status

The fact that the West has chosen to freeze the dollar (and euro) reserves of the Russian central bank may prompt some central bank governors to rethink the logic of reserve

accumulation and also the wisdom of investing part of the balance sheet in US Treasury bonds. If Washington can decide overnight to freeze the dollars that a sovereign

country thought were its own, won't central bank governors in China, Pakistan, India, Turkey, Kazakhstan or Saudi Arabia be prompted to sell all or part of their dollars andre-anchortheir local currencies in assets that are less likely to be influenced (or confiscated) by Western governments? Possible candidates include the yuan, gold and even

bitcoin, three 'currencies' that are now accepted by Russia as a means of payment and thus potentially accumulated on its balance sheet.

TREND 10 —

From maximising wealth to maximising health and well-being

As a result of the pandemic and the ageing of the baby boomers, the lure of maximum wealth have become less important. Indeed, the current labour shortage in the US is partly due to this shift in priorities. Many households have developed a taste for life at home and have enough savings to leave the workforce. This megatrend is leading to new consumer behaviour with an increase in demand for services and goods related to quality of life, sports, leisure, wellness and of course health. This shift in emphasis is also having an impact on property markets around the world. For example, the trend towards teleworking and self-employment has reduced the demand for real estate in some megacities.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Gemini 3 has just been ranked as the best performing AI model, a reversal that few saw coming. A year ago, OpenAI models were leading the charts.

The 2025 season is coming to an end. This year has been anything but quiet: Trump's historic return to the presidency, the April "Liberation Day" tariff shock, major AI breakthroughs, bitcoin's volatile journey, and a stunning market rebound. Here are ten stories to remember.

Could Google’s custom AI chips (or TPUs) dent Nvidia’s dominance in the AI chip market? While Nvidia’s dominance faces scrutiny, the AI market is vast. Whether rivals can scale fast enough to dent Nvidia’s leadership remains an open question. Alphabet clearly benefits, but disruption is far from certain.

.png)