The combination of equity and bond pockets in a discretionary portfolio is part of the offer of many banks and asset management companies. With some success, since this type of portfolio construction has worked relatively well over the past decades. Indeed, both asset classes are riding the wave of a very long bull market. Moreover, the correlation between stocks and bonds has proven to be negative most of the time. When stocks have performed poorly, bonds have performed well and vice versa.

Their offsetting performance has allowed investors to build less volatile portfolios, better manage market downturns and improve risk-adjusted returns.

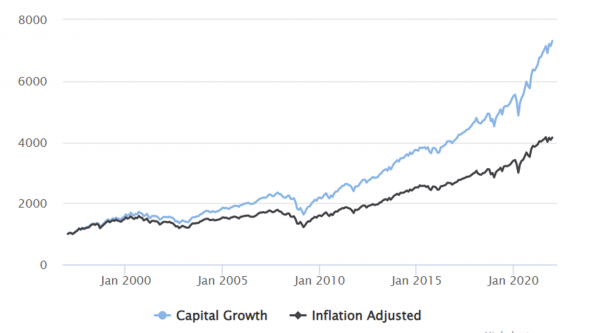

$1,000 in capital invested in 1996 in a 60% US equity / 40% US bond portfolio in nominal and real terms.

Source: Highcharts.com

- Performance over the last 10 years: 11.01% annualised return with a standard deviation of 8.22%.

- Performance over the last 25 years: 8.28% annualised return with a standard deviation of 9.38%.

However, this "traditional" approach must now face a major challenge: that of financial repression, a phenomenon of central bank intervention which consists, among other things, of conducting a policy of very low or even negative interest rates. This paradigm poses two major problems for "traditional" asset management:

- On the one hand, the yields offered by the bond component are very low, which de facto reduces the expected performance of portfolios.

- On the other hand, the diversification properties of the bond portfolio are much less effective than in the past. During downturns in risky assets, which generally push investors towards safe havens such as fixed income products, the upside potential of bond prices is limited by low yields. In other words, the performance of the bond portfolio only compensates for a small part of the losses recorded on the equity side. However, an even more revealing element of the reduced usefulness of bonds in a diversified portfolio is the increase in correlation between equities and bonds, a phenomenon observed in particular at the beginning of the year, when the two asset classes underwent a simultaneous correction.

In this context, our clients are incentivised to consider new options. These include:

- Accepting a higher risk profile (and therefore higher volatility of returns) in order to be able to achieve the performance levels they enjoyed in the past;

- Replace part of their bond allocation with less liquid (or downright illiquid) investments such as hedge funds, real estate funds, private debt or venture capital;

- Favoring a 100% liquid allocation that excludes bonds and dynamically manages the allocation between equities and cash - with the objective of achieving a similar level of risk to that of a balanced equity/bond mandate, but with the potential for higher performance.

At Bank Syz, we have an open discussion with our clients about these three possibilities. Below, we would explore the third one, and how we respond to its demand.

The Syz Symphony discretionary portfolio mandate

During 2021, we launched a new kind of discretionary mandate called Symphony. As mentioned above, this solution contains only two asset classes: equities and cash. Based on our research, the risk profile of this type of mandate can correspond to that of a traditional balanced portfolio (equities/bonds) if, and only if, the allocation between the equity and bond pockets is managed in a very flexible and dynamic way.

Therefore, this type of management cannot be based on a traditional investment committee. Indeed, the emotional and subjective nature of the participants in this type of committee is too important. Moreover, a consensus-based management process rarely achieves the necessary degree of flexibility and responsiveness. In our view, only a disciplined, systematic and quantitative approach can overcome this emotional aspect and manage changes in equity vs. cash allocations in the portfolio in a completely objective manner.

The Syz Symphony systematic investment process is based on a pragmatic quantitative approach. By this, we mean an approach that is neither algorithmic nor optimised based on the recent or distant past. Indeed, the poor performance of purely algorithmic models in 1997 (LTCM) and in 2020 (the year when the main quantitative hedge funds delivered poor performance) demonstrates that over-optimisation is far from guaranteeing good performance.

This solution is aimed at investors seeking attractive returns while having a low tolerance for downturns. It is a service offering that complements a traditional portfolio management approach.

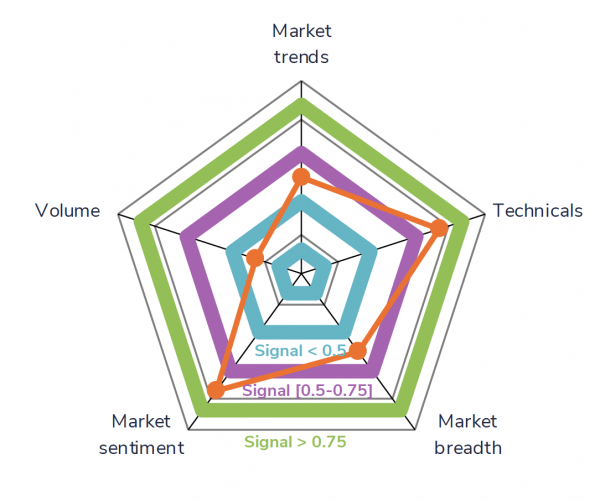

The systematic investment process aims to build a flexible and dynamic portfolio in cash and equities (only in US equity ETFs and/or European equity ETFs). The asset allocation decisions are based on 11 market indicators divided into 5 categories: market trend, volume, sentiment, technical indicators and market breadth.

Changes in equity/cash allocation in the portfolio are based solely on the signals provided by these indicators. As shown in the chart below, the aggregation of the scores generated by the indicators gives an overall score that determines the equity allocation: a high score can fix the equity allocation up to 100%. A low score can lower the equity allocation to 0%. Allocations are adjusted on a weekly basis.

The 5 types of indicators of the Syz Symphony allocation process

Source: Bank Syz

Note that these indicators have different signal frequencies over time, as our process combines high, medium and low frequency indicators. As our research shows, this combination systematically offers a better risk-return ratio than using one or two indicators in isolation. By using indicators with different frequencies, the probability of being caught off guard is considerably reduced. Indeed, by favouring only high-frequency indicators we could quickly reduce exposure to stocks, but also exit too early in bull markets. By using only low frequency indicators, it may take too long to reduce equity exposure in the early stages of a bear market or miss the initial rebound phase of the equity market. It is the combination of multi-frequency indicators that allows us to be both agile and pragmatic in our equity allocation.

An important note: the Syz Symphony Mandate's investment process and decisions are communicated to our clients in a transparent manner. It is not a 'black box' model. This transparency makes it easier for our clients to buy into the concept and to be reassured in difficult market phases.

This portfolio management solution is particularly well regarded by clients who are currently investing with more conservative profiles, or even with a 100% bonds allocation, and who do not have the risk appetite to switch to "balanced" type profiles. The Syz Symphony mandate allows them to gain exposure to satellite equities with good downside risk control.

Conclusion

As we enter a challenging decade for multi-asset investing, we propose to revisit established paradigms and complement traditional management with a dynamic and systematic approach. This new methodology aims at capital appreciation while providing a safety net through disciplined, measured and objective decision making.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)