What is scarcity

It is important to understand the concept of scarcity to better understand its mechanics and its impact on markets. Scarcity refers to the mismatch between a finite supply (resource) and a theoretically unlimited demand. Supply is therefore a key factor in determining the degree of scarcity of a good or asset, but demand also plays an important role. The relationship between supply and demand is well known in microeconomics as it is used as a model for determining prices in markets. In the case of so-called scarce goods or assets, a limited supply and a high demand mechanically translate into higher prices.

The business models of some companies are based on the principle of scarcity. Let’s take the example of luxury brands. Their limited supply combined with the high desire of consumers to experience or own a brand allows manufacturers to practice a high pricing policy. And even more than that, since certain Swiss watches (Rolex, Patek, etc.) or Hermès bags have become real speculative assets that seldom depreciate (if intact).

Over the past 12 months, the sharp rise in inflation has only increased the appeal of these so-called “ scarce “ goods and assets. Many experts do not hesitate to make a link between this craze and the massive flow of liquidity injected by central banks following the coronavirus crisis.

Post-2020 recovery benefits scarce assets

We distinguish two types of scarcity effects at this stage of the economic recovery.

The first type affects assets, goods and services that are suffering from a temporary supply deficit. Indeed, the 2021 inflation spike can be explained not only by a much stronger-than-expected recovery in demand, but also by bottlenecks in transportation, supply chains, labor, and supply shortages of some commodities, in the energy sector in particular. We expect this scarcity effect to be resolved by 2022. Take the case of second-hand cars in the US. The shortage of semiconductors has led to latencies in the supply of new cars but also to higher prices, which has caused consumers to rush to used cars. The Manheim index of used cars in the U.S. has risen 50% in 2021, due in part to a speculative frenzy in second-hand cars, with some now viewing used cars as financial assets and anticipating a continued rise. We do not believe that this type of asset will benefit from a scarcity effect in the long term, as car production possibilities will be almost infinite the day the supply chains are running at full capacity again. We also believe that the labor market, energy and transportation sectors should soon return to equilibrium.

On the other hand, there are some assets and sectors for which the imbalance between supply and demand is bound to remain perennial. We include in this category luxury real estate, especially in locations where construction possibilities are very limited. The sharp rise in the number of millionaires (+7% per year) and very competitive mortgage conditions have caused prices per square meter to skyrocket in high-end ski resorts (Gstaad, Verbier, Courchevel, Aspen, etc.) as well as in cities and towns favored by the wealthy (Geneva, Zurich, Monaco, London, Hong Kong, etc.). Prices in cities where the supply of property remains abundant (e.g. Dubai) have not experienced the same trajectory.

Other assets for which scarcity should continue to be synonymous with high prices are vintage cars, the art market, collectibles and luxury watches. Last month, a Patek Philippe Nautilus model with a Tiffany blue background sold at auction for $6.5 million, while this model, limited to 170 pieces, sold for $52,000 in stores a few days before...

For such assets, the cocktail of “limited supply, abundant liquidity and rising inflation” should remain explosive.

Precious metals such as gold and silver also possess the characteristics of a store of value that is favored at the time of inflation and liquidity abundance scenarios. Although they have not performed up to expectations in 2021, this type of assets could soon be back on the “radar” of asset allocators.

It is interesting to note that the saying “what is rare is expensive” also very much applies to the equity market. This is the case, for example, of certain luxury stocks (LVMH, Hermes, Richemont, etc.). Let’s also remember that the exceptional dominance of the famous FANGs has caused their valuation multiples and market capitalizations to explode.

Below, we would like to focus on three themes whose scarcity aspect could positively contribute to their market performance: 1. Industrial metals needed for the energy transition; 2. Uranium and 3. Crypto-currencies

Metals required for the energy transition

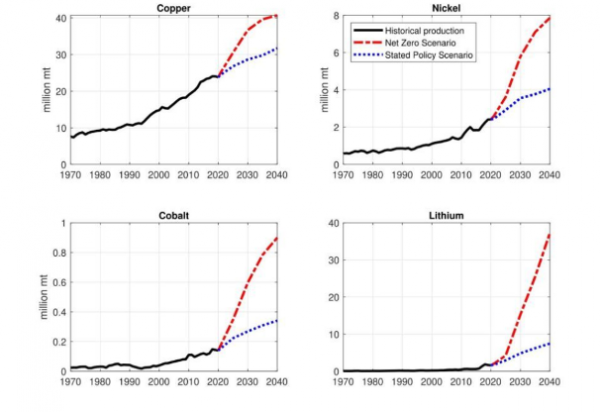

Many countries around the world are making carbon neutrality by 2050 a priority goal. Solar photovoltaic panels, wind turbines and electric vehicles are key to achieving climate goals. However, most of these clean technologies rely on very specific metals and some of them are already in short supply. To achieve carbon neutrality, the demand for some metals is expected to continue to grow by a much larger magnitude than supply. Lithium and cobalt, in particular, are creating bottlenecks in production chains. Lithium is an important component of lithium-ion batteries. They are found in a wide range of products, from smartphones to electric cars, which are currently their most important customers. Copper could also find itself in a supply-demand an imbalance.

Metals consumption in the IEA’s net-zero emissions scenario (in red) and the stated policy scenario (in blue)

Another example is the rare earths, a group of 17 chemically related elements. Each has its own set of qualities, making them essential components for many functions, from energy-efficient lighting and catalytic converters to magnets in wind turbines, electric vehicles and computer hard drives. Rare earths, cobalt and many other elements have been designated as key materials by the U.S. Department of Energy and the European Union because of their importance to clean energy, the risk of supply shortages and the lack of replacements.

Uranium

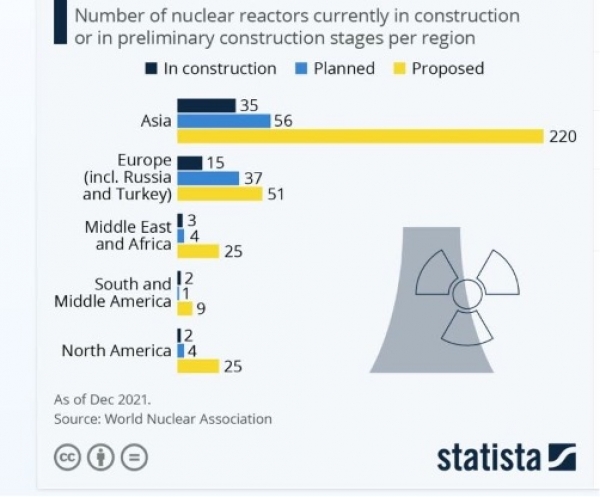

In the energy transition, nuclear power could also play an important role. This energy source emits nearly 70 times less carbon dioxide than coal. In addition, the costs of nuclear power plants tend to be relatively low. These are very attractive characteristics in the context of the energy crisis we are experiencing. While the world has a great need for clean energy, governments are also realizing that renewable energy cannot replace fossil fuels in such a short period of time. It is therefore not surprising to see many countries considering nuclear power in the coming decades. This is the case in Asia. For example, China is planning to build 168 new reactors in addition to the 18 currently under construction and 37 planned, which would represent a 337% increase.

These projects are driving up demand for uranium even though uranium mine supply covers only 74% of the needs of currently operating reactors. This gap is expected to continue to widen as demand continues to grow. As a result, the price of uranium is rising sharply, as are mining stocks. Given the imbalance between supply and demand, this theme could remain attractive in the coming years.

Asia is going nuclear

Source: Statista

Bitcoin and Ether

The year 2021 may mark a turning point in the history of blockchain technology and the adoption of cryptocurrencies by users and investors. Among them is Bitcoin, often referred to as “digital gold.” Indeed, its time-limited supply is one of its main similarities to precious metals. The “white paper” published before its launch in 2009 stated that Bitcoin production would be capped at 21 million by 2140. Today, 90% of the tokens have already been mined. It is estimated that there are less than 0.4 Bitcoin per millionaire on the planet. This ratio is expected to decline, as the number of millionaires grows faster than the number of Bitcoins in circulation. The process of introducing new Bitcoins into the economy is therefore the opposite of fiat currencies, for which an unlimited amount of bills are currently printed. Bitcoin is thus the first “scarce” asset that can be transferred digitally. In addition, this digital scarcity has contributed to the sharp rise in its price.

While many experts view bitcoin as a digital storage asset, Ether (ETH) - the native currency of the Ethereum blockchain - is often seen as the equivalent of Web 3.0 and is more akin to a technology asset. However, a recent update to Ethereum (“London”) will also introduce a notion of scarcity to the Ether cryptocurrency. This is the “coin burning”, a practice that consists of voluntarily destroying cryptocurrency units in order to increase their value. With each transaction on the blockchain, some ETHs are now being burned. Eventually, the burning rate could become greater than the inflation of ETH (i.e. the increase in new supply). The “net” supply could therefore fall (see chart below https://ultrasound.money). LuckyHash estimates that the rate of deflation on the ETH network should reach 1% per year. This is a very attractive equation for investors: the growing success of the Ethereum protocol will not only increase demand but also reduce supply - the perfect “scissor effect”. More investors are therefore inclined to hold ETH because of this scarcity effect.

Conclusion

In a world of abundant liquidity and inflationary pressures, assets that are in short supply should continue to appreciate in price. Even if all these assets are not necessarily liquid or even accessible, it is still possible to create a basket of assets that are characterized by a scarcity effect. This is the case for certain growth stocks (technology, luxury), certain metals (precious and industrial), uranium mines or even ETPs on bitcoin and Ether.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)