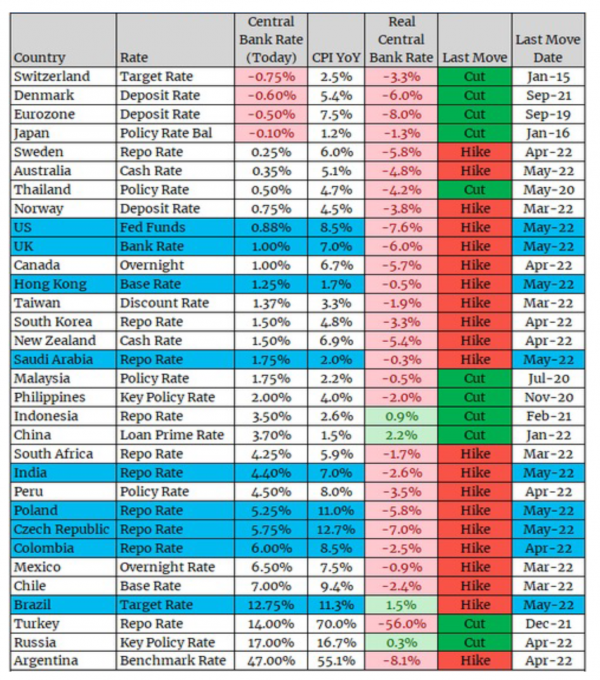

The U.S. Federal Reserve was of course the center of attention last week. As expected, the Fed raised its key interest rates by 50 basis points.

But the U.S. monetary authorities were not the only ones to act. Indeed, countries whose currencies are pegged to the U.S. dollar are under a virtual obligation to replicate any rate move by the Fed. Not surprisingly, the central banks of Hong Kong, Saudi Arabia, the United Arab Emirates followed, among others, the Fed's lead by raising their own rates.

The Fed's monetary tightening policy is pushing up the greenback, thereby increasing the cost of dollar-denominated loans and the price of imported commodities traded in dollar. Some developing countries are therefore trying to halt the depreciation of their currency against the dollar and are resorting to monetary tightening to do so.

India raised its rates by 40 basis points last week, Poland and the Czech Republic by 75, Brazil and Colombia by 100.

As for the British central bank, which now fears double-digit inflation, it raised rates by 25 basis points.

.png)