The vast majority of investors are looking for what are known as "secular bull markets", i.e. assets backed by factors that remain buoyant for years.

But most of these investments are over-represented in portfolios, with the result that valuation ratios are far too generous. As with all overvalued crowded trades, the risk of a sharp fall in the event of bad news is relatively high.

In the recent past, the GAFAs (Google, Apple, Amazon, etc.) and European luxury goods stocks (LVMH) have suffered relatively intense selling without their long-term fundamentals being called into question.

Is it now possible to identify markets that appear to be on a long-term uptrend, but with attractive valuations that are still under-represented in portfolios? Here are 5 examples of assets that seem to combine these characteristics.

THEME 1

Japan equities

In a previous FOCUS note (Wasabi - May 2023), we underpinned our favourable investment thesis for stocks in Japan a still-accommodating monetary policy, a weak yen, better corporate governance, an improving economic outlook, a favourable geopolitical positioning (Japan is on good terms with the United States and China), inflows from domestic and foreign investors and attractive valuation multiples. All these ingredients have the potential to lead to a significant market revaluation.

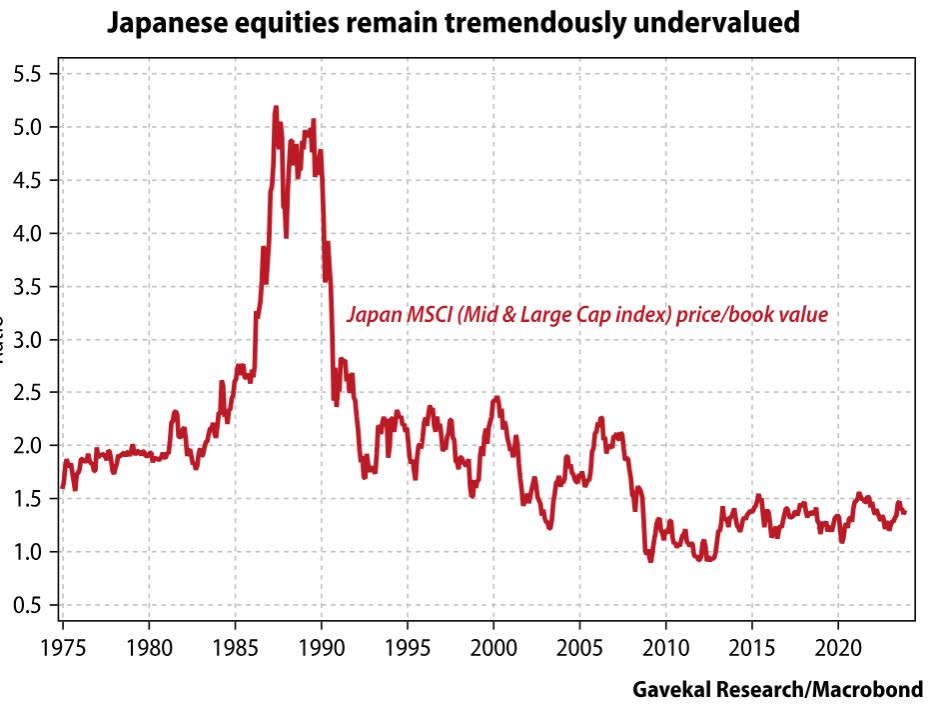

In 2023, the Nikkei 225 finally regained the 30,000-point level last reached in 1989. Despite this bull market, the majority of investors seem to be neglecting Japanese equities, which is rather a positive factor from a contrarian point of view. On the other hand, the market remains undervalued, as shown in the Gavekal chart below (Price-to-book value of the Nikkei 225).

Of course, many risks remain. In the short term, these include a sharp rise in the yen or the negative consequences of a sharp global slowdown (the Japanese economy is one of the most sensitive to the macroeconomic cycle). In the longer term, Japan is suffering from a very unfavourable demo-graphic situation, its dependence on energy imports and its staggering government debt (over 250% of GDP).

However, the indicators for this market remain positive. Japan is one of the few countries that combines favourable funda-mentals and an attractive valuation, yet is under-represented in international portfolios.

THEME 2

Latam assets

The Latin American countries with the best macroeconomic fundamentals - Mexico, Brazil, Chile, Colombia, Peru and Uruguay - are currently benefiting from three favourable winds: falling interest rates, currency appreciation and rising asset prices (equities, property or corporate debt).

The region is geopolitically neutral, allowing it to trade with the Eastern bloc as well as with the United States and Europe.

The demographic profile is very favourable. The political situation is improving, with the population moving away from the Marxist or pro-revolution votes of yesteryear.

In terms of growth, the region is benefiting from some of the key trends of the current decade, such as rising demand for raw materials, "friendshoring" (Mexico has replaced China as the USA's leading trading partner) and the USA's reliance on foreign labour against a backdrop of rising wages and labour shortages. As a result, remittances from the United States to Latin America are rising sharply, boosting local consumption and the continent's currencies.

Finally, the creation of pension funds in several Latin American countries is boosting demand for local assets.

Latin American bonds and equities remain attractive in terms of valuation, and largely underheld by foreign investors. With the disinflationary trend, there is considerable potential for interest rates to fall. The bull market in the region's assets could therefore continue.

Source: The Hub

THEME 3

Uranium

As mentioned in a November 2021 FOCUS note ("The price of scarcity"), governments around the world are becoming increasingly aware of the importance of reliable, carbon-free electricity generation. Nuclear power emits almost 70 times less carbon dioxide than coal. Meanwhile, the costs of nuclear power plants tend to be relatively low, given the amount of material needed to fuel the plant.

Against this backdrop, it is not surprising that some countries are considering the use of nuclear power for decades to come. In the United States, Joe Biden's $2 billion "Green New Deal" style infrastructure plan has led to the creation of a new ARPA Climate Agency, which has prioritised the development and deployment of advanced nuclear reactors. In addition, in 2020 the Senate approved the US Nuclear Infrastructure Act, designed to boost the US nuclear industry, establish a strategic uranium reserve, support improvements to the US nuclear fuel cycle and encourage exports of US reactors worldwide.

At the same time, the energy crisis in Europe has forced politicians and citizens to recognise the inescapable logic of nuclear power. Features such as 24/7 reliability, production resilience in all weather conditions, price stability and superior energy security have put nuclear new build back on the agenda.

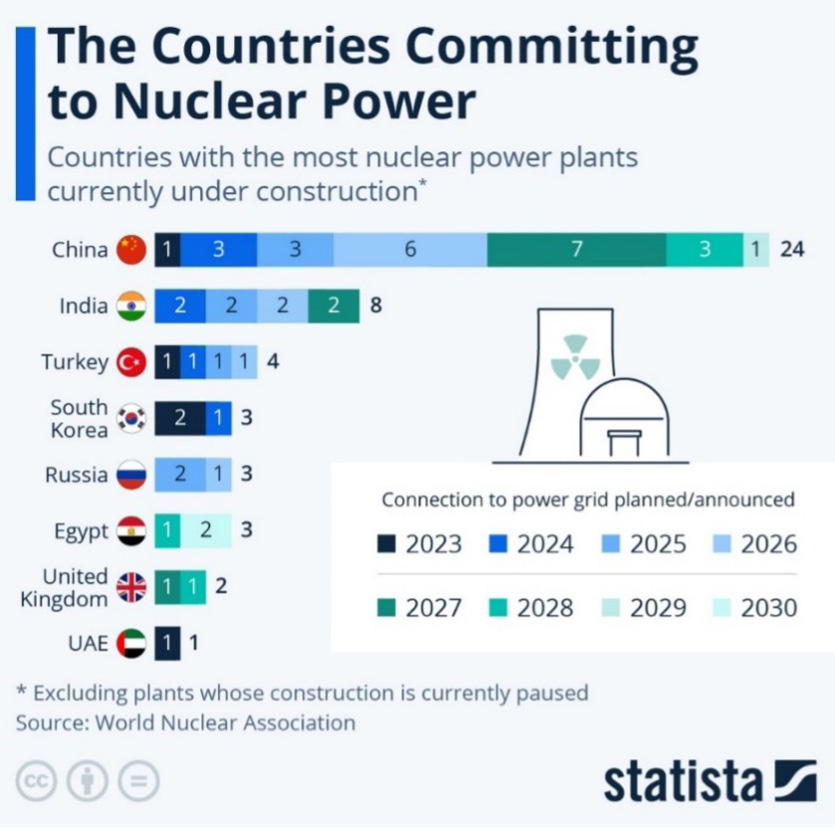

At COP 28 in Dubai last December, participants pledged to triple the use of nuclear power over the next decade.

Asia (China, India) has the largest number of nuclear power plants currently under construction.

In light of this renewed investment in nuclear power, uranium is benefiting from a strong upturn in demand against a back-drop of limited supply. Indeed, in the wake of the Fukushima disaster in 2011, many countries established a moratorium on nuclear energy.

The impact on uranium has been enormous, because unlike other industries, uranium mining serves a single purpose: to fuel nuclear reactors. The vast majority of uranium mines became unprofitable and drastically reduced their production, resulting in the current shortage of supply at a time when demand is rising sharply.

This imbalance between supply and demand can only be resolved by increasing the price of physical uranium.

Unlike most raw materials, demand for uranium is not very price-sensitive, since price represents only a small part of the total cost of operating a nuclear power plant. Nor is it subject to substitution effects.

In addition, apart from Canada and Australia, most of the uranium produced in the world comes from destinations with a high geopolitical risk: Russia, Kazakhstan (where Russia's ability to tip the balance is colossal) and the Sahel, a vast region of Africa where the French Foreign Legion is increas-ingly being replaced by the Russian mercenaries of the Wagner group.

Despite all these positive factors and the sharp rise in uranium prices (see chart below), this theme is not very present in international portfolios. Admittedly, uranium is a niche market and there are few ways for investors to participate in a wider revival of nuclear energy. This is especially true as it seems likely that many of the nuclear power plants planned around the world will ultimately be built by Chinese or Indian companies. Investors can gain exposure to physical uranium through the Sprott Uranium Trust, which trades on the Toronto Stock Exchange. On the other hand, the companies that mine the commodity (Uranium mining companies) have a leverage effect on the price of the underlying. The Global X-Uranium ETF (URA) and the North Shore Global Uranium ETF (URNM) are exposed to this.

THEME 4

Gold

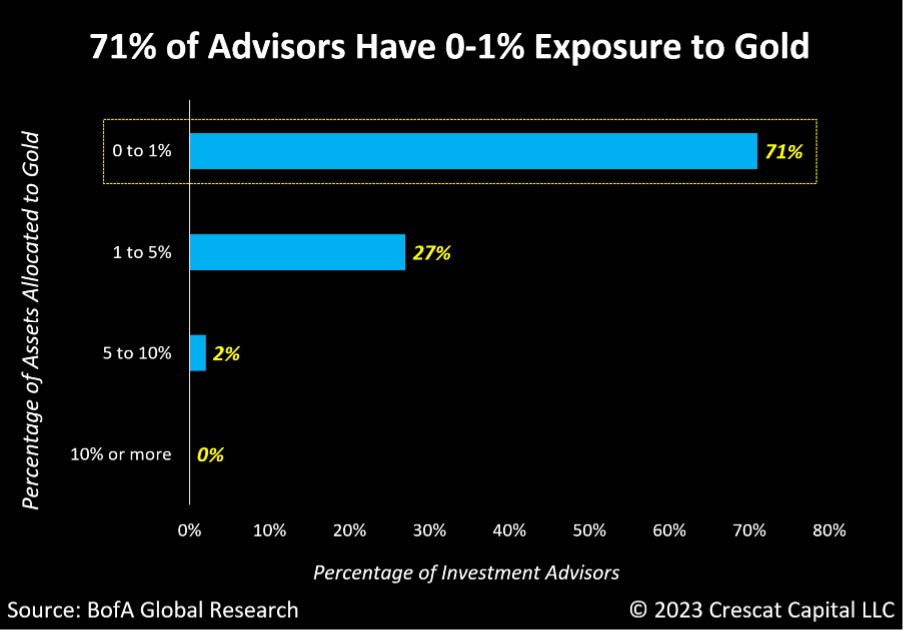

In our last FOCUS of 2023 ("The hidden reasons behind soaring gold prices"), we highlighted the favourable winds currently bolstering gold: the frenetic and significant accumu-lation of gold by China and Russia, the fall in US real interest rates, a possible depreciation of the dollar in 2024, demand in the technological and industrial sectors, and the fact that the precious metal is seen as a protection against fiscal excesses and government debt.

But while the case for investing in gold is well known, the yellow metal is far from being a 'crowded trade' among inter-national investors. As the chart below from BofA / Crescat Capital shows, 71% of financial advisers in the United States recommend an insignificant allocation to gold (between 0 and 1% of an overall portfolio). This very low level of enthusiasm considering geopolitical tensions and positive correlation between equities and bonds should be seen as a positive factor from a contrarian point of view.

THEME 5

Bitcoin

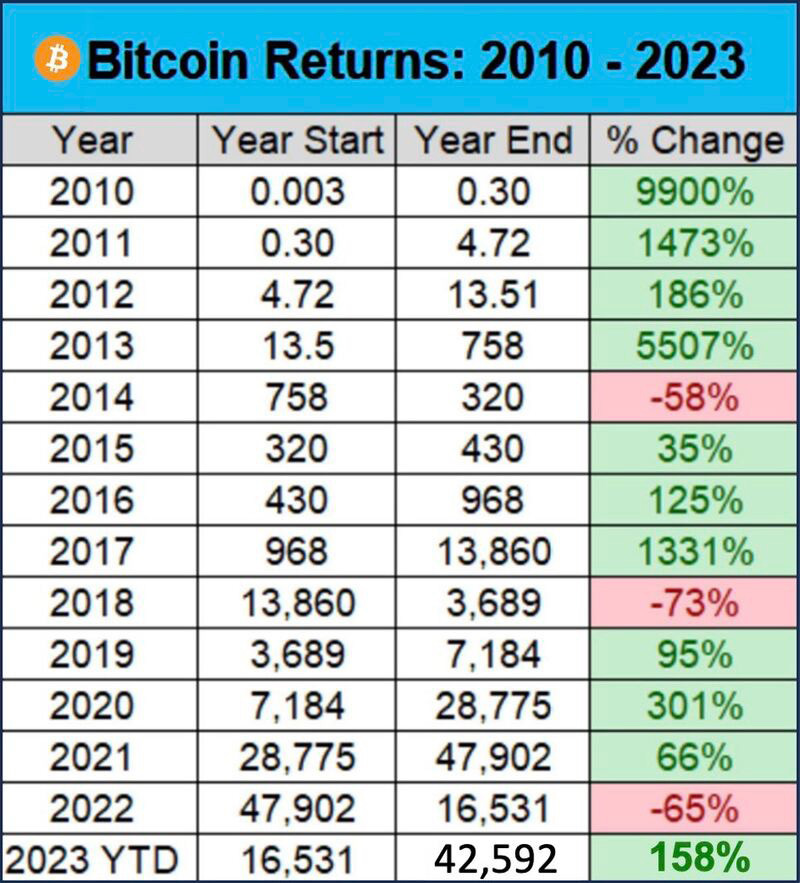

The crypto-currency market rebounded strongly in 2023, with bitcoin recording a rise of nearly 160%.

In 2024, digital gold could benefit from an alignment of the planets.

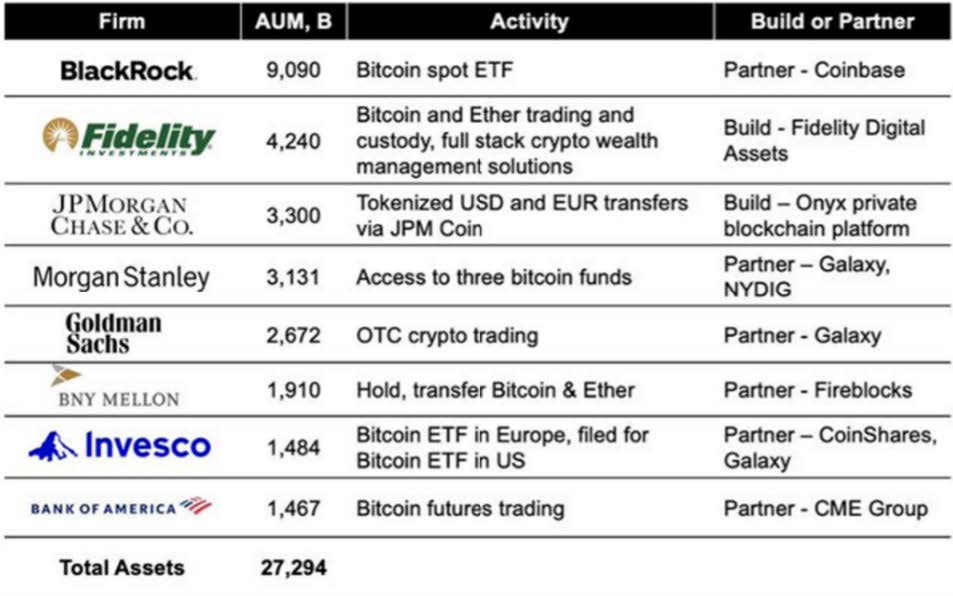

The first driving force will be the SEC's possible approval of one or more bitcoin spot ETFs. With 10 applications filed and a decision expected by mid-January 2024, these ETFs could change the perception of the risk and viability of crypto-currencies. The approval of these ETFs could also result in a substantial influx of funds, which could lead to an increase in demand for bitcoin. In the long term, this decision could promote the accessibility and adoption of bitcoin, which would have a positive influence on the crypto-currency market as a whole.

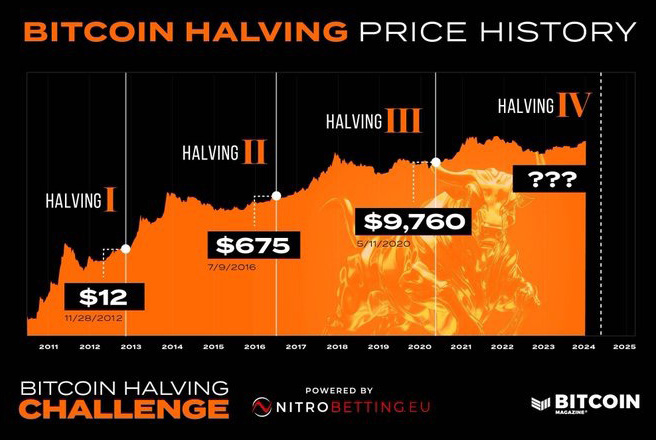

The second favourable tailwind is the famous "Bitcoin Halving", which will take place in April 2024. This process will reduce daily bitcoin issuance by 50%. The reduction in supply, combined with sustained demand, could push up the market price of bitcoin considerably. History shows that previ-ous halvings have generated substantial bull markets.

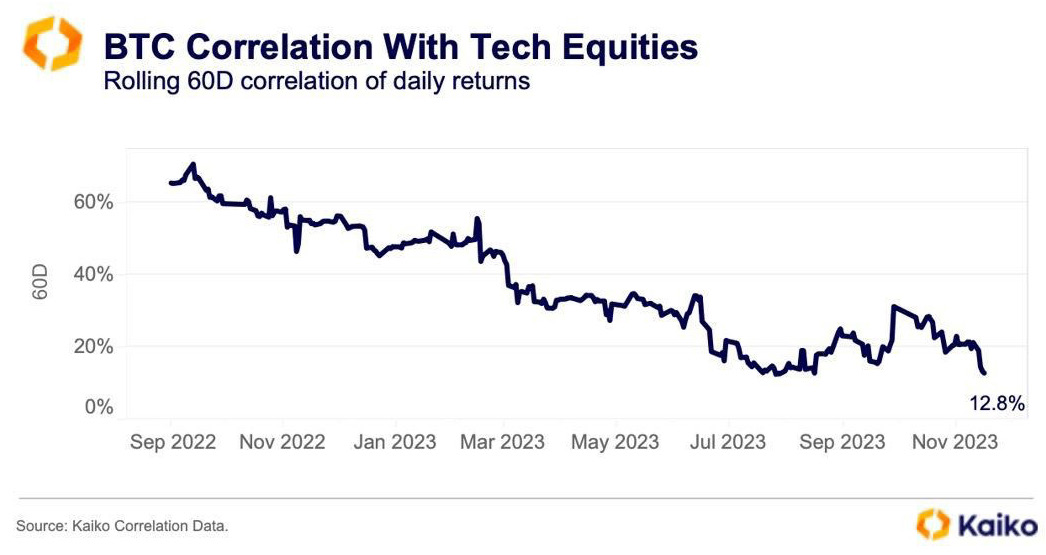

A third factor in bitcoin's favour is investors' search for decorrelated assets. Indeed, bitcoin's declining correlation with US equities is boosting its appeal as a diversification asset. As the chart below shows, the correlation between the price of bitcoin and the price of the Nasdaq is currently at its lowest level for two years.

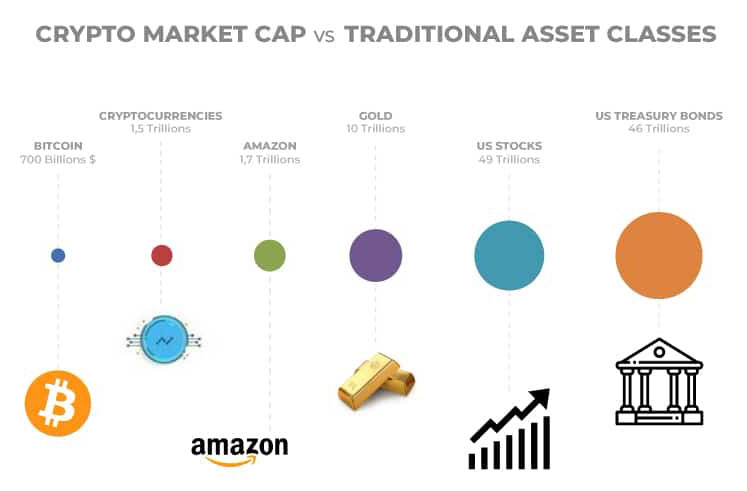

Despite the great curiosity generated by bitcoin and crypto-currencies among investors, it has to be said that digital assets are very poorly represented in portfolios. The growing adoption of crypto-currencies could change this.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)