2023, the year of AI

Since the announcement of ChatGPT 3.5 in November 2022, the financial markets and much of the public have been captivated by the seemingly limitless possibilities of AI. How can we explain such enthusiasm?

Firstly, the free availability of ChatGPT has enabled everyone to realize the tremendous potential of generative AI. Unlike traditional AI models, which operate within predefined parameters, generative AI uses algorithms (such as ChatGPT) to create new content, including audio files, coding, images, text, simulations, and videos.

Another factor explaining the buzz around AI: wage pressure in an inflationary context unseen since the 1980s and geopolitical upheavals forcing companies to relocate their formerly foreign-based entities ("reshoring" or "nearshoring").

Both contribute to creating a sense of urgency to improve productivity in order to preserve margins. In this context, the explosion in the number of AI tools comes at just the right time for many companies, who are setting up task forces or specialized entities before reinventing their business models.

What about investment opportunities?

The AI bubble

Bank of America doesn't hesitate to speak of the birth of a new investment bubble on par with the Internet bubble, the Biotech bubble, Ark Invest stocks, bitcoin or GAFAs. While some AI-related stocks have the potential to deliver a growth rate in line with current market expectations, history tells us that most of them will not. As explained in a recent article by Research Associates, picking future AI winners is the equivalent to investing in Amazon, Apple and ADP in early 2000.

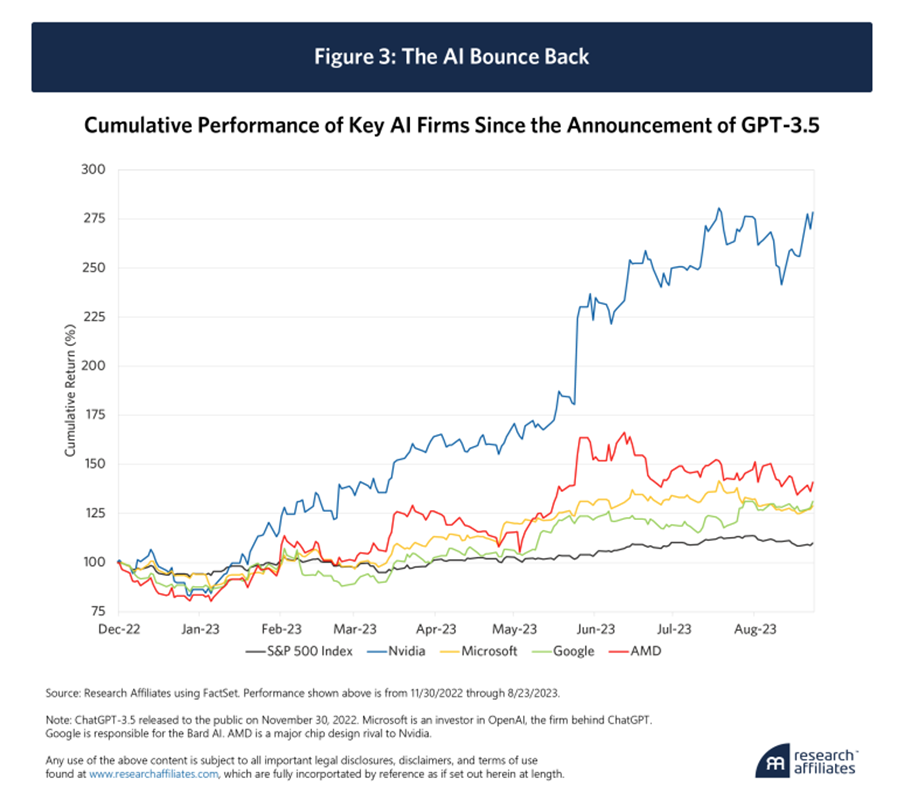

These three stocks are the only ones among the 40 biggest names in the technology sector at the turn of the century to have recorded double-digit performances in the 23 years since. Since ChatGPT 3.5 was released by Open AI in November 2022, companies deemed likely to be AI leaders in the coming years have seen their share prices significantly outperform the rest of the market.

In fact, a new term has emerged on Wall Street - "The Magnificent Seven", or the seven large-cap tech companies considered to be the likely AI winners. At the time of writing, these seven stocks account for almost 28% of the S&P 500's market capitalization.

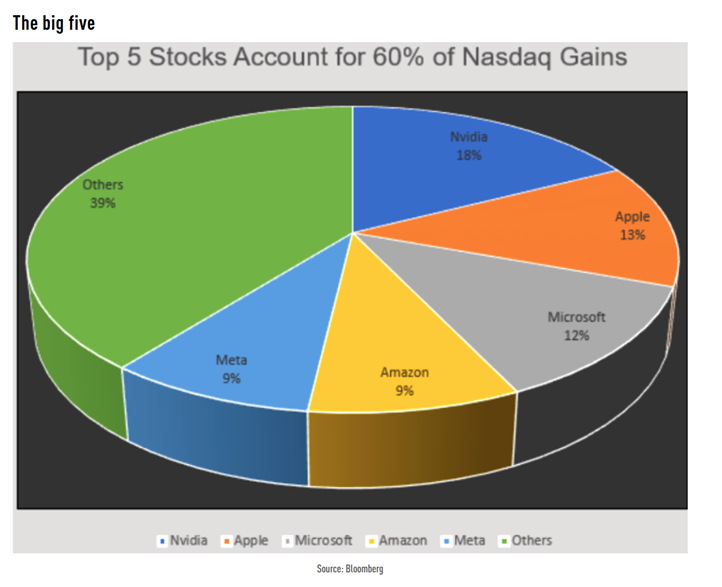

Indeed, since the start of the year, the performance of the major US stock market indices has been heavily concentrated on a small number of stocks. As the chart below shows, 5 stocks are responsible for over 60% of the Nasdaq 100's gains in 2023. AI is a common denominator for these American market behemoths.

Source: Bloomberg

Many investors tend to see these stocks as the sole beneficiaries of the AI revolution, not only because of their ability to attract talent, but also because of their financial strength, which enables them to make huge R&D investments in their AI branches. This is an important difference from the dot-com bubble of the 2000s, when not only large-cap companies were riding the ".com" wave; indeed, numerous IPOs of Internet stocks had broadened the spectrum of available investment opportunities.

Should we deduce from the above that the best way to invest in AI is to be positioned in a very limited number of stocks? Are there other stocks and sectors that stand to benefit from this technological transformation?

The potential winners of the AI revolution

We believe there are two types of beneficiaries:

1. The Innovators

First and foremost, these are the companies that stand to benefit from the immense investment capital expenditure associated with AI. A vast ecosystem of industries and sectors is poised to benefit directly from the rise of AI, each playing a unique role in technological transformation.

We can identify 3 distinct sub-categories:

i. The model builders or the so-called "platform" companies:

these include Microsoft, Alphabet, Baidu, MetaPlatform, Amazon, Tencent, Alibaba and others. The software industry is undergoing a metamorphosis driven by the demands of generative AI. The total market for generative AI software is estimated at $150 billion, opening up a veritable boulevard for software developers and companies specializing in AI-based applications. The tools and platforms these companies develop will certainly prove essential for harnessing the power of AI in a variety of sectors.

ii. Infrastructure and database companies:

ServiceNow, Snowflake, Cloudflare, Datadog, Altassian, MongoDB, Altervx, etc.

The recent craze for AI has highlighted its insatiable thirst for data. Storing, managing and accessing this data requires a solid infrastructure. This is where data centers and cloud service providers come into play. These entities ensure that AI algorithms have uninterrupted access to the vast data sets they need, making them indispensable cogs in the AI machinery.

iii. Semiconductor companies:

Nvidia, AMD, Intel, Marvell, SK Hynix, Samsung Electronics, Taiwan Semiconductors, etc.

At the heart of AI’s computing prowess are, of course, semiconductor companies. They provide the essential hardware that powers AI’s complex algorithms. With the growing demand for AI algorithms, the need for computing power is increasing massively. Semiconductor companies, beyond Nvidia, are well placed to reap major benefits. Their role in making generative AI work, places them at the forefront of AI's direct winners.

Beyond the established players, a new generation of startups and innovators are making their way into the AI landscape. These smaller entities are pushing the boundaries of what's possible with AI. Their innovations, whether niche AI applications or revolutionary algorithms, position them as future nuggets. As investors look to diversify their portfolios, identifying these direct beneficiaries offers a roadmap for navigating the AI investment landscape.

Whichever path the investor decides to take, he must do so by implementing a diversified approach and adopting all necessary measures to avoid idiosyncratic risk. One way of doing this is to include ETFs in the portfolio. ETFs with exposure to the AI theme include BOTZ, the Global X Robotics & Artificial Intelligence ETF, and ROBO, the ROBO Global Robotics and Automation Index ETF.

2. The beneficiaries of innovation

The AI technology revolution also affects the businesses that adopt and implement this technology. From retail giants leveraging AI to create personalized shopping experiences to healthcare facilities harnessing AI for diagnostics, the spectrum of end-user companies likely to benefit is vast. Investments by these companies in AI-based software and infrastructure services will not only improve operational efficiency, but also redefine customer and workforce engagement paradigms.

AI beyond the United States

The USA has long been at the forefront of AI innovation, thanks to its tech giants and pioneering research institutions. It is precisely these tech giants, such as Nvidia, Microsoft and Alphabet, that are not only shaping the discourse on AI, but also setting benchmarks in the research and application of these technologies. But the USA does not have a monopoly on innovation. China is rapidly establishing itself as a formidable player in the AI field.

The country has drawn up ambitious plans to become the world's leading center of AI innovation by 2030. Its own tech giants, such as Baidu, Alibaba and Tencent, are by no means mere regional players, but rather global competitors pushing the boundaries of AI research and use. The country has made AI a strategic priority, recognizing its potential in sectors ranging from healthcare to national security.

Although Europe has recently lagged behind the USA and China in terms of innovation, it has a rich history of research and scientific discovery and is making its mark in the AI world. It may not have comparable technological behemoths , but Europe's strength lies in its regulatory foresight and its focus on AI ethics. In many ways, the EU is regarded as the global standard for regulatory guidelines, and this is no exception in the field of AI, as it strives to ensure accountability and fairness while emphasizing transparency.

Countries such as Singapore, South Korea and India are also emerging as important players in the AI world, thanks in part to government support, a talent pool and strategic collaborations.

Conclusion and Forewarn

From our point of view, the potential of AI is enormous, and we have probably entered a new era. Like the Internet, AI will revolutionize the business world and our daily lives. The history of financial bubbles tends to repeat itself. As was the case during the Internet boom, financial markets tend to pay very high valuation multiples for companies that seem best positioned to benefit from the new technological revolution.

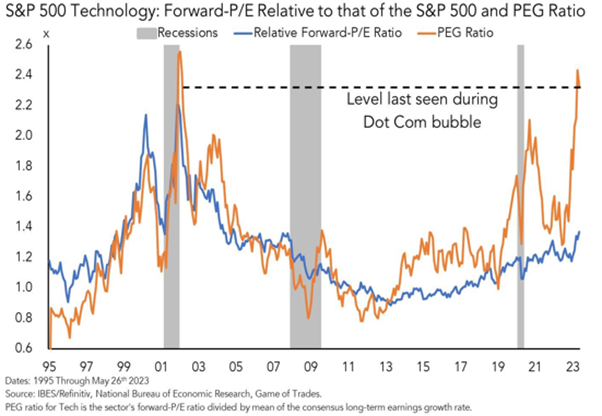

Never before has a mega-cap traded on the basis of Nvidia's current multiple (nearly 45 times sales and over 100 times earnings). Looking at relative valuation ratios, like in the example below, with relative PEG - i.e. P/E compared with expected earnings growth rate, the S&P 500 technology index is trading at a valuation premium similar to that of the dot.com bubble. The potential for correction is therefore significant.

Source: Game of Trades

Another characteristic of financial bubbles is that investors too often tend to overlook the fact that the main beneficiaries of technological innovation are the customers of that innovation, and not necessarily the innovators themselves.

Finally, the companies that initially appear to be the leaders of a technological revolution are not necessarily those of tomorrow. In a recent article, Research Associates highlighted the example of the Smartphone. In 2000, Palm's market capitalization was briefly worth more than that of General Motors. But in 2003, Palm Pilot was supplanted by the Blackberry, which in turn was replaced by the iPhone in 2008. Often, it's the disruptors who pay the highest price for disruption.

Today, Nvidia is the most emblematic stock of the AI bubble. But it is also perhaps the one most likely to disappoint investors' very high expectations. As mentioned above, investors can consider other stocks and instruments to invest in AI innovators and should consider the impact of AI on companies as a whole. This means identifying companies capable of using AI to generate the greatest productivity gains and/or transform their business model. Investing in AI is likely to be more of a marathon than a sprint.

NB: These are not investment recommendations.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)