What is an “Economic Moat”?

Initially used by Warren Buffet, a moat is the sustainability of a company's competitive advantage. In a market-based economy, competition is attracted to areas of activity in which companies have high profitability. With the arrival of new competitors, the profitability of companies tends to erode. Only companies with a significant competitive advantage are able to fend off competitive forces in a sustainable way.

Source: Capuccino Finance

Source: Capuccino Finance

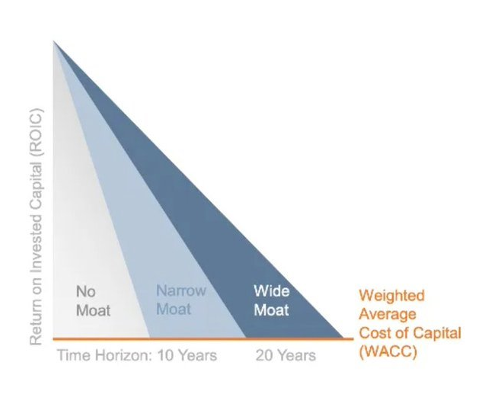

For Morningstar, the "economic moat" allows a company to generate excess economic returns over an extended period of time. Economic moat is the return on capital employed (or "ROCE") compared to the weighted average cost of capital (or "WACC").

The higher the economic moat, the higher the ROIC will be compared to the WACC over a longer period of time.

Two criteria must be met to have a moat: 1) the prospect of a return on capital that exceeds its cost; 2) sources of competitive advantage that will prevent this return from being rapidly eroded.

The concept of "economic moat" (sustainable competitive advantage) is often used as a central element in the fundamental analysis of companies. It also plays a key role in assessing the long-term investment potential of a stock and in estimating its intrinsic value.

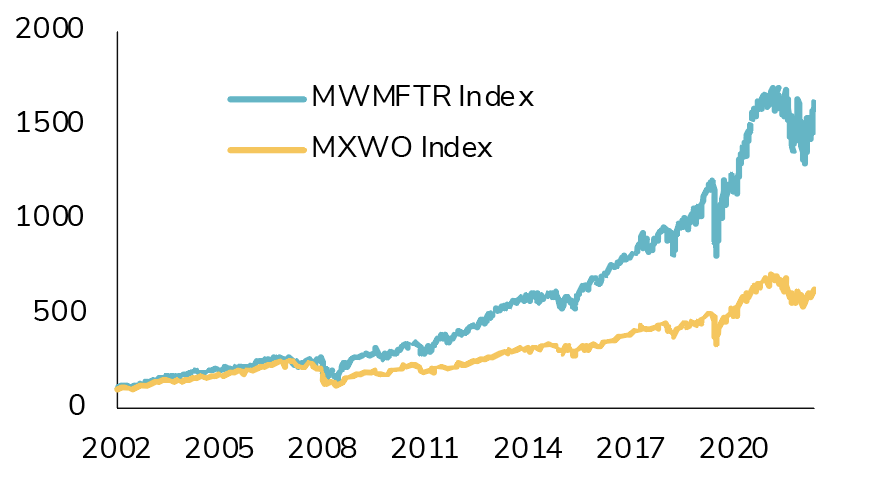

Indeed, companies with structural competitive advantages tend to generate high returns on invested capital, which allows them to generate earnings growth and free cash flows above the market. As a result, stock market performance is often better than that of the indices.

.png)