What is an ISA (Income Share Agreement)?

While university studies are almost free of charge in Switzerland and other European countries, university tuition fees are often exorbitant in the United States. Some students are lucky enough to be financed by their parents, while others have the courage to work part-time to pay for their studies. But most of them use student loans. They often accumulate a large debt that that becomes a heavy burden for many years, especially if they are unable to find a well-paying job after graduation.

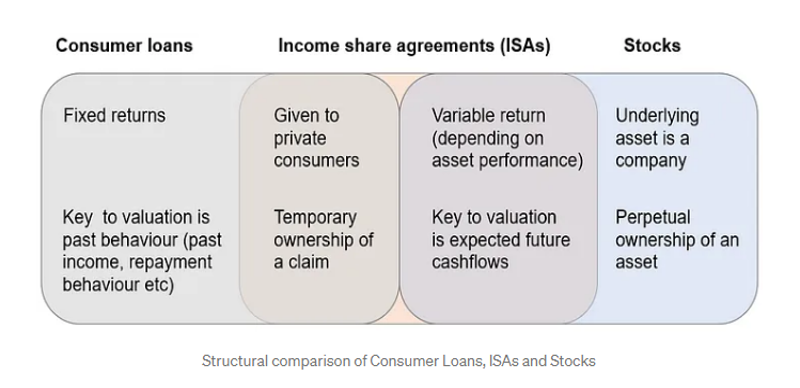

However, there is an alternative to student loans: the Income Share Agreement (ISA). The idea is that in exchange for paying their tuition, the student agrees to give back a portion of their salary to the funding entity for a certain period of time.

For example, a $10,000 tuition payment may be taken care of today by the funding entity. Upon graduation, the student dedicates a set percentage (say, 5%) of his or her earnings to the lender for a fixed period of time (say, 10 years). If the student earns $40,000 in the first year after graduation, he or she will pay $2,000 per year. And if his or her income five years after college is $80,000 a year, the redistributed share will increase to $4,000 a year.

Most contracts also have minimum income requirements (if you don't make enough, you don't pay) as well as repayment caps (if you make a lot, you only pay back a portion of the amount).

.png)