While the Covid-19 situation has worsened, governments have learned how to mitigate the economic impacts since the first wave last March, and we do not believe the second tsunami of infections will derail the recovery. Crucially, vaccination is helping businesses see the light at the end of the tunnel and hold tight until things normalise.

As a result, forward-looking markets have rallied to new highs, and we expect pent-up demand to keep fuelling macroeconomic momentum. In the context of continued accommodative central banks and government support, we should also see inflation pick up from a low base.

MAKING THE MOST OF THE GROWTH

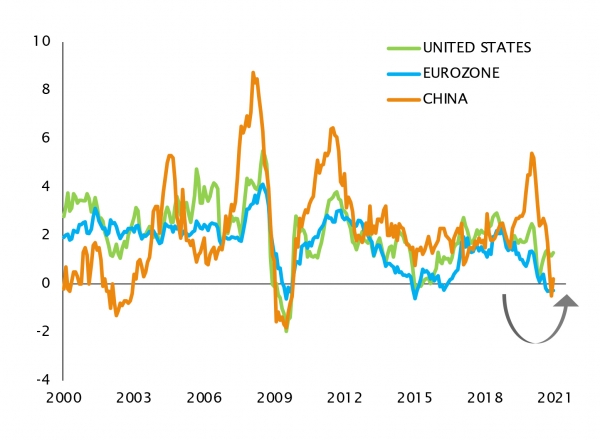

This acceleration will not be permanent, however. The long-term Japanification trend of low growth and low inflation – which does not rule out short reflationary cycles – will inevitably resume its gravitational pull on the economy towards the end of the year.

Once the recovery is well underway, perhaps towards the end of the summer, we expect governments and central banks to gradually shift their tone – highlighting economic improvements rather than downside risks. As they contemplate the withdrawal of supportive measures, markets will need to fundamentally reassess the outlook. The removal of the proverbial punchbowl can hurt assets across the board and lead investors to re-evaluate the premium they are prepared to pay for risk.

With this in mind, the current rally presents a tactical window of opportunity to capitalise on higher growth and inflation. Since we identified the potential for a return of growth in November, we have been gradually repositioning the portfolios to capture more cyclical equity exposure and less rate sensitivity. As the upward trend has steadily been confirmed by economic data, we have made a series of incremental changes – from increasing the equity allocation and reducing our quality and growth stock bias to obtaining broad-based value exposure through global ETFs.

TAKING CYCLICALITY TO THE NEXT LEVEL

Our confidence in imminent economic growth has increased and we are now contemplating additional moves within the equity allocation – replacing sector neutral value and quality growth stocks temporarily with sector-specific cyclical exposure. While we will retain certain all-weather quality growth stocks, we want to benefit from the cyclical companies poised to assume market leadership.

Downtrodden commodity-related sectors, such as materials, and financials offer significant catch-up potential, and the temporary growth outlook offers a tactical opportunity to benefit from these sectors we otherwise classify as ‘structural losers’ of Japanification. A reflation scenario should increase demand for raw materials, while financials, which have lagged structurally over the past several years, should rapidly benefit from steeper yield curves and higher long-term rates. Despite an initial rebound, these sectors are still cheap compared to others.

Core eurozone equity markets, such as Germany and France, are also attractive, given the super-low-rate context in Europe, and could benefit from a global reflation scenario, as well as the Japanese market. Meanwhile, Chinese equities continue to be boosted by macro momentum and a raft of domestic support measures.

REDUCING RATE RISK

On the fixed income side, we have also made changes to reflect the solidifying reflation scenario. As the US curve appears prone to further steepening, due to positive growth prospects and additional fiscal stimulus, we are exercising caution on nominal government bonds, especially US treasuries.

The combination of rising yields and stretched valuations across the entire credit spectrum have also led us to decrease our investment grade credit exposure, as both carry and potential for spread compression are very limited. In fact, credit spreads are at risk of widening along with rising rates. While macro and liquidity conditions are favourable, we prefer to seek opportunities elsewhere, as the potential for positive performance appears limited in a temporary reflation scenario.

Emerging market hard currency debt remains our favourite segment of the fixed income universe, as the combination of improving global growth dynamic, ample US dollar liquidity, very low rates and the recent weakening of the dollar clears the outlook for some issuers and allows us to benefit from still attractive spreads. We also continue to see value in high yield, where additional spread compression remains possible for cyclical issuers and short-dated bonds offer positive carry.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)