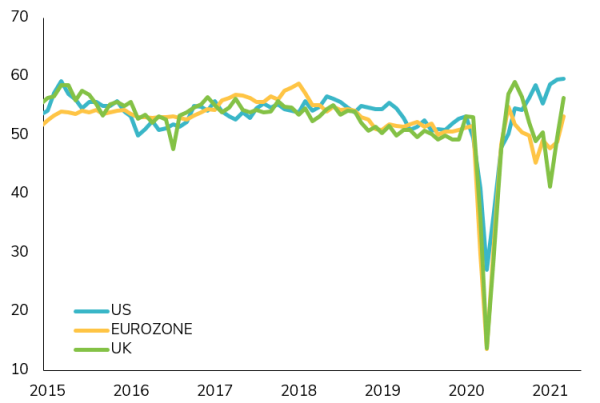

Supported by fiscal and monetary stimulus, the pace of vaccine distributions in western economies is largely dictating the speed of economic recovery. Inoculations in the UK and US are both proving that the economic rebound after lockdowns can be rapid, after China paved the way to recovery in Asia last year. This is reassuring for the European Union where many states, including France and Germany, have been forced to re-impose new restrictions.

Investor attention is poised to shift

March underlined again that 2021’s equity markets continue to be driven by macroeconomic reflation expectations, rather than stock-specific factors. In this environment, equities remain the most attractive asset class since the global recovery is fuelling earnings growth, offsetting any increases in fixed income yields. Indeed, the Fed has consistently reminded markets that it will tolerate rising yields as long as they are driven by the improving economic outlook, itself positive for equities.

As this recovery matures and we move into the first quarter’s reporting season we expect markets to become more responsive to stock-specific fundamentals, and so start to differentiate between sectors and firms. Investors’ attention will then return to sectors where there is appetite for more quality stocks, such as technology. Until then, we maintain our cyclical bias to sectorial and geographical equity allocations and remain cautious on fixed income assets, which are subject to upward pressures on long- term rates.

The pandemic has not exposed fragilities in the credit markets, supported as they are by central bank liquidity and governments’ fiscal policies. Corporations have used the opportunity to refinance at very favourable rates. And although high yield credit remains correlated to equity values, commercial lending has been supportive. We see no catalysts to change that for the moment.

We are not yet at the end of this reflation cycle, and do not yet see signs of returning to the longer-term ‘Japanification’ trend in the global economy. With the normalisation of interest rates and the end of monetary and fiscal stimulus still distant, it is certainly too early for radical portfolio adjustments.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)