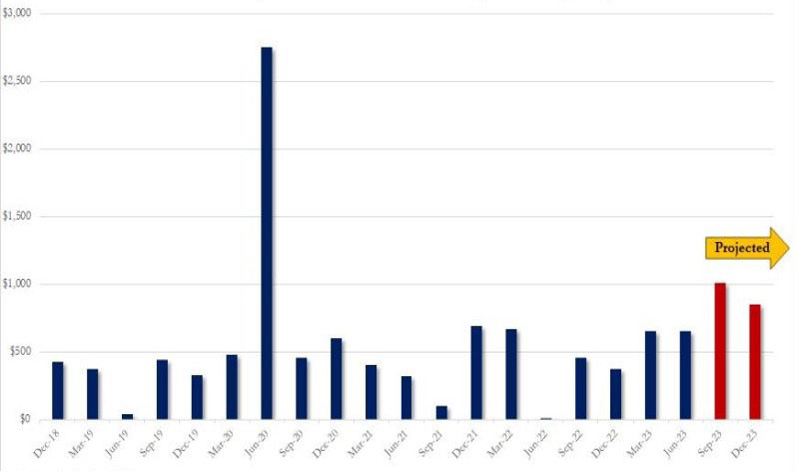

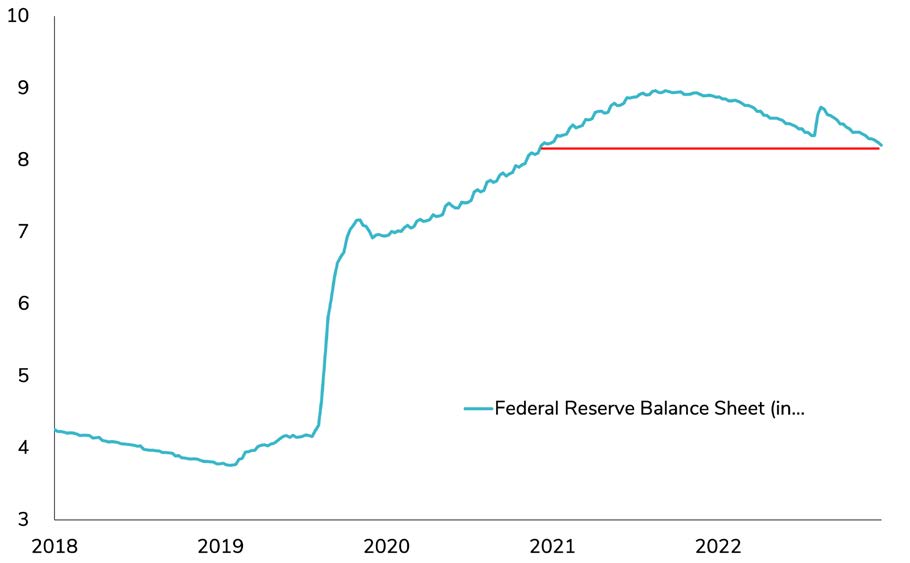

Navigating the Storm: The recent sharp sell-off in US Treasuries presents both challenges and opportunities for investors. While supply pressures, economic strength, and tightening liquidity have pushed yields higher, attractive valuations, potential inflation cooling, and favorable market positioning offer opportunities.Our investment view on US Treasuries suggests a cautious yet strategic approach.

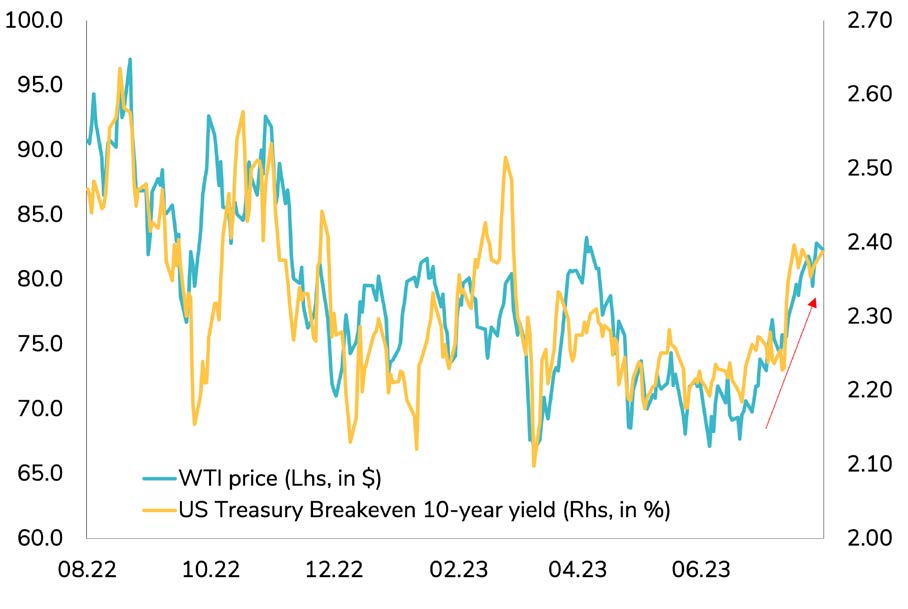

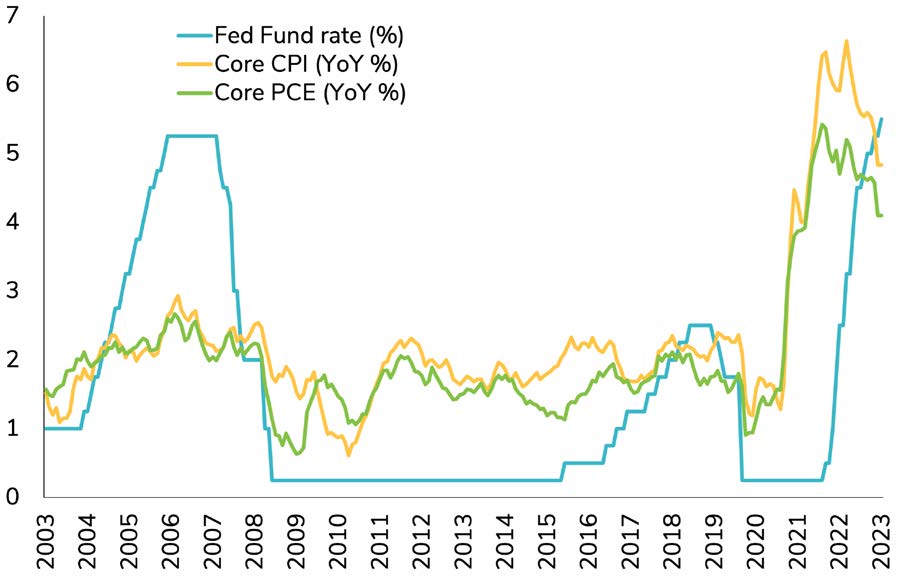

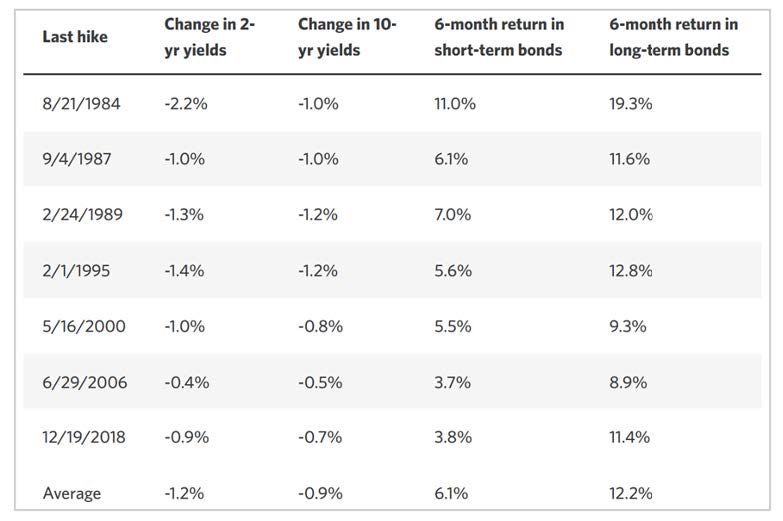

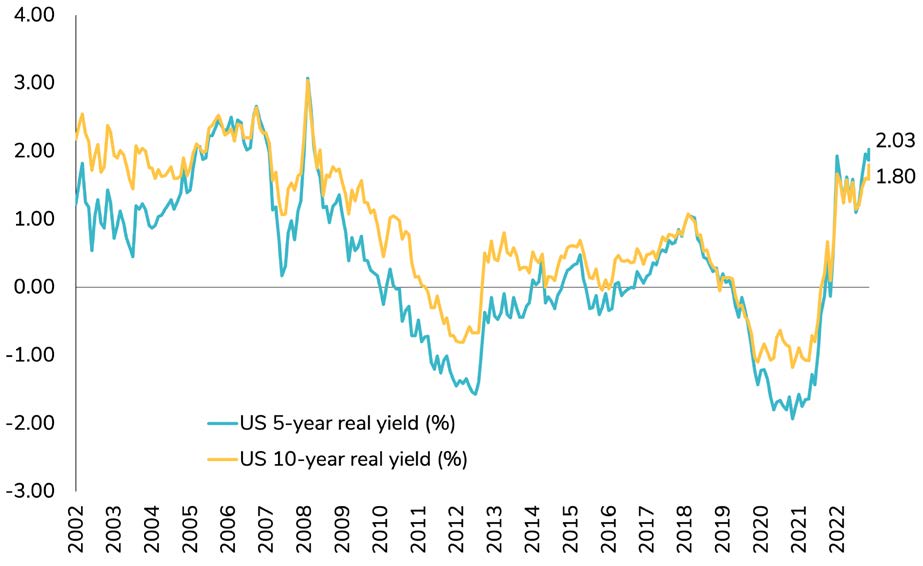

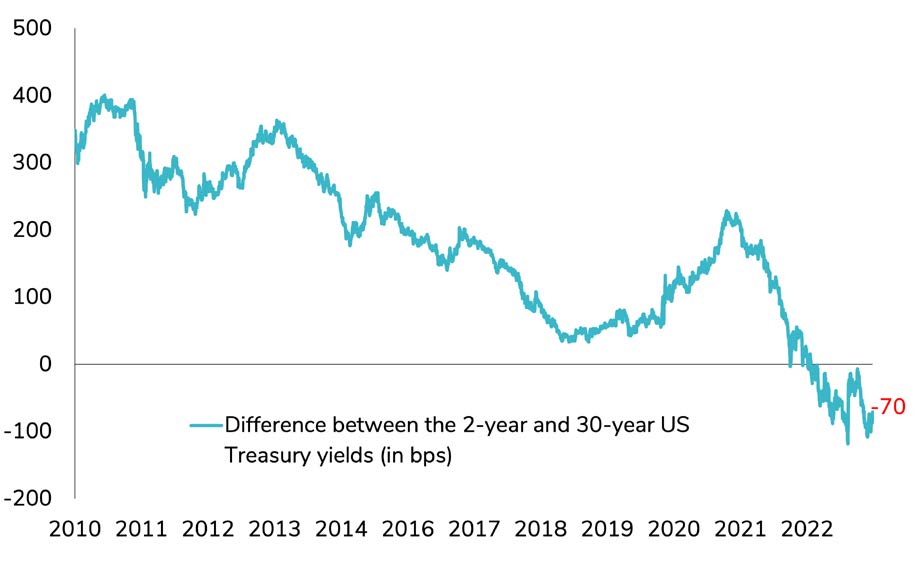

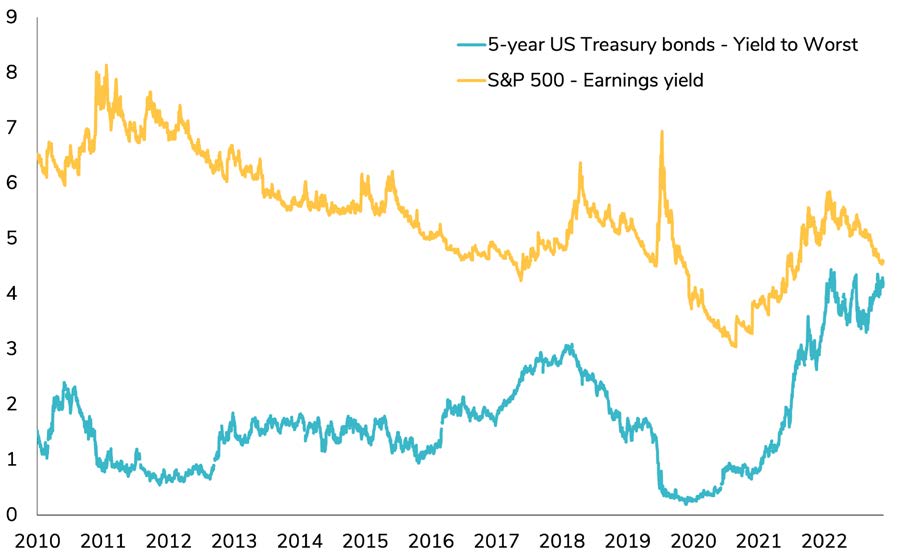

Focusing on the belly of the yield curve (around 5 to 10-year maturities) offers attractive entry points with historically high real yields. We remain cautious on the long end, given the market's interest in repricing the steepening trend. However, the current historically high yields also provide an excellent opportunity to lean in on duration. By complementing short-term bonds and cash with long-term fixed income, investors can take advantage of attractive yield levels while managing interest rate risks. Inflationary pressures are abating, potentially signaling an end to the Federal Reserve's rate-hiking cycle, with the upside potential for yields now outweighing downside risks.

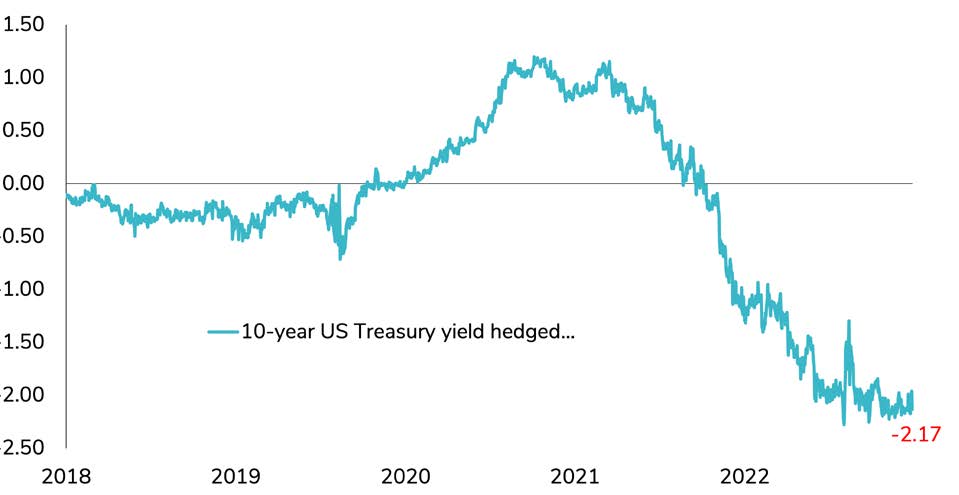

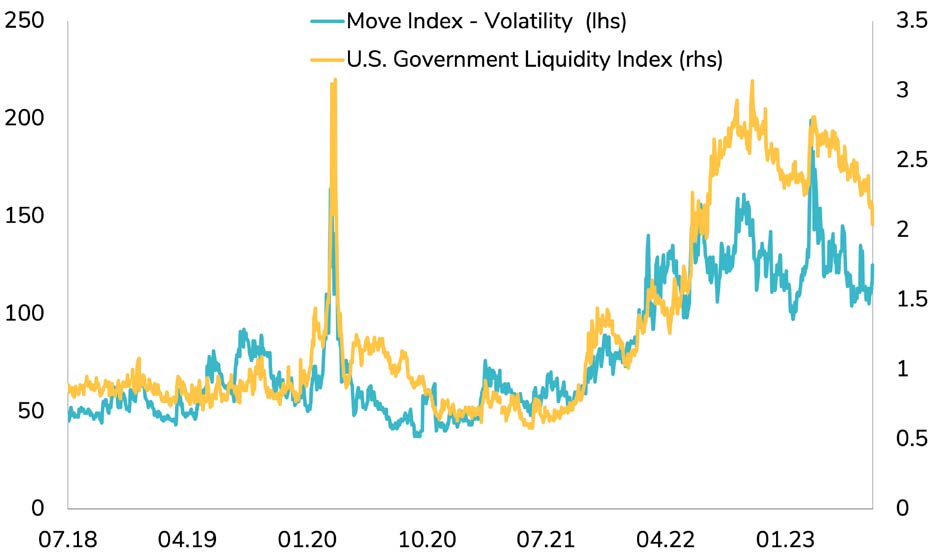

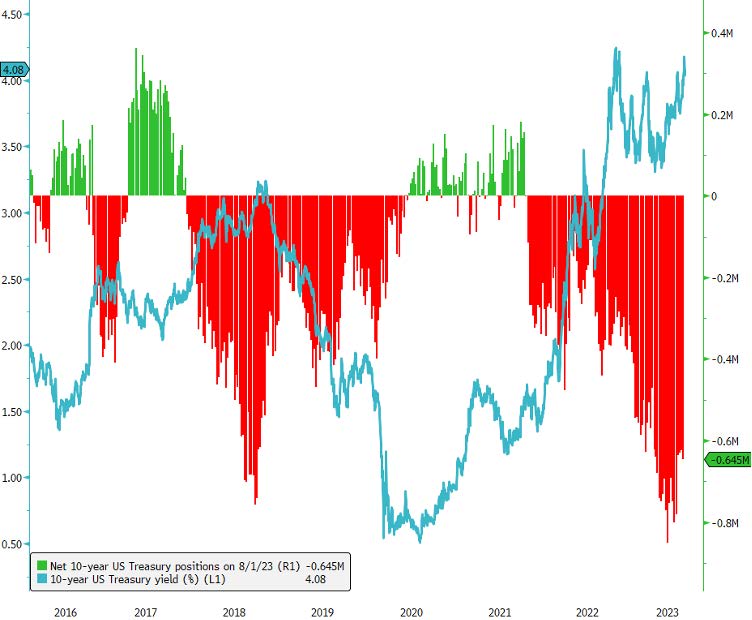

Market's short positioning on US 10-year Treasuries suggests a potential turnaround, favoring fixed-income investments. Additionally, the normalization of correlation between bonds and equities strengthens the case for bond investments in multi-asset class portfolios.

In conclusion, the recent sell-off in US Treasuries demands prudence and discernment. Selective positioning in the belly of the yield curve, along with a duration tilt, can seize opportunities amidst the storm. Monitoring inflation trends and Federal Reserve policy will be critical in making informed investment decisions as market dynamics evolve.

.png)