Source: DBS Bank

What is fungibility? An asset is said to be fungible if it is not unique and is interchangeable against an asset of the same type. For example, dollars are fungible assets. Similarly, most crypto currencies are fungible or partially fungible assets.

Conversely, some assets are non-fungible. This is the case with train tickets. Although there are thousands of them, certain characteristics are unique to each ticket, such as the seat number or departure time. Among digital assets, NFTs are non-fungible. This means that no two tokens created will be exactly identical and interchangeable. These unique tokens are stored on the blockchain.

Source: DBS Bank

The concept of owning a unique, verifiable digital asset has gained many fans, particularly in the field of art and collectibles. At the start of the decade, the NFT market boomed with high-profile sales such as Beeple’s digital artwork and Twitter founder Jack Dorsey’s NFT tweet.

Anatomy of a crash

In 2021, the NFT market reached its peak, with weekly trading volumes reaching between $750 million and $1.5 billion (between August 2021 and April 2022). Enthusiasm was at an all-time high, as numerous celebrities and artists backed and invested in NFTs. Auction houses such as Christie’s and Sotheby’s began to organize NFT sales, contributing to their legitimacy.

However, the year 2022 marked a major turning point in this history, with the NFT market experiencing a spectacular collapse. The average price of token sales has fallen by 92% since its peak. By way of example, Dorsey’s “first NFT tweet”, originally purchased for the exorbitant sum of $2.9 million, was worth less than $4 at the start of the year.

This spectacular fall can be explained by several factors. The first is the bursting of virtually all speculative bubbles by 2022. The FAANGs, small and mid-caps, venture capital, cryptocurrencies and NFTs have all experienced historic “purges”. The collapse in the value of NFTs has led to growing scepti-cism, triggering panic selling by speculators.

Another important factor was market saturation. The initial runaway success of NFTs led to a flood of new artists and creators, resulting in a glut of digital assets, and reducing the perceived value and uniqueness of each NFT.

The absence of a comprehensive regulatory framework has contributed to uncertainty, generating legal and security concerns for NFT transactions. Environmental concerns, due to the use of energy-intensive blockchain technologies, have also played a role.

Source: Watcher Guru

The sharp fall in NFT prices meant that some digital assets lost all their value overnight. Leading collections such as Bored Ape and Decentraland experienced dramatic declines in value. In addition, the crash led to a notable drop in user activity and traffic on blockchain platforms, reflecting a significant loss of interest and confidence in the NFT market.

Crypto currencies such as Ethereum, often used for NFT transactions, suffered a sharp depreciation in value. This ripple effect demonstrated the interconnected nature of digital asset markets. The crash also had a profound impact on artists’ and collectors’ appetite for digital assets.

The future of NFTs

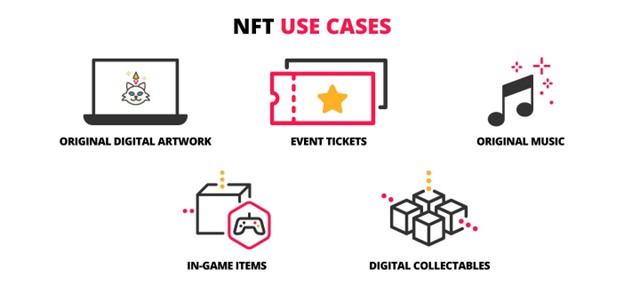

In the wake of the crash, the NFT market has adapted and continues to evolve. Despite the crisis, NFT technology is progressing, exploring new use cases. This innovation is a response to those seeking greater utility and durability from NFTs. The market is diversifying into sectors such as gaming, finance, virtual real estate and virtual goods. In finance, NFTs facilitate the tokenization of assets, enabling fractional ownership and the fluidity of transactions on traditionally illiquid assets. Brands are integrating NFTs into loyalty programmes to boost consumer engagement. In the art world, NFTs are not limited to the sale of digital art but are redefining artist-public interaction by enabling the creation of unique, interac-tive and dynamic works. These varied applications highlight the vast potential of NFTs, showing that they are much more than just a digital tool, but a versatile technology capable of revolutionizing interactions in many sectors.

Looking ahead, the NFT market appears to be heading towards a more stable and mature phase, with regulatory changes expected to boost user and investor confidence. The focus on green blockchain technologies is attracting new, environmentally conscious participants. Continued diversification into virtual real estate and virtual assets paves the way for new phases of growth. Concrete projects are expected to gain momentum, marking a significant change in image from the purely speculative nature of NFTs. A sign of the market’s upturn is the explosion in the number of NFTs developed on the Bitcoin blockchain since the launch of the Ordinals protocol in January 2023.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

President Donald Trump signed an executive order relating to cryptocurrencies. The US is now one step closer to the creation of a strategic bitcoin reserve. Overview below.

"There are decades where nothing happens; and there are weeks where decades happen." - Vladimir Ilyich Lenin

Solana and Ethereum are two dominant blockchains in the crypto sector, each boasting robust DeFi ecosystems and a plethora of diverse applications. The two blockchains are often seen as competitors. How do they compare?

.png)