The era of the private client comfortably installed in a hushed lounge to consult his bank account statement under the benevolent eyes of the banker, seems to be well and truly over. In the space of two decades, the needs of customers have changed considerably. It is now a question of being able to access one's account 24/7, in real time and via an intuitive digital interface. The content of information and recommendations must match their preferences and risk profile. Without completely abandoning discretionary management, many clients want to have control over their investment decisions. They are becoming skeptical about the soundness of the financial advice given by their bankers. Ikea paved the way for the "do-it-yourself" and now the same concept applies to the banking world, as the customer becomes a "consumer actor" of his/her bank and wants to consciously use its services. Market data and comments do not come solely from the bank as the amount of information available on social networks is limitless. Customers tend to evaluate risk in terms of drawdown rather than the volatility. It is about accessing the most sophisticated products and strategies previously reserved for institutional clients. Finally, management performance and fees charged must be fully transparent and compete with non-traditional players.

But changing customer needs are not the only challenge facing banks. Regulatory pressure is driving operating costs higher. Disruptive business models and new entrants (fintech, robo-advisors, etc.) increase competitive pressure. The rise of artificial intelligence, “big data” and blockchain is transforming the financial industry and leading to new ecosystems. A new generation of investors think differently about advice, and banks need to adapt.

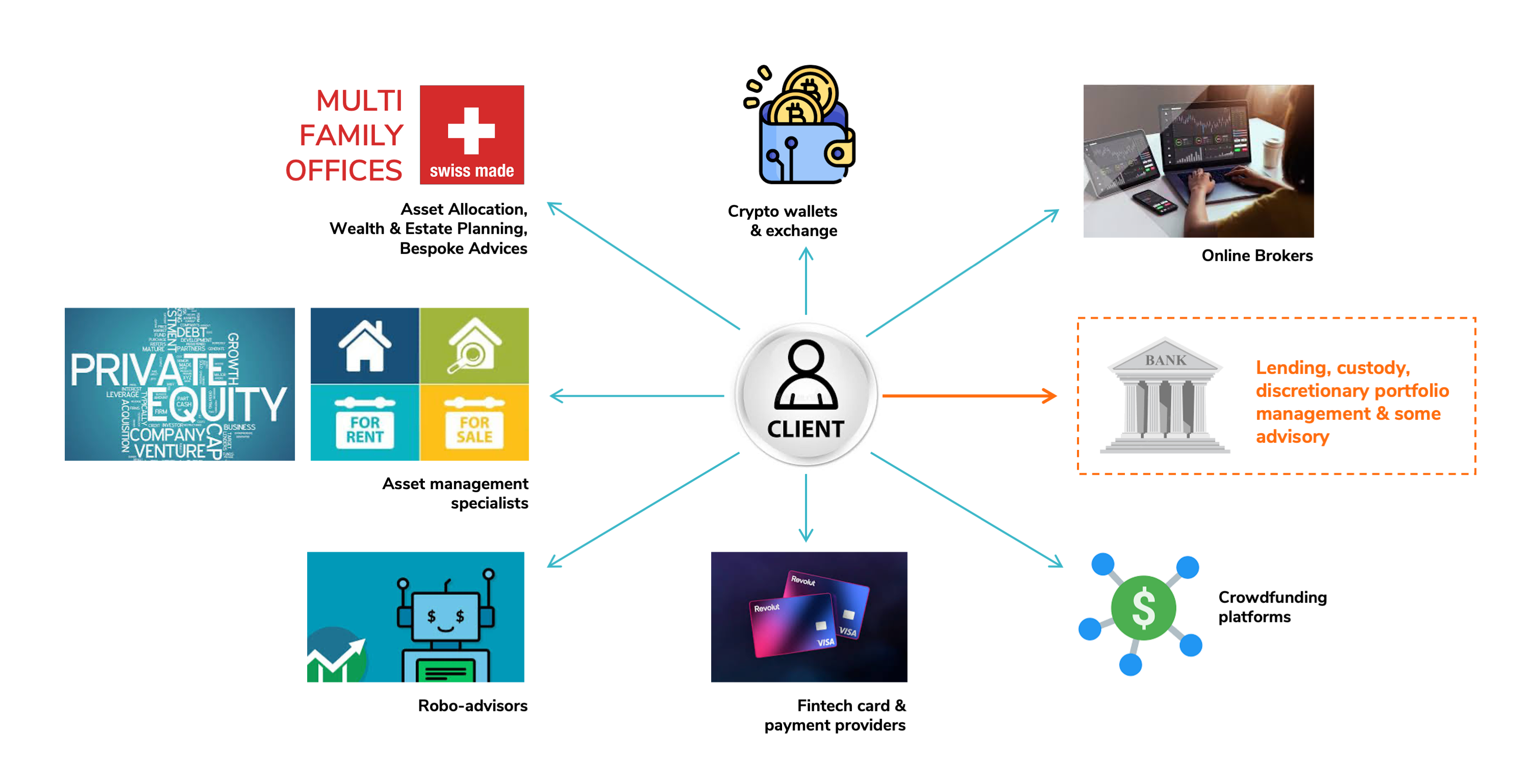

It is also a question of banks positioning themselves to recover some of the added value lost over the years to non-bank players. Indeed, part of the products and services offering is no longer the prerogative of traditional banks. High-net-worth clients are increasingly turning to a family office for strategic asset allocation, financial planning, and specific advice. They use asset management specialists when it comes to investing in illiquid strategies such as venture capital or real estate. For traditional discretionary management, private clients no longer hesitate to use the services of a robo-advisor to lower management fees. As far as "execution only" is concerned, click-and-trade offered by online brokers is on the rise, as well as platforms and wallets hosting crypto assets. For payments and credit cards, fintechs such as Revolut are even attractive to high-net-worth clients. Crowdfunding platforms are also popular with the latter. Incumbent banks are content to offer traditional and low-margin services such as deposits, loans, or discretionary management.

.png)