Story #1 —

A volatile but positive quarter for markets

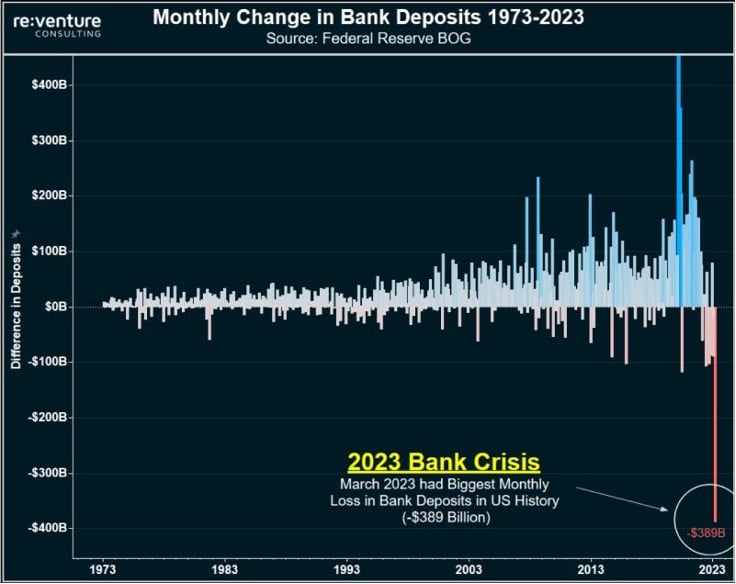

Q1 2023 was a turbulent period in markets, with a surge in volatility (especially in bonds) during March, following the collapse of Silicon Valley Bank. That led to fears about broader contagion across the banking system, while the sudden implosion of Credit Suisse led to its acquisition by UBS with guarantees from the Swiss government, and further bank crisis fears. Some of the US Treasuries’ daily moves were the largest in decades, and the MOVE index of Treasury volatility hit levels last seen at the height of the2008 global financial crisis (see story #3).

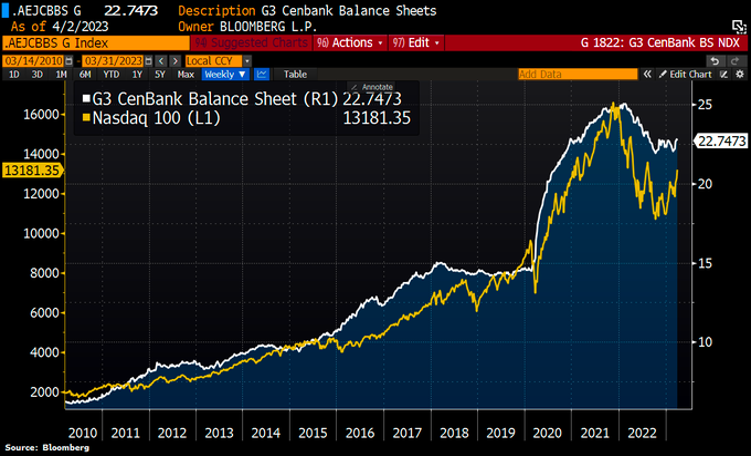

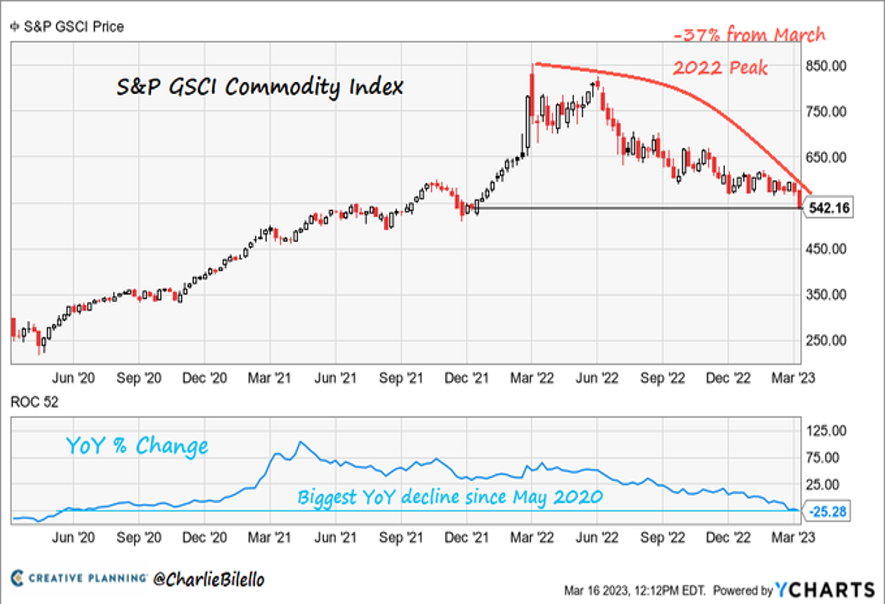

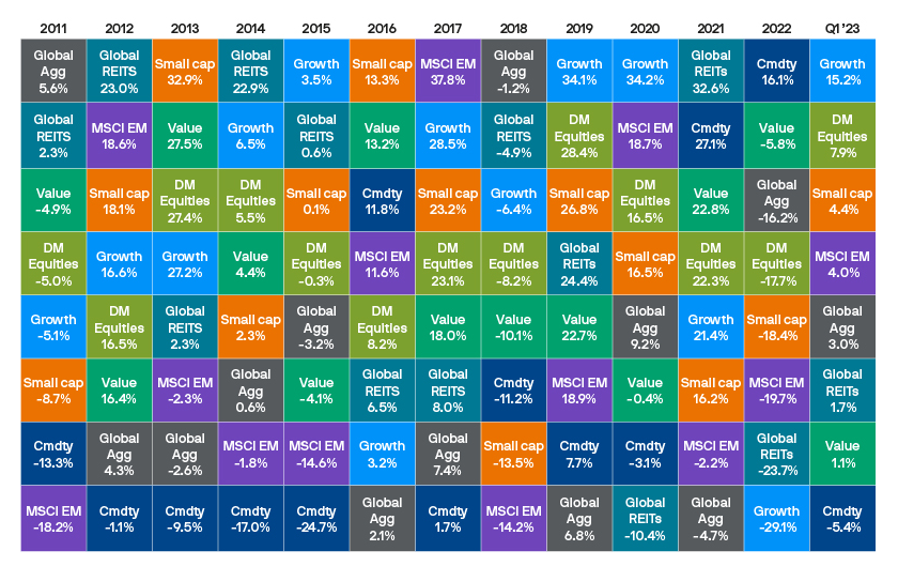

By the end of the quarter, market fears had subsided due to 1) markets’ anticipations that the Fed's rate hike cycle is effectively over; 2) the rise of the Fed’s balance sheet being seen by many market participants as a “stealth QE”. While the banking crisis might be a warning signal that the rapid series of central bank rate hikes is finally breaking something, Q1 as a whole saw some incredibly broad gains after the weakness of 2022, with advances for equities, credit, sovereign bonds, Emerging markets assets and cryptocurrencies (see story #10). The only major exception to that pattern were commodities (see story #9), with oil prices losing ground in every month of Q1.

Source: JP Morgan

.png)