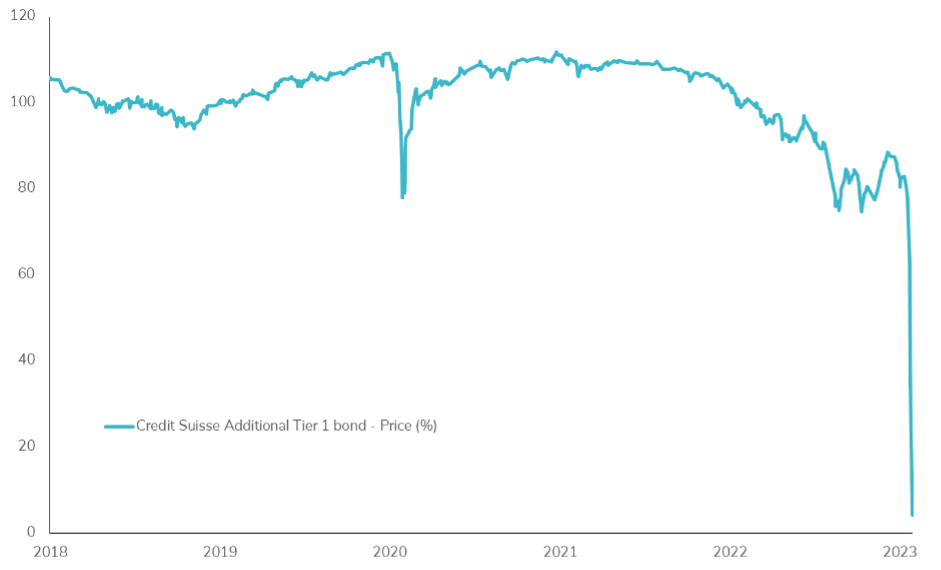

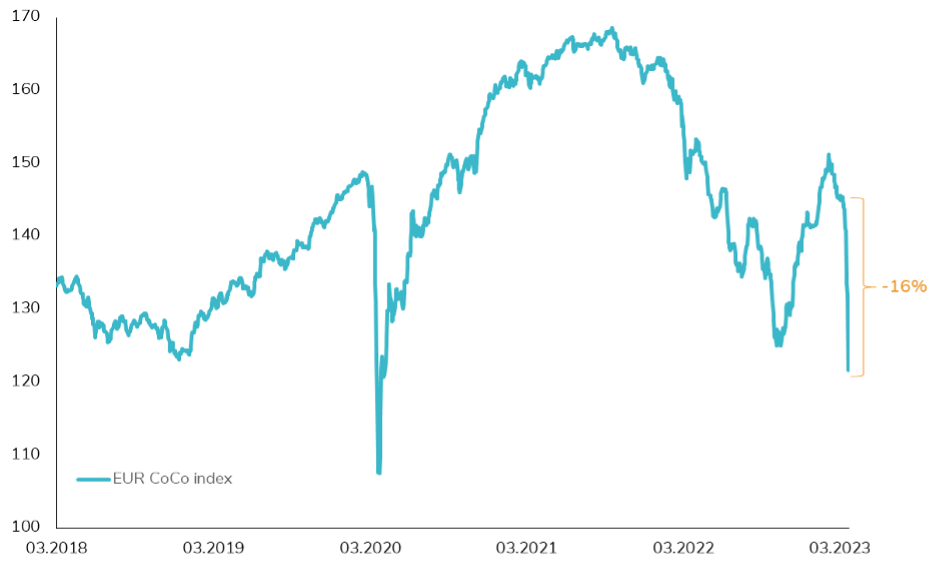

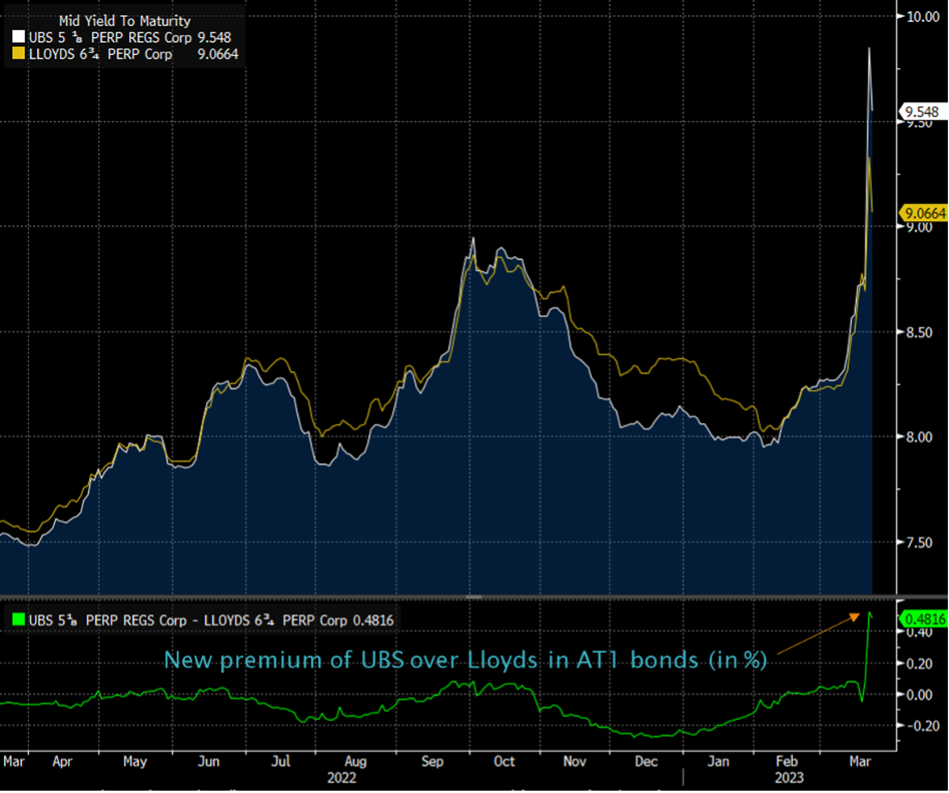

The UBS/Credit Suisse affair has caused the AT1/CoCo bond markets to struggle

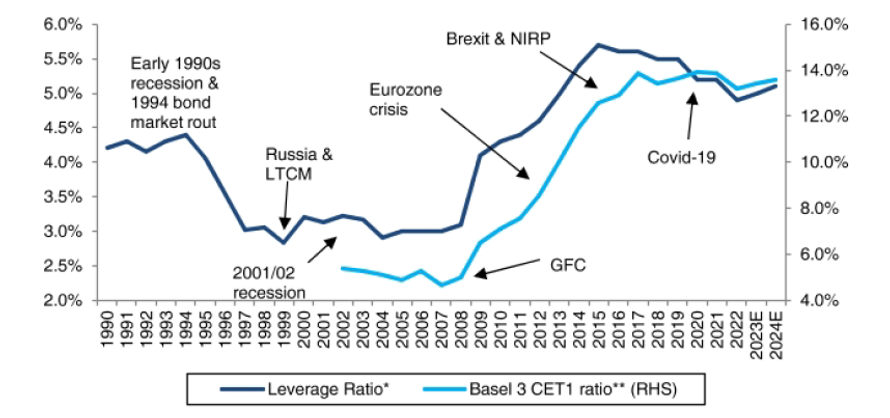

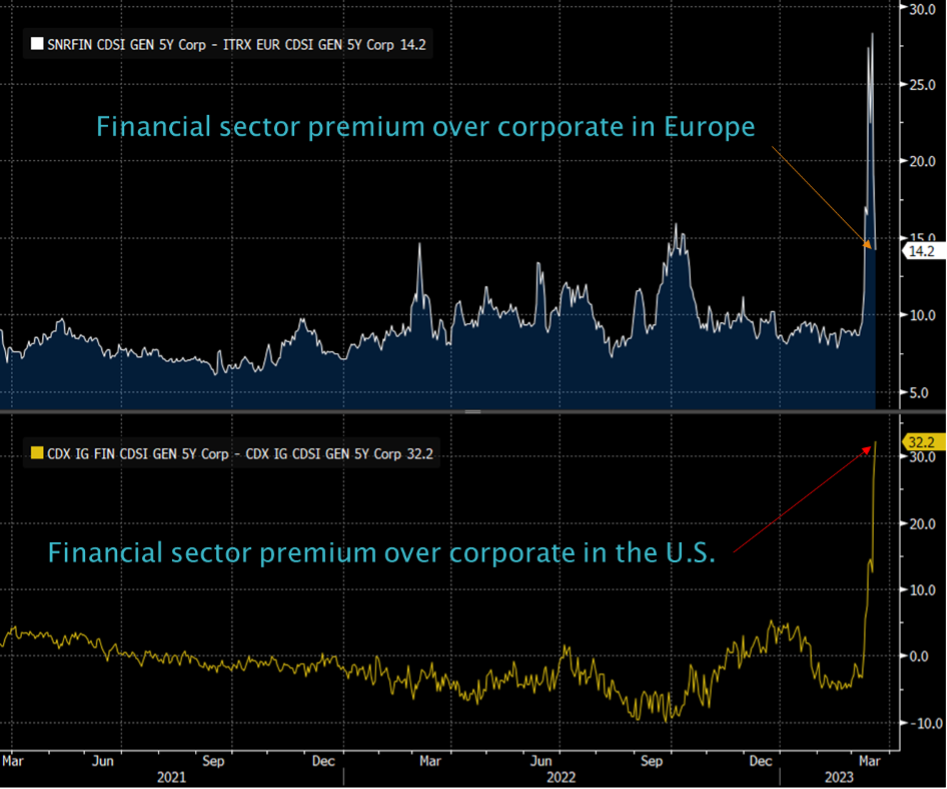

By tightening their monetary policy sharply and rapidly, central banks have highlighted certain weaknesses in our financial system: insufficient risk coverage, liquidity problems, lack of business diversification, governance issues, and now uncertainties in the treatment of hybrid instruments. After the failure of some US regional banks, the UBS/Credit Suisse affair has shaken the financial world and more particularly the specialists of a specific bond segment which weighs about 250 billion dollars: Additional Tier 1 bonds (AT1) and/or Contingent Convertible bonds (CoCos).

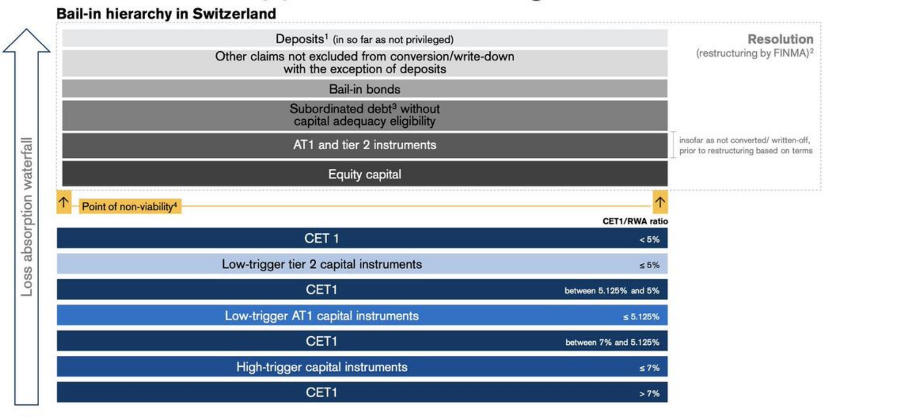

Indeed, a global coordination of the FINMA (the Swiss regulator), the SNB (Swiss National Bank), and the Swiss Confederation decided to breach the hierarchy of claims by giving more than 3 billion dollars to the shareholders of Credit Suisse but wiping out the entire 16 billion dollars of Credit Suisse AT1 bonds. This has caused the bond markets to struggle.

.png)