While 2022 is well on its way to becoming one of the worst years in history for multi-management, it is clear that investors haven’t changed their preferences regarding the various asset classes and securities to be favoured much. A certain nostalgia for the "QE" (Quantitative Easing) years remains: FANGs (Facebook, Amazon, Netflix, Google, etc.), ARK Invest funds and other "QQQ" ETFs (Nasdaq) are still over-represented in the portfolios of individual investors, but also of professionals.

While we may have entered a new era in terms of global, economic and financial order, a number of investment themes remain ignored by most investors. Here are some examples.

Theme #1 —

Commodities

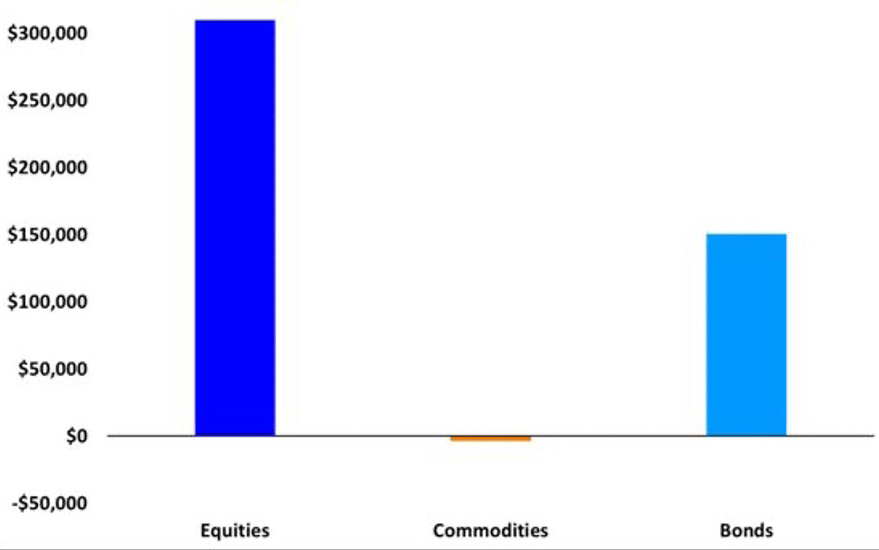

It is the best performing asset class in 2022 (+18% for the Bloomberg Commodity Index), thanks in particular to the sharp rise in oil prices in the first half of the year. Yet private and institutional investors continue to shun commodities. An analysis of ETF flows in the three major asset classes (see below) shows that capital continues to be allocated to the assets that have lost the most value in 2022 (equities and bonds) while ignoring the only segment that is currently in a bull market, commodities.

As we have discussed on several occasions, the supply situation remains tight for many commodities (oil, industrial metals, precious metals, uranium) while demand does not seem to be collapsing despite central bank monetary tightening.

An end to the zero-covid policy in China could even create the conditions for a re-acceleration of demand. It should also be remembered that this is the asset class that has historically performed best in phases of high inflation or even stagflation.

Flows into ETFs across the three main asset classes in 2022 (in millions of dollars)

Source: All Star Chart Plus

Theme #2 —

Commodity exporting countries

For more than a decade, the US equity market has been the darling of most global investors, accounting for nearly two-thirds of the market capitalisation of the MSCI World Index. The strong representation of technology stocks partly explains this success. However, since 2021, the technology sector has lost value, partly due to rising bond yields, which are weighing on valuation multiples. On the other hand, commodity exporting countries - and their capital markets - have in some ways "benefited" from the sanctions against Russia.

Thus, the Brazilian real is one of the few currencies that has appreciated against the dollar since the beginning of the year (+4%). Brazil is benefiting from the strong demand for soya, iron, oil and sugar, raw materials of which Brazil is a net exporter. This advantage also benefits the local equity market; the Bovespa index is up 14% since the beginning of the year in BRL. Yet the allocation to Brazil remains relatively small in global portfolios.

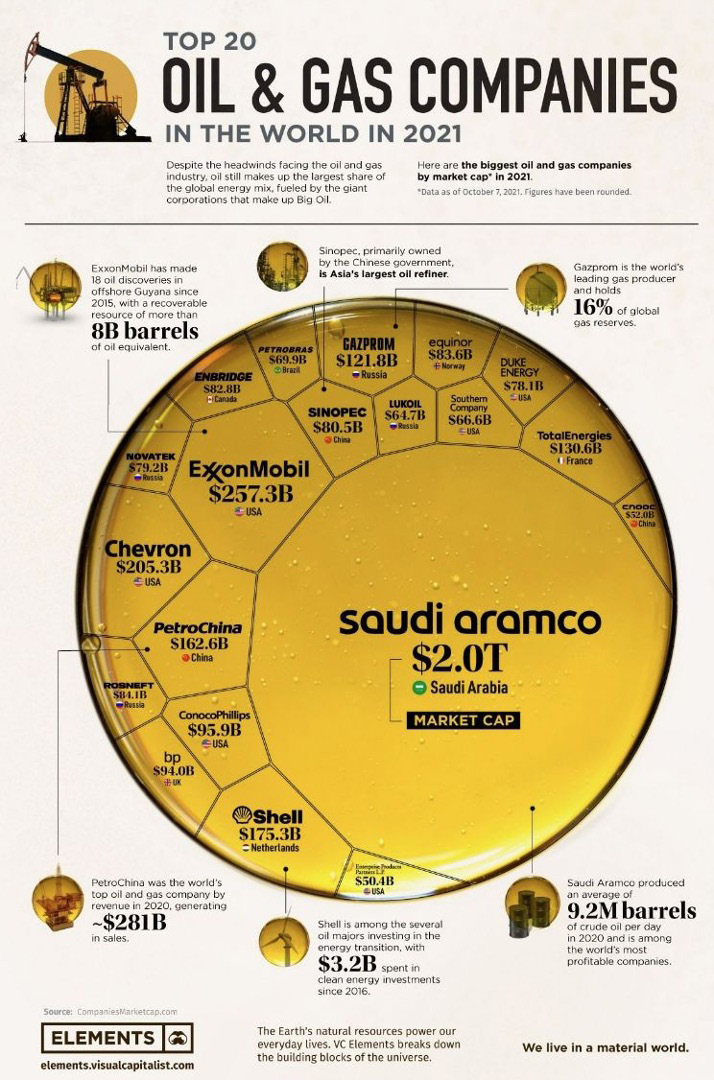

Saudi Aramco, now the second largest market capitalisation behind Apple, is totally under-represented internationally. The same is true for the Middle East region as a whole, whether in bonds or equities. However, Saudi Arabia is currently the country with the highest GDP growth (+9.5% expected this year) and the United Arab Emirates are currently booming. The equity markets of these two Gulf countries have held up rather well this year, consolidating the very strong gains recorded in 2021, despite the strength of the dollar and rising interest rates.

The world's largest oil and gas companies

Source: Elements, The Visual Capitalist

Theme #3 —

High Free-cash Flow Yielders

In this period of great uncertainty and economic slowdown, the analysis of free cash flow is of great importance as it is used to measure the financial wiggle room of companies but also the quality of their operational performance. Investing in companies with a high free cash flow yield allows to favour quality stocks with an attractive valuation.

GAFAs have in the past offered very high free cash flow yields. Unfortunately, this is no longer the case for some of these stocks, although it is possible to find interesting candidates in the technology and communications sector. However, the highest free cash flow yields can now be identified in the old economy sectors (energy, materials, industry) but also in the healthcare and non-cyclical consumer sectors.

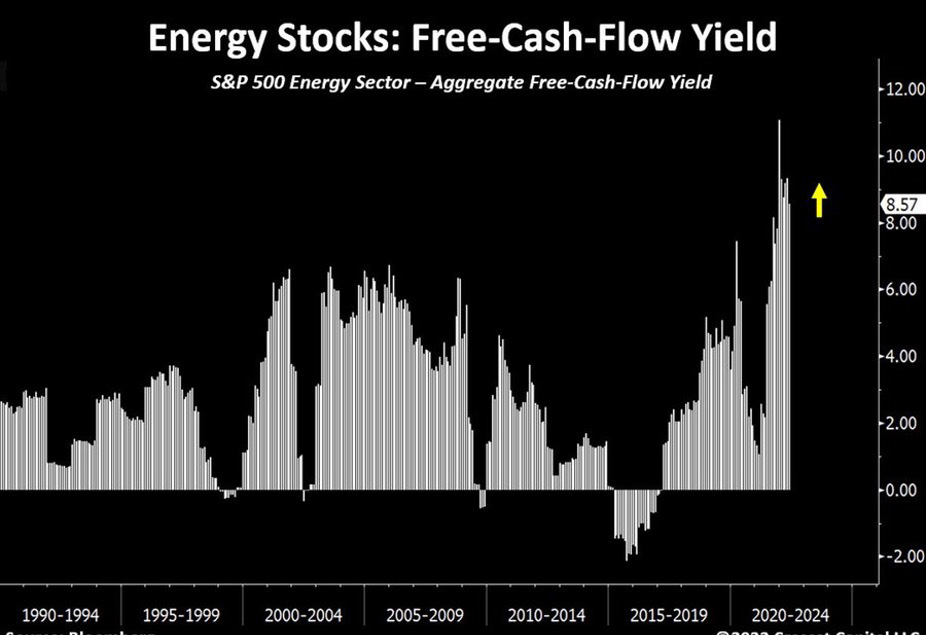

In general, it can be observed that stocks with high free cash flow yields remain underrepresented in clients' portfolios. Despite the fact that energy is by far the best performing sector in 2022, the weight of this sector in the indices remains low (around 4% of the S&P 500) and the free cash flow yield has never been so attractive (see below).

Aggregate free cash flow yields on US energy stocks

Source: Crescat Capital, Bloomberg

Theme #4 —

Chindia

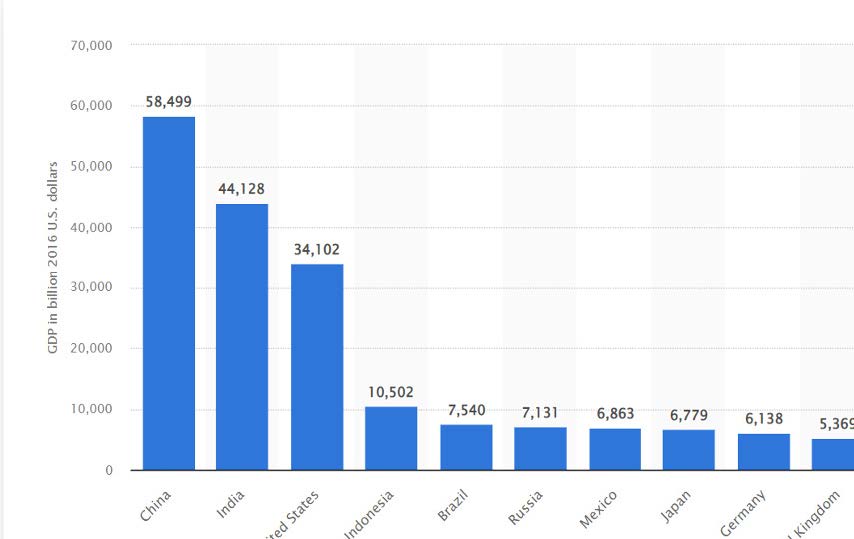

By 2050, the combined GDP of China and India is expected to exceed $100 trillion, more than twice the size of US GDP. And yet, the capital markets of these two economic and demographic behemoths (2.8 billion inhabitants between them, or 36% of the world's population) are virtually absent from the asset allocation grids of the major banks.

While China was supposed to open up aggressively to foreign investors, it is now perceived as "uninvestable" by the major US financial firms. This is due to regulatory pressures, geopolitical concerns and a worsening trade outlook, all of which are weighing heavily on the attractiveness of Chinese assets. However, it would appear that pessimism towards China has reached its peak even though the long-term outlook remains very attractive.

As for India, the Nifty 50 index has risen slightly since the beginning of the year, despite the sharp rise in imported energy costs and the lack of foreign buying. Indian equities are holding up well thanks to very good economic fundamentals and growing interest from local investors in their domestic equity market.

The dichotomy between the economic importance of Chindia and the very low exposure of international investors to these two regions looks like a strong anomaly. Especially since the inefficiencies in emerging markets create very interesting alpha (stock picking) opportunities.

Top ten countries in the world expected to have the highest GDP in 2050 (in billions of 2016 US dollars)

Source: Statista

Theme #5 —

UK equities

Since the Brexit, UK equities have underperformed most other developed country indices. International investors' dislike of the Isle of Albion has been further reinforced in 2022 by the political saga at 11 Downing Street.

To date, UK equities offer one of the most attractive valuations in the developed world (8x expected earnings) and are underinvested by the vast majority of international investors.

However, it should be borne in mind that 70% of the profits of the FTSE 100 index are generated abroad. The index is largely made up of old economy sectors, including a few large caps linked to commodities. These companies are also benefiting from the weakness of the pound. A stabilisation of the political situation could reduce the risk premium and attract investors back to UK equities.

Theme #6 —

Active management

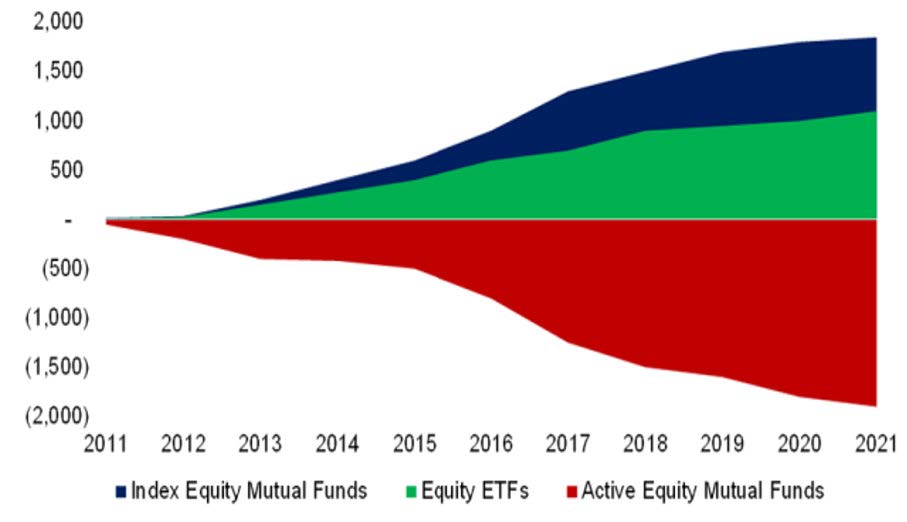

One of the big winners of the "QE years" were ETFs, i.e. index trackers. Most of the performance of indices came from a small number of stocks (including GAFAs) and investors had gradually moved from active to passive management. The new macroeconomic context (return of inflation, strength of the dollar, etc.) and the market context (loss of momentum of major technology stocks) could allow stock-picking and therefore active management to return to favour.

Cumulative flows between passively and actively managed equity funds

Source: CFA Institute

Theme #7 —

Hedge Funds

Like active management, hedge funds have been snubbed by most investors over the last decade. The year 2022 seems to be the year of the comeback of hedge funds and in particular of Macro and CTA strategies.

Given the limited number of instruments that allow for decorrelated investment in stocks and bonds, hedge funds could see a significant resurgence in interest. While their allocation sometimes reached 20 to 25% of discretionary portfolios in Swiss banks before 2008, the percentage allocated is currently very low.

Theme #8 —

Private assets

As we have seen this year, the diversification properties of the bond portfolio are much less effective than in the past. In contrast to the previous decade, the correlation between stocks and bonds has increased. For the first time in history, both asset classes are down by more than 10% since the beginning of the year.

In order to improve the risk/return trade-off of diversified portfolios, one solution is to replace part of the bond allocation with less liquid (or even much less liquid) investments such as hedge funds, real estate funds, private debt or venture capital.

This type of asset allocation is favoured by large institutional investors such as the Endowments in the United States. At present, the allocation to private assets remains marginal in the discretionary accounts of private clients.

But demand is growing.

Theme #9 —

Cryptocurrencies

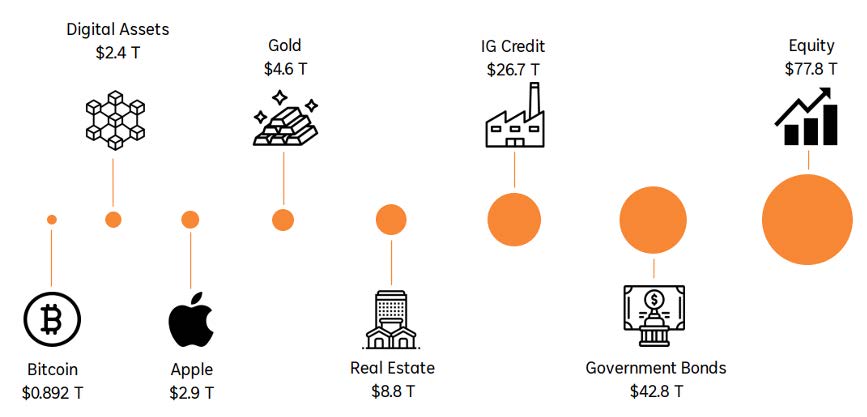

During the cryptocurrency boom in 2020 and 2021, most institutional and private investors preferred not to take exposure to this new asset class for various reasons: little or no knowledge, inability to value tokens, too much volatility or difficulty of access.

In hindsight, ignoring crypto-currencies was not a bad choice in 2022. But during this new crypto winter, the industry fundamentals (level of adoption, ecosystem development, trading and depository infrastructure set-up, etc.) continued to improve. This could therefore be a unique opportunity for institutional and private investors to initiate a first allocation in this new asset class.

The market capitalisation of digital assets remains tiny compared to other asset classes

Source: Coinmarketcap.com

Source: Coinmarketcap.com

Theme #10 —

Cash

Over the past decade, cash has simply disappeared from most asset allocation grids. The reason for this was simple: the zero or even negative interest rate policy of the major central banks. But in the space of a few months, everything has changed. With dollar short rates at 4% and the end

of negative rates in Europe, cash has a place again in an allocation grid. A situation that could well last.

Conclusion

The winners of the QE years will not necessarily be the winners of the next decade. For investors, it often pays to take a contrarian approach and identify asset classes and/or financial instruments that have not yet received the attention they deserve.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)