Surprise #1 —

US Inflation drops below 4%

[Probability: Medium]

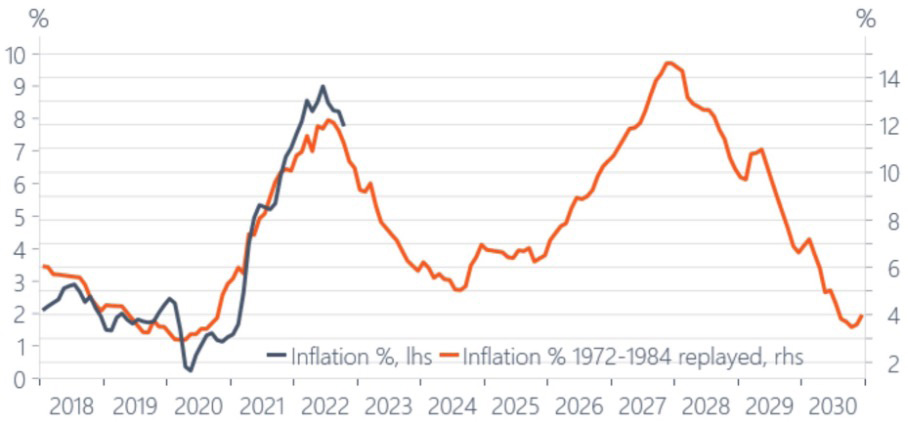

The surge of inflation to almost double-digit levels was most likely the biggest macro-economic surprise in 2022. As we enter into a New Year, inflation might well surprise investors again – but this time positively instead.

Inflation is the rate at which prices change on a year-on-year basis. As the base effect will become more favorable, and due to a sharper than expected drop in goods prices, US inflation might come back down to surprisingly low levels.

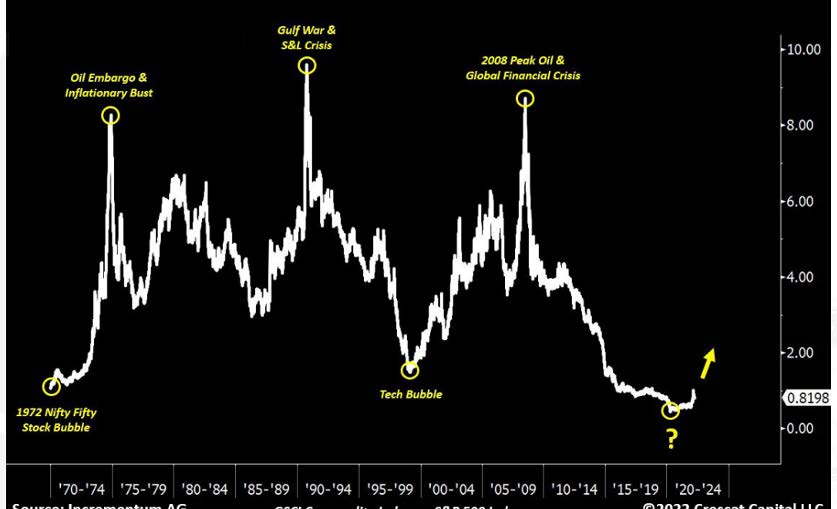

However, this drop might prove to be short-lived. As in the 70s (see chart below), structural factors and a Fed policy mistake (aka premature pause in the tightening cycle) could prompt a new inflationary wave in the years that follow.

Inflation today vs. 1970s

Source: Bloomberg

Surprise #2 —

QE for the markets, rate hikes for

everyone else

[Probability: High]

While global economic growth and inflation might both surprise on the downside, the Fed could initially be reluctant to pause its rate hike cycle. In other words, they might over-tighten. Consequently, equity and bond volatility could jump in the first half of the year, with the risk of triggering financial accidents.

For instance, G7 countries could face a buyer’s strike for their claims, as international investors might be reluctant to get low or negative real rates for bonds issued by highly indebted countries. Similar to the UK, the Fed (and the ECB) would initially refuse to stop hiking. But with the spike in long-term bond yields, they would have no other choice than to re-launch QE (Quantitative Easing), targeting the long-end of the curve. In other words, they would be resorting to QE to save financial markets while hiking rates for everyone else.

Surprise #3 —

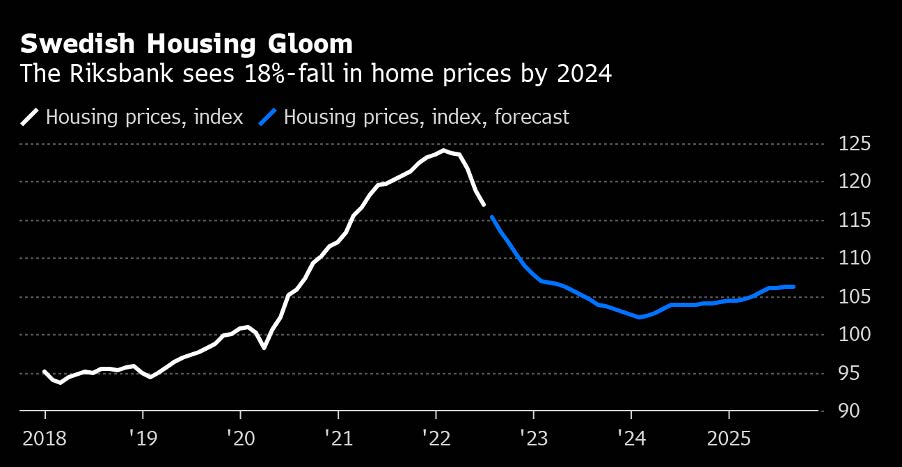

A housing crash of epic proportions

[Probability: High]

2022 saw the burst of several bubbles (bonds, equities, cryptos). In 2023, real estate could be the last shoe to drop. Indeed, the tightening of the monetary cycle is hitting the interest-rate sensitive part of the economy the most. Countries with a high percentage of variable rates mortgages could endure a double-digit decline of housing prices. Sweden, a country where nearly 70% of the mortgages have variable rates, could face a double-digit decline in housing prices according to the Riskbank.

Swedish housing gloom

Source: Bloomberg

Surprise #4 —

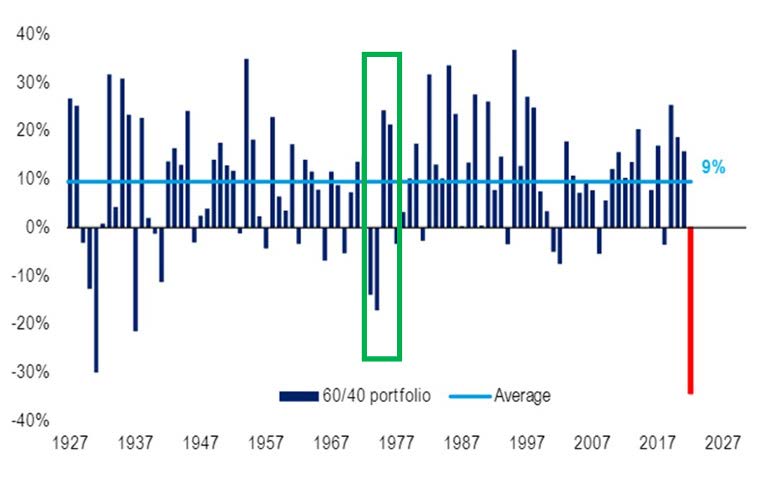

A (temporary) come-back of the 60/40

[Probability: Medium]

2022 was an “annus-horribilis” for the 60/40 (stocks-bonds) portfolio, as both equity and fixed income markets strongly correlated on the downside. 2023 could see a turnaround in both markets. After another volatile semester (1H 2023), a pause by the Fed and attractive valuations could lead investors to come back to equity and bond markets. Multi-assets portfolios would then enjoy a massive rally and record one of their best years ever. This would be similar to what happened in the 70s (see red box in the chart below).

In 2022, the “60/40” portfolio annualized return is the worst in the past 100 years

Source: BofA Global Research

Surprise #5 —

China (sanitary) pivot… or not

[Probability: High]

China’s zero-covid policy has had a disastrous impact on growth in 2022 and has triggered a wave of protests. Beijing is now at a tipping point, which could lead to two tail risk outcomes:

Positive outcome: Beijing finally decides to change its economic and monetary policy. Zero-covid restrictions get progressively lifted. Regulations for technology, gaming and education sectors become more supportive. Significant fiscal and monetary stimuli are injected into the economy. Relationship with Washington progressively improves. On the back of these tailwinds, Chinese equities become the best performing asset in 2023 and the yuan rallies.

Negative outcome: China experiences protests reminiscent of Tiananmen. Human casualties rise to the point where the West decides to apply sanctions and cut some ties with China. The global supply chain is severely disrupted and leads to upward pressure on inflation and downward pressure on growth. The Yuan crashes and stems a wave of competitive devaluation in China. Risk assets tumble globally.

Surprise #6 —

Dollar drops; Emerging Markets and

European assets outperform

[Probability: Medium]

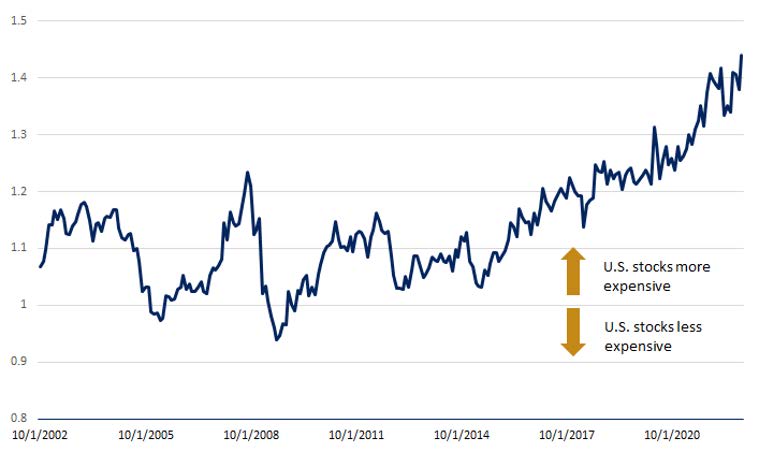

2022 has again been favorable to US assets (dollar, US stocks). At the time of our writing, US now accounts for 70% of the MSCI World and non-US assets remain massively under-represented in global portfolios.

In the case of a favorable macro-economic and liquidity scenario (the Fed pausing, China re-opening and the global economy avoiding a deep recession), the dollar could end its two-year bull market while the Euro, the Yen and Emerging Market currencies would enjoy a spectacular rally. For once, European, UK and Emerging Market assets would outperform the US.

US stocks are relatively more expensive than international equities

Source: Edward Jones

Surprise #7 —

Iraq collapse in H2 leads to another spike in oil prices

[Probability: Low]

The war in Ukraine is entering stasis. The support for war is ebbing on all sides and the market is slowly moving into indifference (although the human cost of the war must never be dismissed). But the real danger to oil supply in 2023 likely won’t come from Russia’s war in Ukraine, but Iraq’s instability. A big geopolitical surprise could be if Iran and Saudi Arabia enter into conflict over Iraq. That is where oil supply loss would happen. With dramatic consequences on oil prices.

Surprise #8 —

Commodities are the best asset class

again. Gold shines

[Probability: High]

While commodities are the best performing asset class in 2022, fund flows have been negative and it remains massively underrepresented in global asset portfolios. With a potential spike in oil prices in the second half of the year and the drop of the dollar, commodities could record another spectacular year as asset allocators finally decide to include commodities in global portfolios. Precious metals (Gold, Silver) would surge on the back of a weakening dollar and declining real interest rates (due to the rise of long-term inflation expectations). Commodities’ relative performance against equities tend to last several years in both directions (up and down). We might be at the start of a secular upward trend for commodities’ relative performance.

Commodities to equity ratio

Source: Crescat Capital, Bloomberg

Surprise #9 —

Bitcoin hits $40k

[Probability: Medium]

After a dreadful 2022, the recovery of risk assets, the decline of the dollar and significant regulatory improvements could lead Bitcoin to more than double its current price. Meanwhile, thousands of cryptocurrencies would not survive the 2022 crypto-winter and disappear.

Surprise #10 —

The fall of an icon

[Probability: Low]

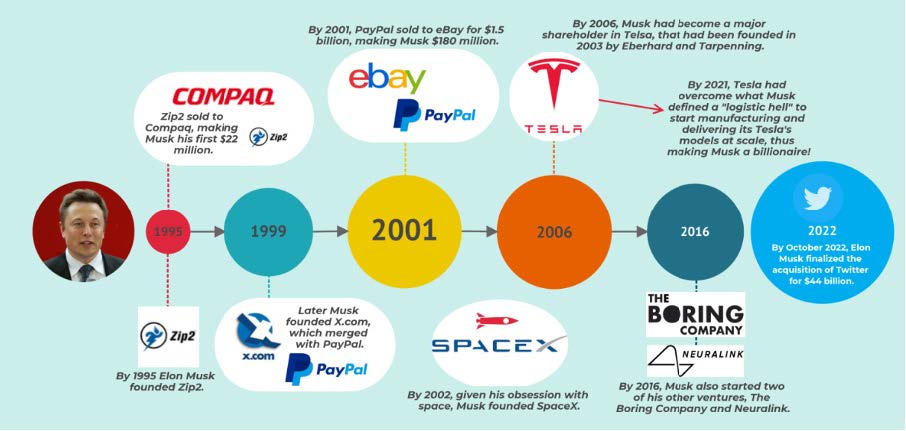

In a very surprising development, the Twitter turnaround story fails as thousands of companies start to boycott the social media platform. Elon Musk would then be forced to sell Tesla stocks to finance another rescue of Twitter, which would ultimately fail. Markets might then start to lose faith in Elon Musk, leading to a demise of his empire.

The Elon Musk entrepreneurial story

Source: Four-week MBA

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)