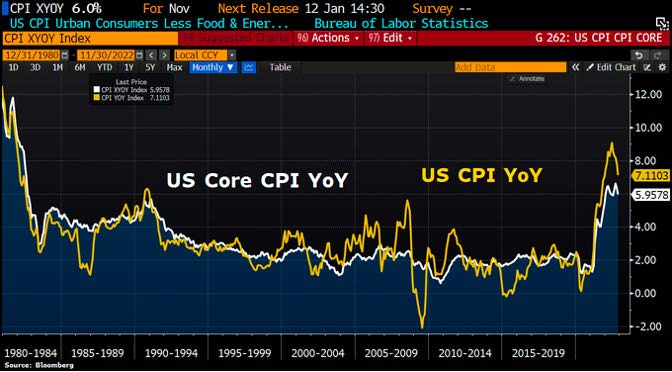

Chart #1 —

US inflation rate surprises on the downside

Inflation numbers continue to move in the right direction. The headline CPI for November came in below consensus expectations, with a sequential increase of 0.1% and a year-over-year increase of 7.1%, the lowest rate since December 2021. The inflation rate excluding energy and food was also weaker than expected with a sequential increase of 0.2% (vs. 0.3% expected) and a year-over-year increase of 6.0% (vs. 6.1%). This decline in the inflation rate can mainly be attributed to energy costs, medical care and used cars. But the good news is that this decline in prices is widespread. With the exception of housing (which lags rents and real estate prices), all major components of the price basket showed a smaller year-over-year increase in November than in October.

US CPI index yoy (yellow) and US core price CPI yoy (white)

Source: Bloomberg

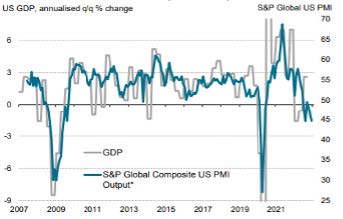

Chart #2 —

Disappointing US Macroeconomic figures

The U.S. Macroeconomic Surprise Index is once again in the red, demonstrating that the numbers released are overall below consensus expectations. Among the statistics released last week showing that the U.S. economy is on the verge of a major slowdown was the S&P Global composite purchasing managers' index for December. The index fell 1.8 points to 44.6, one of the worst readings since 2009. Another leading indicator was the Philadelphia index for December, which came out at -13.8 versus -10 expected. New orders continued to contract, prices fell (but are still expanding), delivery times fell, the average workweek is now firmly in contraction, and employment fell to its lowest level since June 2020. There was also a decline in industrial production in November: -0.2% sequentially (versus

0% expected) and -0.6% year-over-year (versus -0.2% expected). The last notable surprise of the week was retail sales, which fell by 0.6% in November, whereas a small increase was expected by the consensus.

S&P Global US Purchasing Managers' Index

Source: S&P Global, BEA

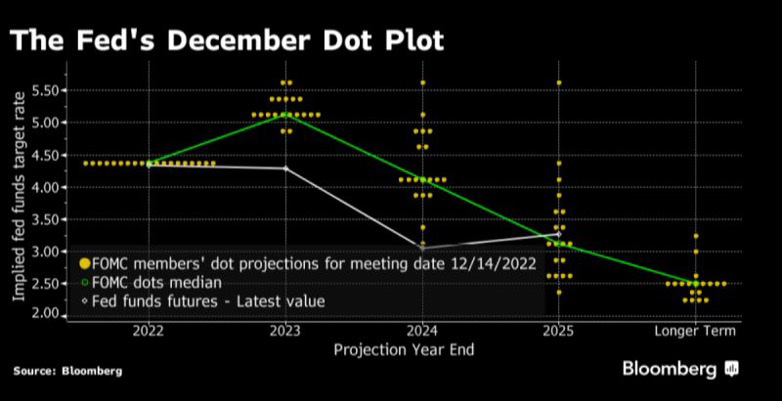

Chart #3 —

US Federal Reserve hikes rates by 50 basis points

At its December meeting, the Fed raised policy rates by 50 basis points (as expected). The pace of rate hikes is therefore slowing down. The U.S. central bank raised its policy rate to 4.5%, the highest since 2007. The Fed's median forecast calls for rates to end next year at 5.1% (50 basis points above the previous median of 4.6%). The Fed's so-called "dots" forecast rates at 4.1% in 2024 - a level that is also higher than previously indicated. Prior to the decision, markets had expected rates to reach 4.8% in May. So the Fed's message about monetary policy in the coming months is overall rather restrictive.

The Fed's expectations for the level of rates in the coming months (median in green) versus market expectations (in white)

Source: Bloomberg

Chart #4 —

The European Central Bank (ECB) also hiked rates by 50 basis points

The U.S. Federal Reserve was not the only one to meet last week. As expected, the Bank of England raised its policy rate by 50 basis points to 3.5%, the highest rate since October 2008. Like the Fed, the Bank of England is slowing the pace of its rate hikes as the inflation rate has eased slightly. The Swiss National Bank (SNB) also raised interest rates by 50 basis points to counter the "continued spread of inflation. SNB officials raised the benchmark rate to 1%. The central bank expects inflation to be 2.4 percent in 2023 and 1.8 percent in 2024. These forecasts are therefore slightly higher than the previous ones (+2.3% and +1.7% for 2023 and 2024 respectively).

Finally, the European Central Bank (ECB) has also decided to slow down its pace of monetary tightening with a 50 basis point rate increase (in line with consensus expectations). The main refinancing rate is now 2.5%, the highest since 2009. The ECB stated that Quantitative Tightening (QT) will begin in March 2023 at a measured and predictable pace. The ECB says the portfolio built up over the years via the Asset Purchase Program (APP) will decline by an average of €15 billion per month in the second quarter of next year.

ECB policy rate (yellow) and central bank balance sheet size (white)

Source: Bloomberg

Chart #5 —

Another down week for the S&P 500, which is back below the 200, 100 and 50-day moving averages

Intensifying fears of rising interest rates and a sharp slowdown in economic growth pushed the S&P 500 Index lower for a second consecutive week. The leading U.S. market index is now trading at levels not seen since early November. Nearly every sector of the index is down for the week, at the exception of energy stocks, which were supported by a rebound in oil prices. The expiration of approximately $4 trillion in options contracts on Friday led to an additional increase in volatility.

It was noted that the S&P 500 level fell back below the 200-, 100- and 50-day moving averages.

S&P 500 Index versus 200, 100 and 50 day moving averages

Source: Bloomberg

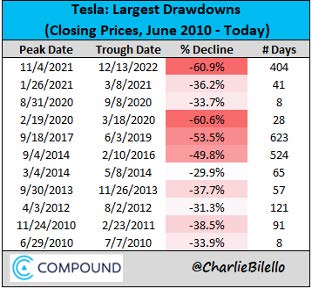

Chart #6 —

Tesla stock continues to fall

Tesla stock has lost about 10% on Wall Street this week as Elon Musk continues to sell off shares of the electric vehicle maker. The U.S. Securities and Exchange Commission announced that sales this time amounted to nearly $3.6 billion. Since the acquisition of Twitter, Elon Musk has to finance the restructuring of the social network. Tesla is down more than 60% since the November 2021 highs. This is the largest decline in its history.

Largest historical drawdowns for Tesla stock

Source: Charlie Bilello

Chart #7 —

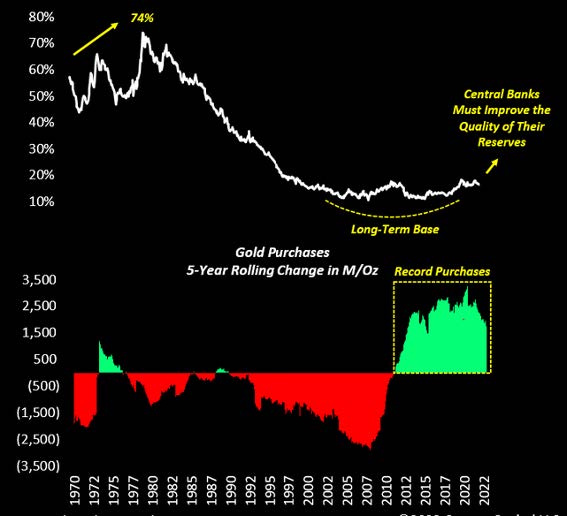

Central banks have accumulated record amounts of gold in 2022

This is probably one of the most important developments in global macroeconomics. Gold is becoming the preferred asset of central banks as they seek to improve the quality of their international reserves.

Gold as a percentage of central bank foreign exchange reserves (top chart) and gold purchases over 5 years (bottom chart)

Source: Crescat Capital, Tavi Costa, Bloomberg

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)