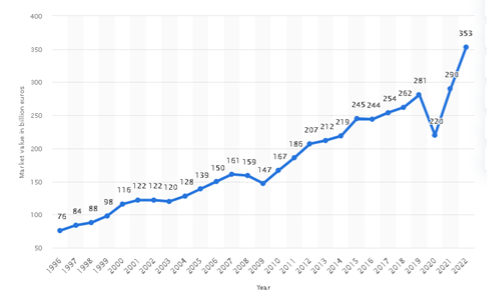

The global luxury goods industry, which includes wines and spirits, fashion, cosmetics, perfumes, watches, jewellery and leather goods, has been on an upward trend for many years. According to Statista, the value of the global personal luxury goods market has been estimated at €353 billion by the end of 2022, an increase of 26% since the end of 2019.

Value of the global luxury goods market for consumers from 1996 to 2022 (in billions of euros)

Source: Statista

Source: Statista

An emblem of the sector, LVMH has become the 1st European company with a market capitalisation in excess of 500 billion dollars. The share value has doubled since the end of 2019.

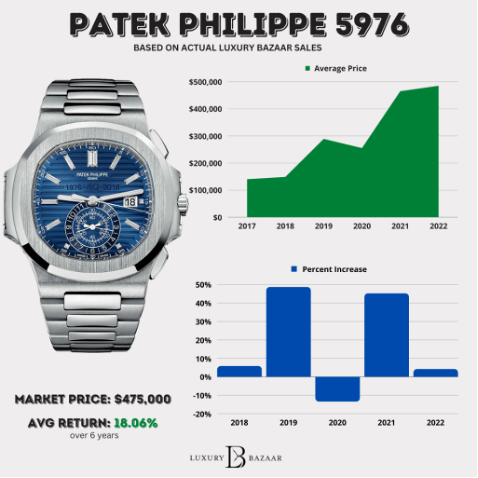

The luxury watch sector has also eperienced an unprecedented boom. Between August 2018 and January 2023, average prices on the second-hand market for top-of-the-range watch models from the three biggest luxury brands - Rolex, Patek Philippe and Audemars Piguet - rose at an annual rate of 2.

In the automotive industry, it is Ferrari that is breaking all records: the best operating margin in the sector (over 23% by the end of 2022) and a market capitalisation of over 57 billion euros, making Ferrari the share with the highest P/E in Europe (55x). It has to be said that models from the prancing-horse maker are selling like hotcakes. The Daytona SP3, of which Ferrari plans to produce just 599 units at a list price of $2.25 million, was sold out even before the brand unveiled its outline.

Despite facing significant economic challenges, the luxury goods market has adapted and thrived in a constantly changing environment.

Before looking at the possible factors behind this resilience, let's take a look back at how the sector has behaved during the crises of the last 15 years.

.png)